- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/USD stumbles from 1.2000 on risk-off impulse and safety flows

GBP/USD stumbles from 1.2000 on risk-off impulse and safety flows

- The GBP/USD is almost flat during the day, barely up 0.02%.

- A dismal mood weighs on the British pound due to ECB’s hiking rates and US President Joe Biden testing positive for Covid-19.

- GBP/USD Price Analysis: Tilted to the downside, as sellers eye 1.1800.

GBP/USD stays in positive territory, though downward pressured, once the European Central Bank (ECB) added to the list of global bank authorities shifting to tightening monetary policy, delivering a surprisingly 50 bps rate hike to all of its three rates, aimed to normalize policy amidst a high inflation scenario.

The GBP/USD is trading at 1.1962 after hitting a daily high at 1.2003, but its correlation with the EUR/USD dragged the pair down towards the daily low below 1.1900. However, once the dust settled, the British pound stood still at current levels.

GBP/USD capped by sentiment and safety flows

A risk-off impulse has kept investors’ flows toward safe-haven assets. Sentiment deteriorated due to factors like the ECB’s monetary policy decision and US President Joe Biden testing positive for Covid, which sent US equities down between 0.22% and 0.87%. The greenback is clinging to the 107.000 area as shown by the US Dollar Index, almost flat, while US Treasury yields are down, reflecting safety flows.

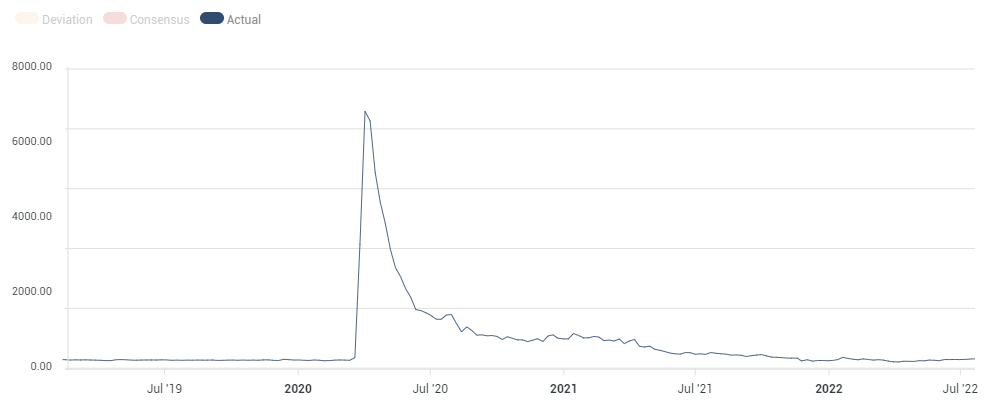

Before Wall Street opened, the US Department of Labour reported that Initial Jobless Claims for the week ending on July 16 rose 251K, higher than the 240K estimated, hitting a fresh 8-month high. At the same time, the Philadelphia Fed Manufacturing Index in June declined for the second consecutive month to -24.8 from -12.4. The report said that “on balance, the firms continued to report increases in employment, but the employment index declined 9 points to 19.4, its lowest reading since May 2021.”

US Jobless Claims rise above expectations

The lack of UK economic data keeps GBP/USD traders assessing words from the Bank of England Governor Andrew Bailey. On Wednesday he stated that a 50 bps rate hike in August is possible, triggering a jump in the GBP/USD. Nevertheless, the gloomy UK economic outlook will keep the pound under selling pressure, despite the efforts that the BoE makes to tame inflation, opening the door for a stagflationary scenario.

Analysts at Rabobank expect the GBP/USD to fall towards 1.1800

“Given our expectation that USD strength is likely to persist for around 6 months or so in view of risks to global growth, we foresee the potential for further sharp drops in the value of the pound. We have revised lower our target for cable from 1.18 and see the potential for a dip to levels as low as 1.12 on a 1-to-3-month view. The assumes a more sustained break below EUR/USD 1.00.”

GBP/USD Price Analysis: Technical outlook

The GBP/USD is still downward biased, despite bouncing off the weekly lows around 1.1860s. GBP/USD buyer’s failure to break above the 20-day EMA at 1.2015 sent the pair tumbling below the 1.2000 figure, extending towards the 1.1920s area. Even the Relative Strength Index (RSI), which at the beginning of the week aimed higher, shifted gears and is about to break below 40 as selling pressure mounts on the pair.

Therefore, the GBP/USD first support would be the 1.1900 mark. Break below will expose the July 18 daily low at 1.1862, followed by the figure at 1.1800 and the YTD low at 1.1760.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.