- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/USD reclaims the 1.2000 figure on US PMIs flashing recession

GBP/USD reclaims the 1.2000 figure on US PMIs flashing recession

- GBP/USD snaps three straight weeks of losses, set to gain around 1.34%.

- US S&P Global PMIs flashes purchasing managers’ worries about current US economic conditions.

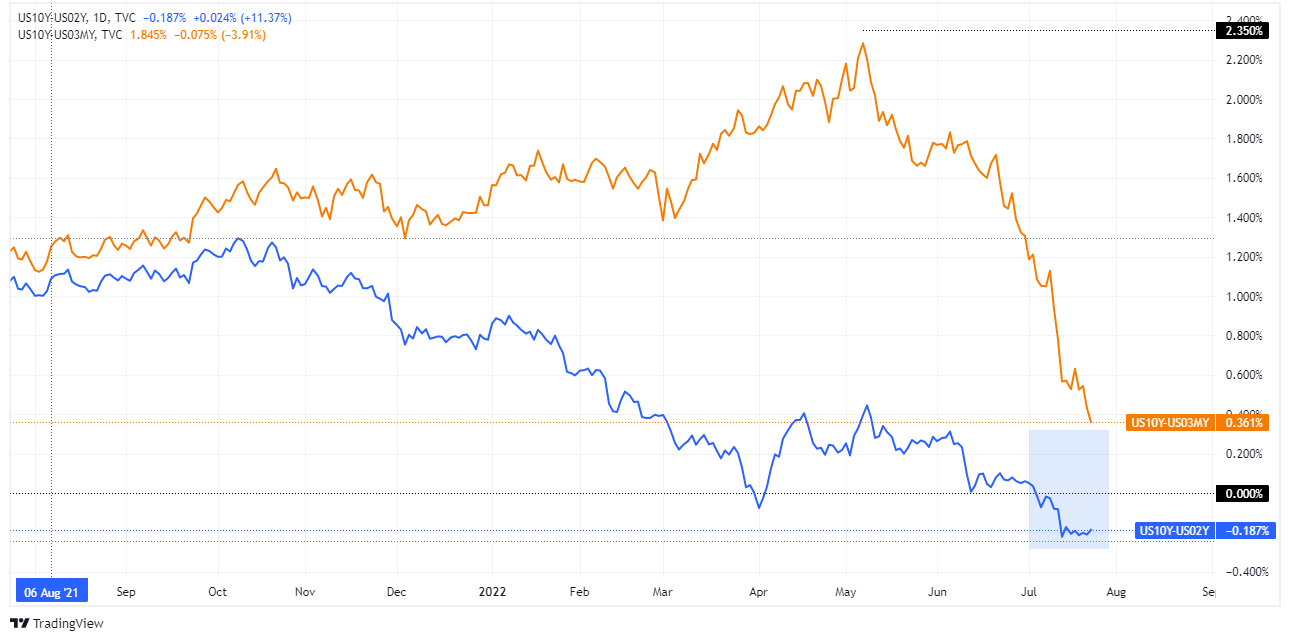

- The US 2s-10s yield curve remains inverted for 14 consecutive days.

GBP/USD recaptures the 1.2000 figure amidst a fragile market mood, as equities are seesawing of late, due to US S&P Global PMI data, flashing a contraction in the services sector and its Composite index, while traders seek safety towards US Treasuries, with US bond yields falling, undermining the greenback.

The GBP/USD is trading at 1.2028 after diving towards its daily low at around 1.1915. Nevertheless, the major bounced back and rallied towards a daily high at 1.2063 before stabilizing around current price levels.

US PMIs show signs of further deterioration

In the meantime, US S&P Global reported PMIs Indices for July. Manufacturing rose by 52.3, above expectations, but Services and Composite tumbled to 47 and 47.6, respectively, suggesting that the economy is deteriorating, according to the survey. When news crossed wires, the US Dollar Index, a basket of peers that measure the buck’s performance, slides 0.18%, sits at 106.407, while the US 10-year benchmark note coupon plunges ten bps to 2.789%.

Traders should be aware that the US 2s-10s yield curve remains inverted, at -0.174%, signaling an impending recession. Nonetheless, the US 3-month to 10-year yield curve bear flattened towards the 0.367% area, which, although positive, has erased since its peak in May at 2.350%, almost 200 bps.

US 2s-10s in blue - US 3m-10y in orange

Meanwhile, on the UK side, UK Retail Sales contracted, showing the pressure of elevated prices in the UK. June sales dropped by -5.8% YoY, more than estimations, while the monthly reading shrank -0.1%, less than the -0.3% contraction estimated.

Later, UK S&P Global PMIs for July held above the expansionary territory, easing some pressures on the shoulders of the Bank of England (BoE) Governor Andrew Bailey. Nevertheless, the political issues surrounding the resignation of the current PM Boris Johnson keep Britons entertained with the battle between Rishi Sunak and Liz Truss. That, alongside Brexit jitters, might cap any upside reaction on the GBP/USD.

What to watch

Next week, an absent UK economic docket would keep GBP/USD traders leaning on US economic data. On the US calendar, the Federal Reserve Open Market Committee (FOMC) monetary policy decision, US inflation data, and Q2 Gross Domestic Product on its advance reading will keep GBP/USD traders glued to their screens.

GBP/USD Key Technical Levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.