- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/TRY extends the uptrend and clinches new 2022 highs past 17.80

USD/TRY extends the uptrend and clinches new 2022 highs past 17.80

- USD/TRY starts the week on a positive note and approaches 18.00.

- Lack of investors’ confidence and rampant inflation weigh on the lira.

- Türkiye Capacity Utilization improved to 78.2% in July.

The selling pressure continues to hurt the Turkish lira and lifts USD/TRY to fresh 2022 highs around 17/85, an area last visited in December 2021.

USD/TRY now targets 18.00 and above

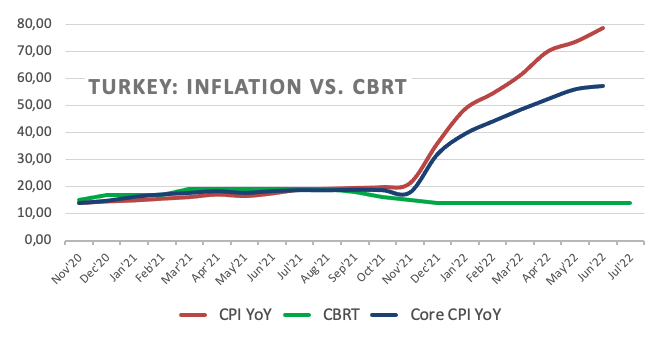

USD/TRY advances for the sixth consecutive session on Monday and gradually approaches the 18.00 neighbourhood, as market participants remain biased towards selling the lira in the current context of elevated inflation and the utter absence of any reaction from both the government and the Turkish central bank (CBRT).

The central bank once again left the One-Week Repo Rate unchanged at 14.00% at its meeting last week despite consumer prices rose nearly 80% in the year to June. Furthermore, the CBRT refrained from acting on rates since it cut the policy rate to 14% at the December 2021 meeting.

In the domestic calendar, Capacity Utilization ticked higher to 78.2% in July (from 77.6%) and Manufacturing Confidence eased to 103.7 also in July (from 106.4).

What to look for around TRY

The upside bias in USD/TRY remains unchanged and stays on course to revisit the key 18.00 zone. It is worth noting that the pair closed with gains in all the months so far this year.

In the meantime, the lira’s price action is expected to keep gyrating around the performance of energy prices, which appear directly correlated to developments from the war in Ukraine, the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent. In addition, there seems to be no Plan B to attract foreign currency in a context where the country’s FX reserves dwindle by the day.

Key events in Türkiye this week: Capacity Utilization, Manufacturing Confidence (Monday) – Economic Confidence Index (Thursday) – Trade Balance (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.73% at 17.8395 and faces the immediate target at 17.8436 (2022 high July 25) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.1903 (weekly low July 15) would pave the way for 16.7486 (55-day SMA) and finally 16.0365 (monthly low June 27).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.