- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD rallies on slight doivish tilt at the Fed, all eyes on Powell

Gold Price Forecast: XAU/USD rallies on slight doivish tilt at the Fed, all eyes on Powell

- Gold price is on the bid following a slightly dovish tilt in the Fed's statement.

- The Fed chairman's presser will likely cause greater volatility as investors seek clarity.

The gold price has rallied on the back of the Federal Reserve's interest rate decision which has weighed on the greenback and has left US yields in limbo, slightly lower now after 20 minutes post the statement's release in the 2 and 10-year yields.

XAU/USD popped to a session high of $1,727.09 from a low of $1,711.56 as the central bank downgrades the economy but remains focussed on inflation risks, as per the statement, repeating that it is `highly attentive' to inflation risks.

Main takeaways from the statement

- The Fed says recent indicators of spending and production have softened.

- Fed says job gains have been robust, unemployment rate has remained low.

- Fed says inflation remains elevated, reflecting pandemic-related imbalances, higher food and energy prices, and broader price pressures.

The Fed funds rate futures forecast 3.4% in December after a 75 basis point hike. That leaves 107 basis points of tightening for the remainder of 2022.

Overall, the outcome is somewhat dovish for the September meeting. The fact that the Fed is acknowledging risks to spending and production, the markets will be tuned in to the Fed's chairman's presser at the bottom of the hour for further insight and what the implications are for the labour sector.

If Powell confirms the market's lowering of rate hike expectations for later this year and early next year, that would likely cement the bearish sentiment around US yields and potentially weigh on the US dollar, lifting risk assets and commodities, including gold. With that being said, the US dollar can benefit from safe-haven flows as well in the face of a global slowdown.

''Barring a dovish scenario, we expect participants to return their attention to the massive and complacent position held by prop traders, which still hold the title as the dominant speculative force in gold,'' analysts at TD Securities said with respect to today's Fed outcome.

'' We have yet to see capitulation in gold, suggesting the pain trade is still to the downside and that the recent rally will ultimately fade when faced with a wall of offers.''

Watch Fed Powell Live

Jerome Powell, Chairman of the Federal Reserve System, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 18:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

Fed, looking forward

''In terms of the Fed policy outlook, we don't anticipate inflation will offer any respite in the short term, keeping the Fed in check regarding expectations for additional rate hikes this year,'' analysts at TD Securities argued.

''As Fed officials have repeatedly underscored, policymakers are looking for compelling evidence that inflation is abating before pausing its ongoing tightening process. If our forecast proves correct, this can happen at the end of Q4/beginning of 2023 at the earliest.''

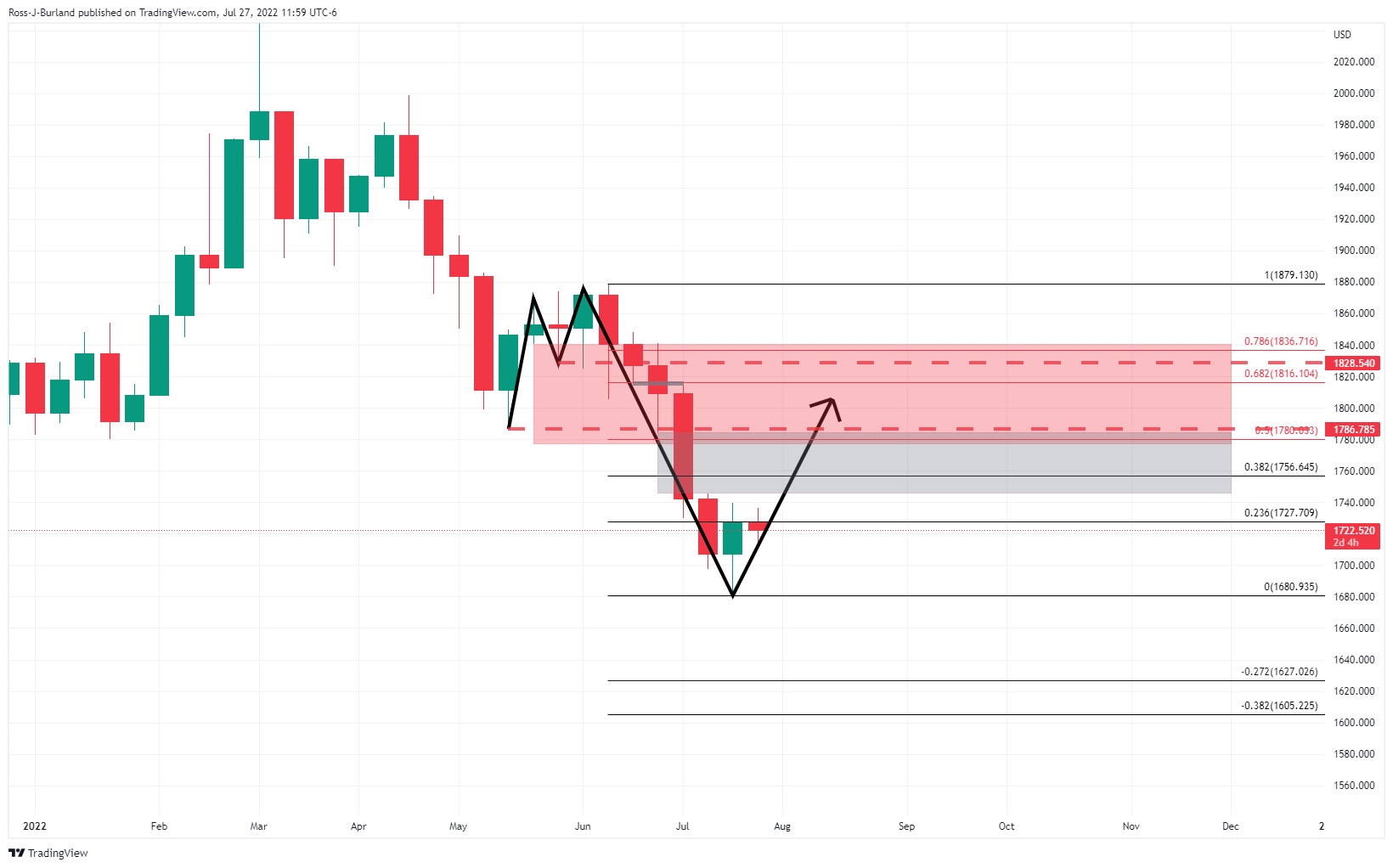

Gold, technical analysis

From a weekly perspective, the bulls are hunting down a critical area of resistance as marked out below:

The greyed areas are price imbalances that will be mitigated at some stage while the Fibonaccis align with the prior pivots.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.