- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/USD bulls are on track for the 1.22 area again

GBP/USD bulls are on track for the 1.22 area again

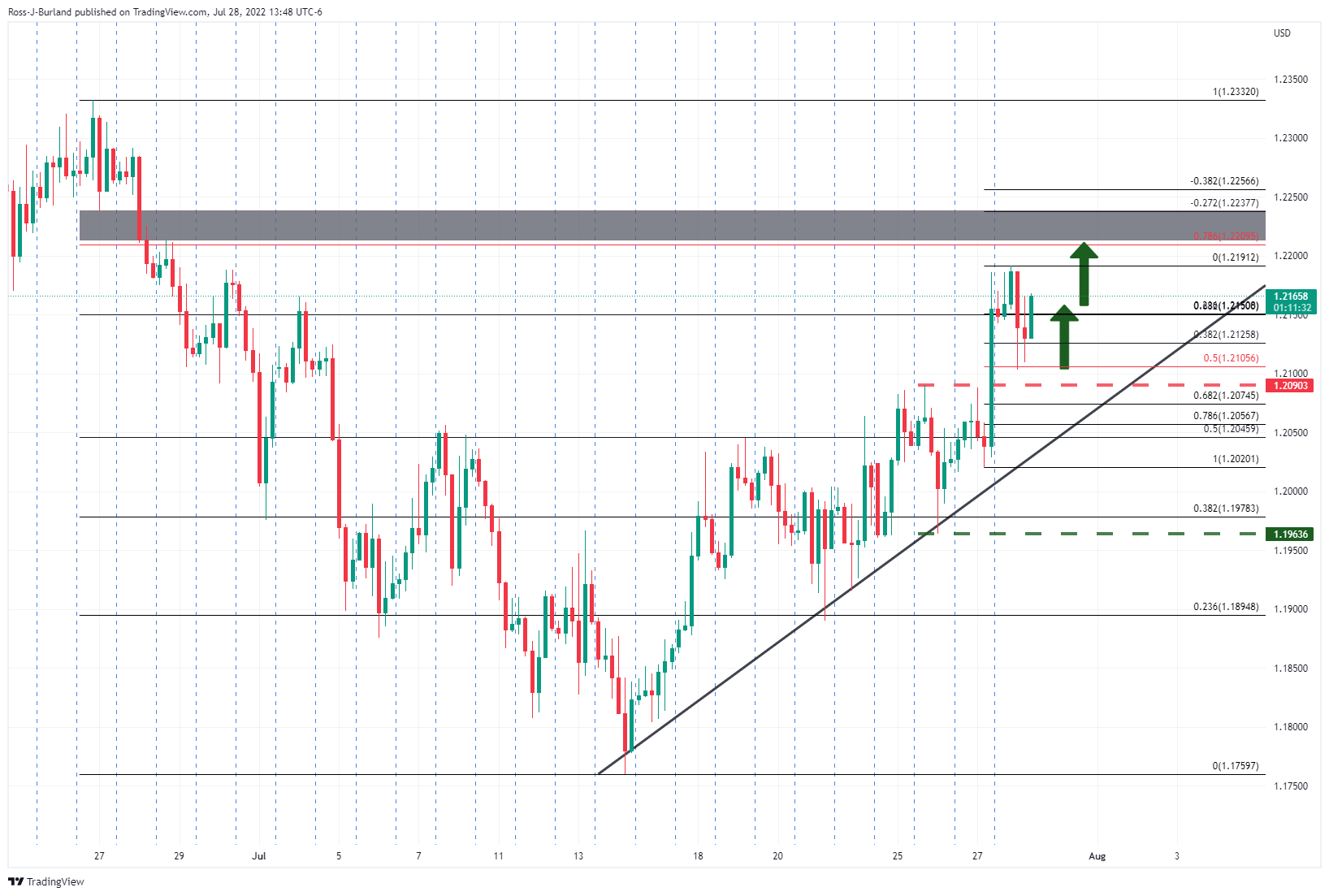

- GBP/USD bulls moving back in for another attempt at the 1.22 area.

- The US dollar remains pinned to the floor following the dialled-down Fed monetary policy pricing in markets.

GBP/USD is trading at 1.2160 and around flat on the day following a surge after the Federal Reserve meeting on Wednesday and a statement that left the futures markets tied to Fed policy expectations tilted towards a more moderate increase for the next meeting. This resulted in the softer US dollar which is now treading water around the lower quarter of the 106 area as per DXY, an index that measures the greenback vs. a basket of major currencies.

Domestically, there has been no UK data but investors are second-guessing the Bank of England's next move. The Old Lady meets on August 4. and markets are pricing the central bank to continue its tightening cycle with the possibility of a larger 50-bp increase. Nevertheless, dosued in political and economic woes, sterling has been one of the laggard this year despite The Old Lady being out of the traps with policy tightening relatively early. Relative to other G10 currencies, GBP is holding in the middle of the pack in terms of its performance in the year to date, improving only as the euro sinks towards the bottom of the pack.

''GBP has been trading under a cloud of negative sentiment for large swaths of this year,'' analysts at Rabobank noted. ''It was notable in May that the BoE’s (as expected) rate hike failed to stop the pound from falling as the market latched on to the Bank’s downside growth revision.''

''Around this time the OECD forecast that the UK would see no growth in 2023, a little worse than our house forecast of 0.2%. The BoE, like most other central banks, it committed to reigning in inflation, even at the cost of growth. However, the absence of the latter has provided a strong headwind for the pound.''

Meanwhile, the US dollar has been pushed and pulled this week in the build-up to the Fed outcome, juggled between the bears and bulls depending on risk sentiment. The weakness in the euro has benefitted the US dollar due to the gas woes in Europe and poor business sentiment from Germany on Monday. Additionally, an overall gloomy outlook for world growth as forecasted by the International Monetary fund has helped to buoy the greenback for its safe haven allure.

However, it has been all about the Fed since Wednesday and the DXY has been trading on the backfoot since since the US central bank raised interest rates by 75 basis points, as was widely anticipated, while comments from Fed Chair Jerome Powell spurred hopes for a slower hiking path.

On Thursday, the US Gross Domestic Product was reported to have fallen at a 0.9% annualized rate last quarter, the Commerce Department said in its advance estimate of GDP. Economists polled by Reuters had forecast GDP rebounding at a 0.5% rate.

GBP/USD technical analysis

The pound is attempting to claim the 1.22 area following a pullback to the 50% mean reversion of the 4-hour bullish impulse. There is a weekly price imbalance (greyed area on the chart above) that has a confluence with the 78.6% Fibonacci retracement level that could captivate the bulls in the near future.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.