- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD bulls are back in play

Gold Price Forecast: XAU/USD bulls are back in play

- Gold is firm into the close of the US forex session as the US dollar sheds some points.

- US yields are under pressure following the Fed and gold bulls are back in play.

At $1,756.64, gold prices continue to rise on Thursday even as the US dollar attempted a comeback. However, bond yields remain on the backfoot following the Federal Reserve's dovish tilt on Wednesday. At the time of writing, XAU/USD is 1.25% higher after climbing from a low of $1,734.18 to reach $1,757.06 the high of the day.

Bad news was good news for US stocks on Thursday stocks, which have extended their bullish recovery following disappointing US growth data that has added to the dovish sentiment surrounding the path of rate hike expectations from the Fed. US second quarter Gross Domestic Product came in weaker than expected, declining 0.9% in SAAR terms (exp: +0.4%, prev: -1.6%). However, while technically, this meets the two-quarters of negative growth definition of a recession, analysts at ANZ bank argue that the details were a little stronger than the headline number suggests.

''A lot of the weakness came from inventories which subtracted 2%pts from the headline figure. Personal consumption growth was positive, rising 1%, but still underwhelming expectations (exp: 1.2%, prev: 1.8%). Private fixed investment was weak, declining 3.9%.'' However, ''all up'', the analysts say, ''it was still a disappointing report, even when accounting for the outsized influence of the inventories number (which the Fed may be inclined to disregard as noise). This will only fuel the current concern markets have about a slowdown in US economic activity.''

Meanwhile, the analysts noted that ''Initial Claims were weaker than expected, at 256k. But that came as last week’s number was revised higher. Overall, claims are still at levels that are too low to suggest a deterioration in the labour market is imminent – a key ingredient for a fundamental recession in the US.''

The US dollar was higher following the data, although the bears moved in later in the session and the DXY is currently trading at the lows of the day. DXY has fallen from a high of 106.975 to a low of 106.059. Nevertheless, bond yields dropped, bullish for gold since it offers no interest. The US 10-year note was last seen paying as low as 2.649%, down by over 3.8%.

Meanwhile, the bar for CTA short covering in gold is declining, analysts at TD Securities argued. ''Given the slowing trend in data, Chair Powell's forward guidance tying another "unusually large" 75bp hike to data placed a high bar for another jumbo-sized hike, which gave a green light for a short squeeze in risk assets associated with pervasively negative sentiment.''

The analysts agued that ''as a short covering rally ensues across global markets, the likelihood for a CTA buying program in gold has risen, given that prices need only close north of $1780/oz to spark a change in trend signals.''

However, the analysts continue to caution that gold markets are faced with a massive amount of complacent length held by prop traders, which still hold the title as the dominant speculative force in gold.

''We have yet to see capitulation in gold, suggesting the pain trade is still to the downside and that the recent rally will ultimately fade when faced with a wall of offers.''

Gold technical analysis

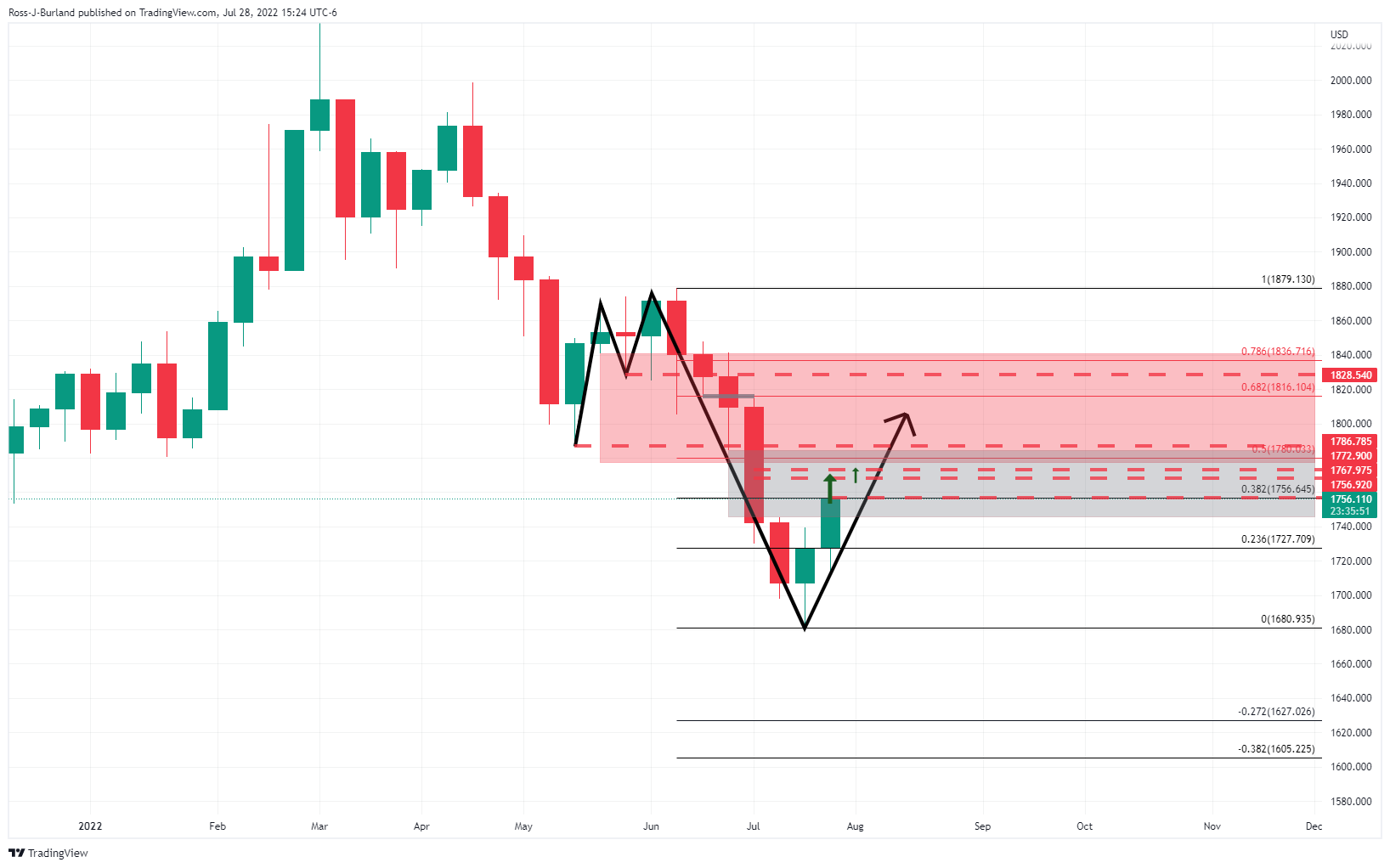

As per the pre-Fed analysis, the price of gold is running higher:

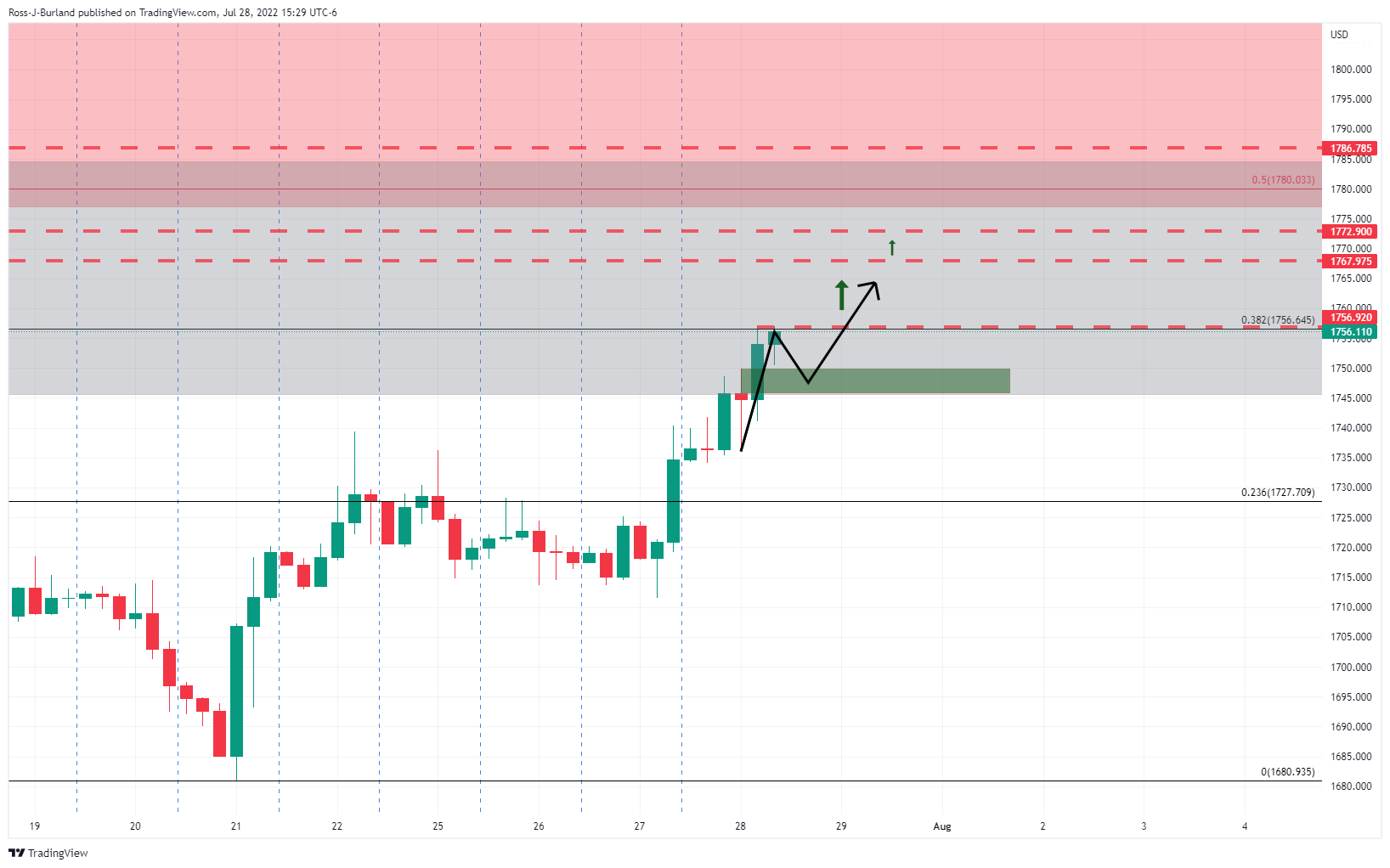

From a 4-hour perspective, the price needs to break above $1,756 for a run to $1,768 and beyond:

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.