- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD sees an establishment above $1,760, US PCE buzz

Gold Price Forecast: XAU/USD sees an establishment above $1,760, US PCE buzz

- Gold price is likely to establish above $1,760.00 as DXY sees more downside.

- The optimism in gold price is back by declining Fed’s confidence in US economic data.

- A preliminary estimate for the US PCE is 6.7% vs. 6.3% recorded earlier.

Gold price (XAU/USD) is likely to hit the immediate hurdle of $1,760.00, tracking the current upside momentum. The precious metal extended its gains swiftly on Thursday after violating the critical barricade of $1,740.00. The release of the downbeat US Gross Domestic Product (GDP) underpinned the gold prices and the asset is expected to establish above the immediate hurdle of $1,760.00 sooner.

The Federal Reserve (Fed) has been elevating its interest rates as solid US fundamentals were providing room to Fed policymakers. Fed’s tedious job of declining demand simultaneously with increasing interest rates and increasing supply to derive optimal prices without triggering the chances of a recession was supported by the upbeat US economic data. Now, less confidence in economic data has brought a sense of optimism in the gold price.

In today’s session, the entire focus will remain on US Personal Consumption Expenditure (PCE) inflation data, which is seen higher at 6.7% vs. 6.3% reported earlier. This will keep the need for more policy tightening measures intact.

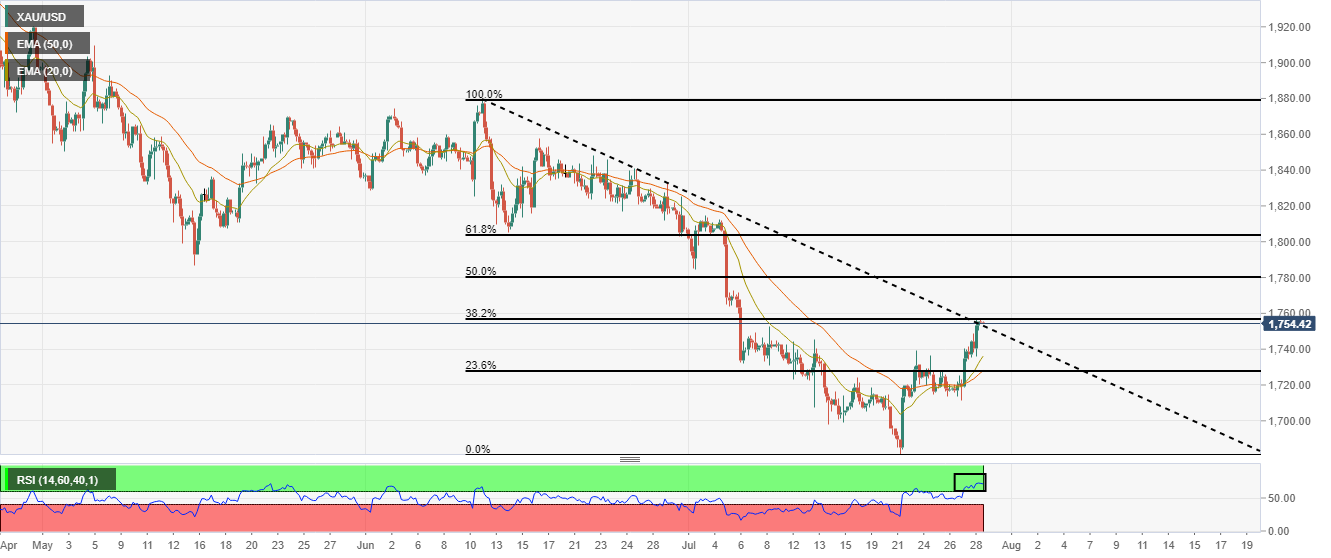

Gold technical analysis

On a four-hour scale, the gold price has attacked the 38.2% Fibonacci retracement (which is placed from June 12 high at $1,879.26 to July 21 low at $1,680.91) at $1,756.64. Also, the precious metal is attempting to establish above the downward-sloping trendline placed from June 12 high at $1,879.26.

A bull cross, represented by the 20- and 50-period Exponential Moving Averages (EMAs) at $1,720.80 adds to the upside filters.

Also, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which indicates a continuation of an upside momentum ahead.

Gold four-hour chart

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.