- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD bulls lurking but US dollar remains firm

Gold Price Forecast: XAU/USD bulls lurking but US dollar remains firm

- Gold remains in bullish territory but it has lost some of its shine to the greenback.

- The US dollar is picking up both a safe haven and Fed monetary policy bid.

The gold price is pressured in Asia, falling 0.2% to a low of $1,756.19 from a high of $1,762.07 in the session so far. US bond yields had been waning in the wake of a less hawkish narrative surrounding the Federal Reserve which has been beneficial for the gold price.

However, US yields have rallied recently weighing on the gold price. The yield on the US 10-year note was last seen trading at 2.748 % after recovering from the lowest since early April and at the bottom of a daily broadening formation's daily range. Meanwhile, the US dollar rose off the lowest in nearly a month early on Tuesday, with the DXY index last seen up 0.10% to 106.445. Markets are trading cautiously around simmering US-China tensions over Taiwan as well as the ongoing concerns about a cooling global economy.

''Fed Chair Powell catalyzed a short covering rally by tying another "unusually large" 75bp hike to data, which places a high bar for another jumbo-sized hike given the slowing trend in data. At the same time, the prevailing risk off tone in the market tied to US-China relations has further supported the yellow metal via modest haven flows,'' analysts at TD Securities said.

''Nonetheless, for further significant short covering from CTA trend followers to take place, gold prices would need to close north of $1820/oz to spark a change in trend signals. However, on the other hand, we see risks that Fed speakers can push back against market expectations for an early Fed pivot.''

US/Sino relations a concern

The greenback is in favour due to the concerns that a visit by U.S. House of Representatives Speaker Nancy Pelosi to Taiwan would further harm relations between China and the United States. China has threatened repercussions if Pelosi visited the self-ruled island, which Beijing claims as its territory.

The US said on Monday it would not be intimidated by China. Consequently, US long-term Treasury yields dropped to a four-month low while the US dollar gained against a basket of currencies. Gold also picked up a bid, but that is being demolished with the sudden corrective spike in US yields.

''Nonetheless, for further significant short covering from CTA trend followers to take place, gold prices would need to close north of $1820/oz to spark a change in trend signals,'' analysts at TD Securities argued.

''However, on the other hand, we see risks that Fed speakers can push back against market expectations for an early Fed pivot. In this sense, gold markets are faced with a massive amount of complacent length held by prop traders, which still hold the title as the dominant speculative force in gold.''

''We have yet to see capitulation in gold, suggesting the pain trade is still to the downside and we expect the recent rally will ultimately fade, facing a wall of offers.''

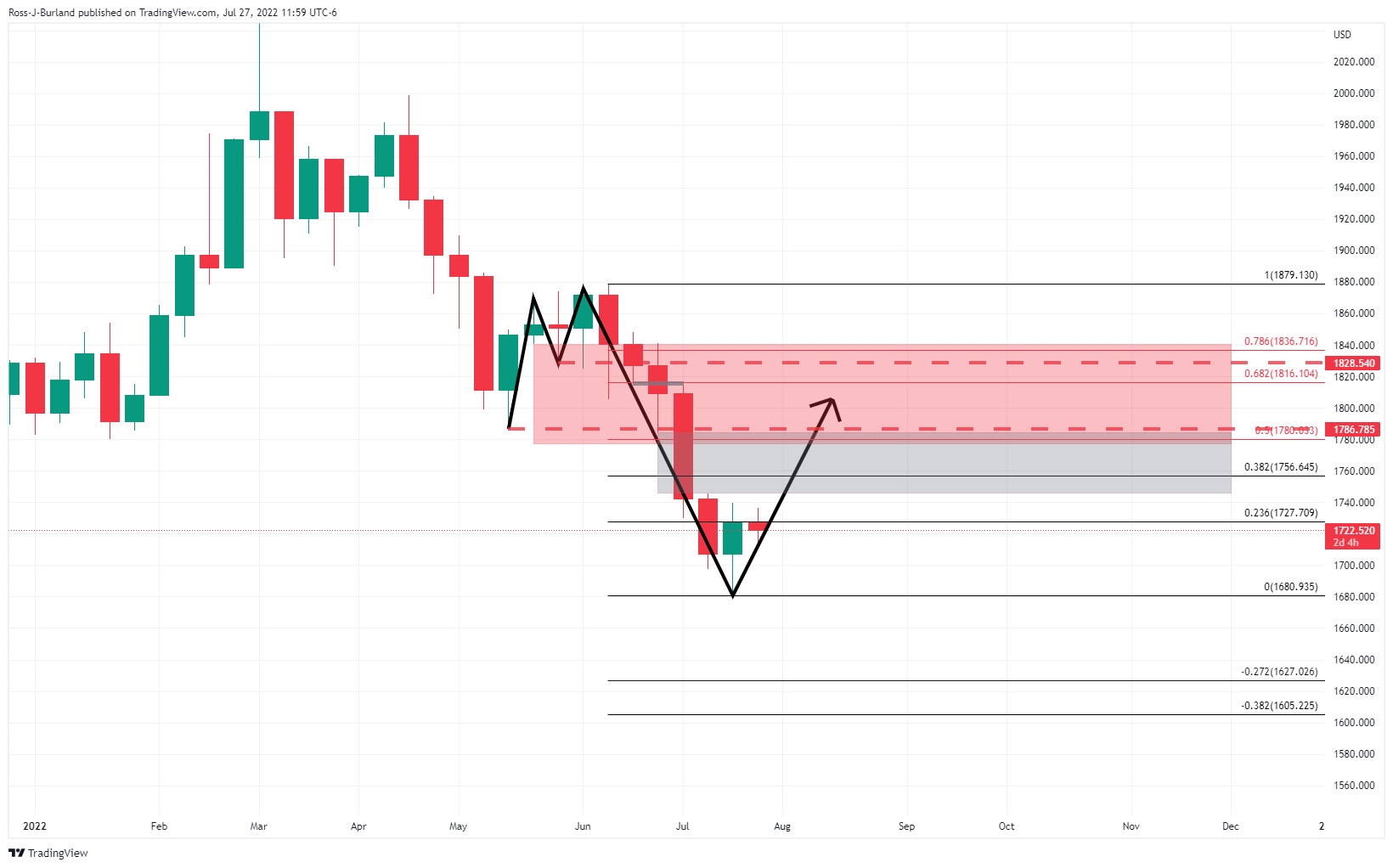

Gold technical analysis

As per the prior analysis, Gold Price Forecast: XAU/USD bulls are back in play, it was explained that the price was running higher in a correction of the weekly M-formation:

The rebound in yields is a weight on the yellow metal. Meanwhile, the US dollar rose off the lowest in nearly a month early on Tuesday, with the DXY index last seen up 0.72% to 106.166.

US/Sino relations are the wild card for gold

To add insult to injury, the US dollar is attracting a safe haven bid on worries a visit by US House of Representatives Speaker Nancy Pelosi to Taiwan would further harm relations between China and the United States. China has threatened repercussions if Pelosi visited the self-ruled island, which Beijing claims as its territory.

The US said on Monday it would not be intimidated by China. Consequently, US long-term Treasury yields dropped to a four-month low while the US dollar gained against a basket of currencies. Gold also picked up a bid, but that is being demolished with the sudden corrective spike in US yields.

Gold technical analysis

As per the prior analysis, Gold Price Forecast: XAU/USD bulls are back in play, it was explained that the price was running higher in a correction of the weekly M-formation:

The grey area was a price imbalance that has now been mitigated by a 50% mean reversion:

There are prospects for further upside with the 68.2% Fibonacci meeting prior structure around $1,800.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.