- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Silver Price Forecast: XAGUSD oscillates around $20.15 sideways ahead of US NFP

Silver Price Forecast: XAGUSD oscillates around $20.15 sideways ahead of US NFP

- Silver price is still directionless amid the lack of tier 1 US economic data.

- Sentiment is fragile due to increased concerns of a recession, as the BoE concedes that the UK might tap into one.

- US Initial Jobless Claims could be a prelude to Friday’s NFP, estimated to add 250K jobs.

Silver price climbs for two straight days, registering gains of 0.51%, as US equities finished mixed, while Asian stock futures are fluctuating as recession fears reignited, courtesy of the Bank of England. That said, alongside a soft US dollar, underpinned by falling US Treasury yields, bolstered the white metal on Thursday. At the time of writing, XAGUSD is trading at $20.14.

Silver trades range-bound, waiting for a catalyst

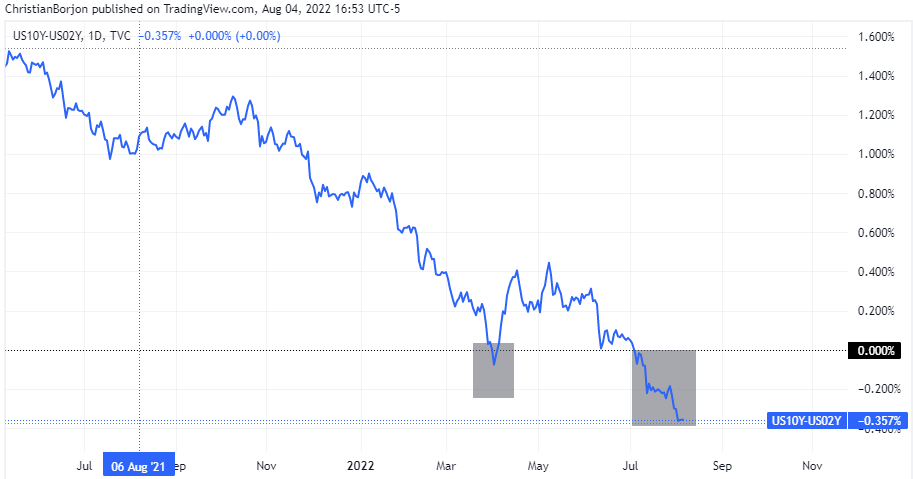

The story of the day is the BoE hiking rates by 50 bps but acknowledged that the UK might tap into a 15-month recession, beginning at the end of the 2022 Q4. Meanwhile, in the US, the 2s-10s yield curve inversion further deepened, sits at -0.357%, and extended to 23 days, while the US 10-year benchmark note rate retraced five bps to 2.694%.

US 2s-10s yield curve inversion

Data-wise, the US calendar featured Initial Jobless Claims for the week ending July 30, which increased by 260K, more than estimated, showing signs that the labor market is easing. At the same time, the US Trade Balance narrowed its deficit from -$80.1 B in May to -$79.6 B in June, propelled by Exports.

In the meantime, the US Dollar Index, a gauge of the buck’s value vs. a basket of peers, tumbled 0.58% at 105.700, accumulating losses from the YTD peak of 3.8%, a tailwind for the dollar-denominated XAGUSD.

Late in the day, Fed speaking, led by Cleveland’s Fed Loretta Mester, reiterated that there’s a path for a soft landing but recognized that recession fears have risen, adding some fuel to the uncertainty confirmed by the UK, recession lingering worldwide.

Shifting to geopolitical jitters, tensions between the US and China persist. In response to US House Speaker Nancy Pelosi’s trip to Taiwan, China fired missiles over Taiwan during military drills, while Japan complained that five of those missiles landed in Japan’s exclusive economic zone. The US National Security spokesman John Kirby said that “China has chosen to overreact,” while adding they’re using the visit to increase military activity around Taiwan.

Those plays, amongst market mood, will keep the silver price fluctuating. Nevertheless, it appears that buyers don’t have the strength to crack the XAGUSD’s 50-day EMA at $20.39.

What to watch

The US economic docket will feature July’s Nonfarm Payrolls estimated at 250K, less than June’s 372K. At the same time, the Unemployment Rate is foreseen to persist unchanged at 3.6%.

Silver (XAGUSD) Key Technical Levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.