- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/USD plummets to a 2-week low below 0.6900 as US jobs knocks risk appetite for six

AUD/USD plummets to a 2-week low below 0.6900 as US jobs knocks risk appetite for six

- AUD/USD is knocked for six on the strong NFP headline.

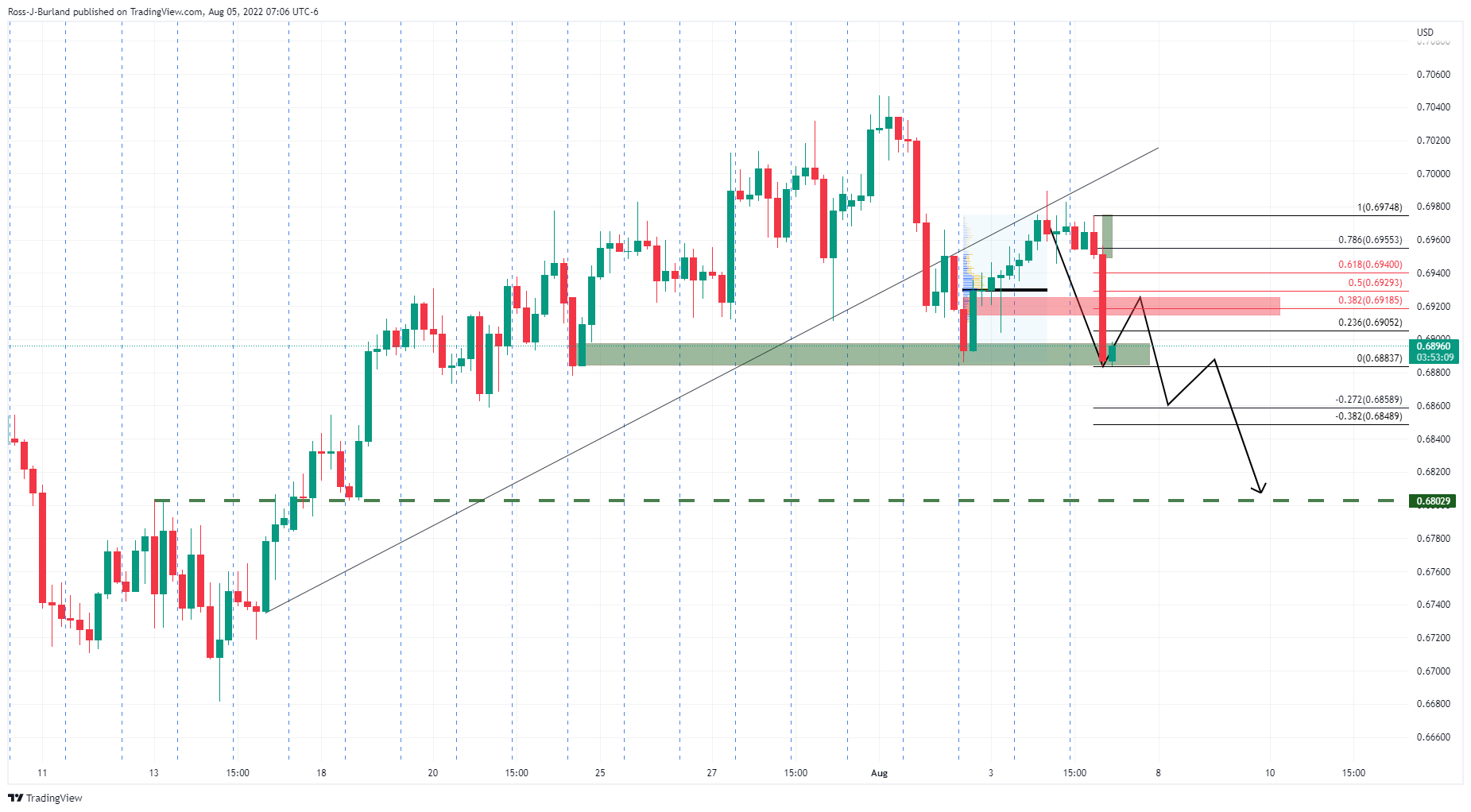

- The price is taking on 4-hour support, a break of that opens the risk of a deeper run below the countertrend line to test 0.68 the figure.

AUD, sensitive to risk tones in financial markets, has been battered by a doubling of market expectations in the Nonfarm Payrolls outcome. AUD/USD has fallen to 0.6882, dropping three pips below the August 2 lows. This move could be carving out a technical bearish breakout towards 0.6900 as illustrated below.

NFP doubles market expectations

- Breaking: US Nonfarm Payrolls rise by 528,000 in July vs. 250,000 expected

Nonfarm Payrolls in the US rose by 528,000 in July, the data published by the US Bureau of Labor Statistics revealed on Friday. This reading followed June's increase of 398,000 (revised from 372,000) and came in better than the market expectation of 250,000. The Unemployment Rate edged lower to 3.5%.

Further details of the publication revealed that the annual wage inflation, as measured by the Average Hourly Earnings, remained unchanged at 5.2%, compared to analysts' estimate of 4.9%. Finally, the Labor Force Participation Rate declined to 62.1% from 62.%.

Investors had been in anticipation of the report for further hints of how the US economy is faring considering a data-dependent Federal Reserve. The data now raises the prospects of a 75 bp hike from the Federal Reserve which is not going to be favourable for risk sentiment or the Aussie that tends to track the performance of global stock markets. The odds of a 75 bps hike have leapt to 61% from 40% on the release.

US dollar tears higher on NFP

Meanwhile, ahead of the jobs data, the US dollar edged higher on Friday in a correction of some of the sharpest daily drop in more than two weeks, sliding 0.68% on Thursday, the largest fall since July 19. The US dollar index (DXY), which measures the greenback against a basket of currencies, was up 0.15% to 105.90 just ahead of the data release, a touch below the day's high of 106.00. While the data is being digested, the index is rallying to a high of 106.808 so far, up over 1% on the day so far.

AUD/USD technical analysis

The price is taking on 4-hour support. There are prospects of a correction following this knee-jerk sell-off as the markets continue to position themselves around the data. There is scope for the price to correct to a higher area of volume to the upside near 0.6920/0.6940, but given the strength of the sentiment surrounding the Fed, a break below the lows printed today opens the risk of a deeper run below the countertrend line to test 0.68 the figure and a prior resistance structure.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.