- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/JPY bears move in on a critical daily support area ahead of US CPI

USD/JPY bears move in on a critical daily support area ahead of US CPI

- USD/JPY bulls could be about to move back in on the daily chart.

- US CPI will be key this week, with eyes on US yields.

USD/JPY has been in recovery mode for the best part of a week, but it came up against resistance following last week’s strong July labour market data in the US. On Monday, the pair is ending the New York session flat for the day at around 135 the figure having ranged between 134.34 and 135.58.

Analysts at ANZ Bank said that despite clear signs of a moderation in Gross Domestic Product growth globally, ''the slower growth and less accommodative monetary environment have yet to show up in increased labour market slack. Until clear evidence emerges that both labour markets and core inflation are moderating, central banks will remain dedicated to getting inflation down, a bias that points to the potential for further large incremental rate hikes.''

The focus for the week ahead will be the July US inflation data in Consumer Price Index that is expected to confirm core inflation (ex-food & energy) rose 0.5% MoM, up 6.1% YoY (5.9%). ''That is way too high for the Fed amid a tightening labour market. The priority of reducing inflation in order to underpin the expansion in domestic demand and sustainable jobs growth will ring loud and clear from the August 25-27 Jackson Hole symposium,'' analysts at ANZ Bank explained.

The analysts at ANZ Bank also said that before the Federal Open Market Committee meets again in September, it will also have the August CPI and labour market data. ''Unless that moderates meaningfully from July’s strong gains, the risks are significant that the Fed may need to hike rates by another 75bps at the 20-21 September meeting.''

Meanwhile, from a positioning perspective, JPY net short positions fell according to the latest CFTC data. In the spot market the JPY had recovered some ground vs the USD as US yields dropped back. ''The stronger than expected US July payrolls report, however, has subsequently caused US 2-year yields to push higher and this has lent fresh support to USD/JPY in the spot market,'' analysts at Rabobank explained.

USD/JPY technical analysis

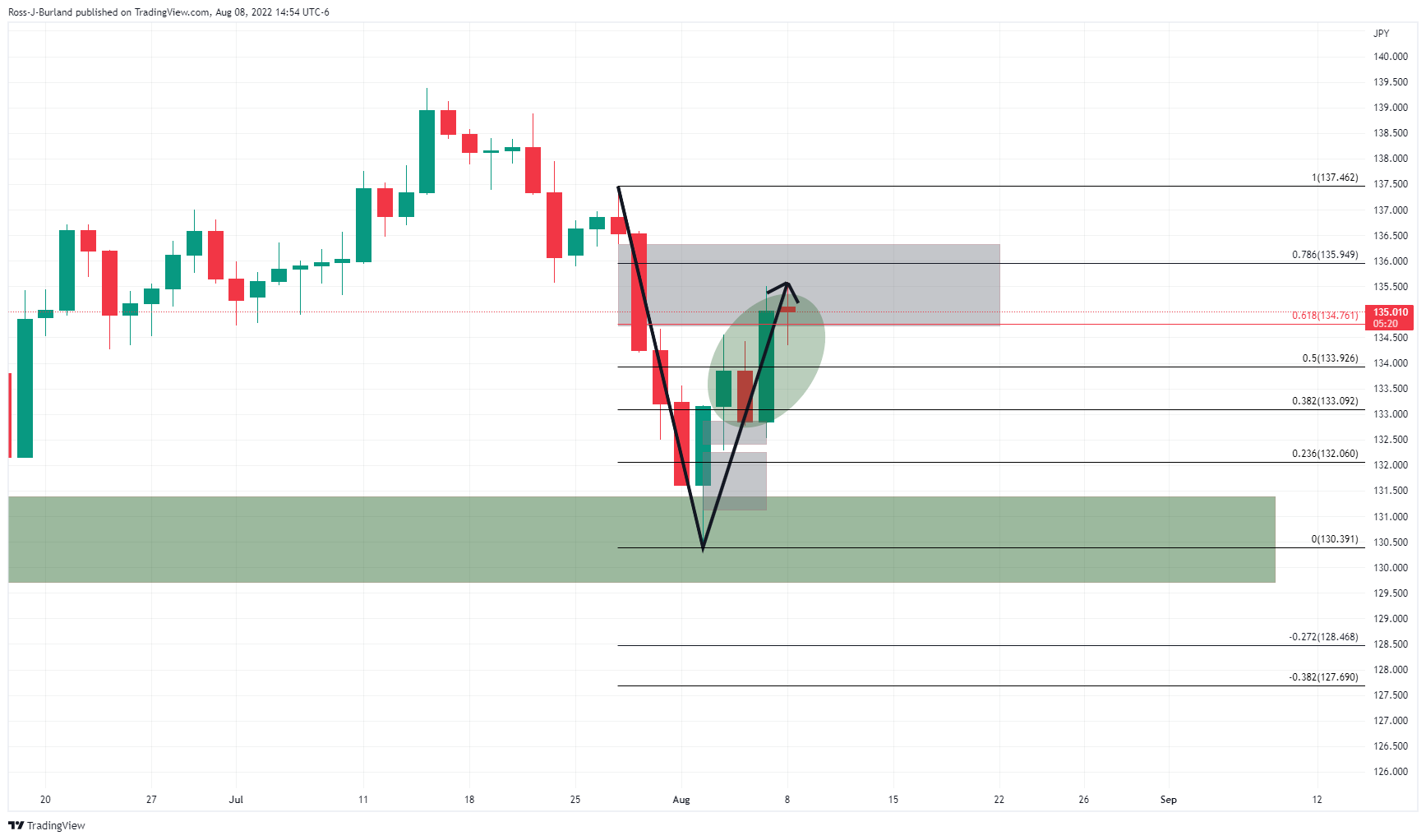

As per the prior analysis, USD/JPY Price Analysis: Bears are lurking within a strong bullish trend, the price moved in to correct the bearish impulse:

(Prior daily chart, above, prior H4 chart, below)

USD/JPY live market

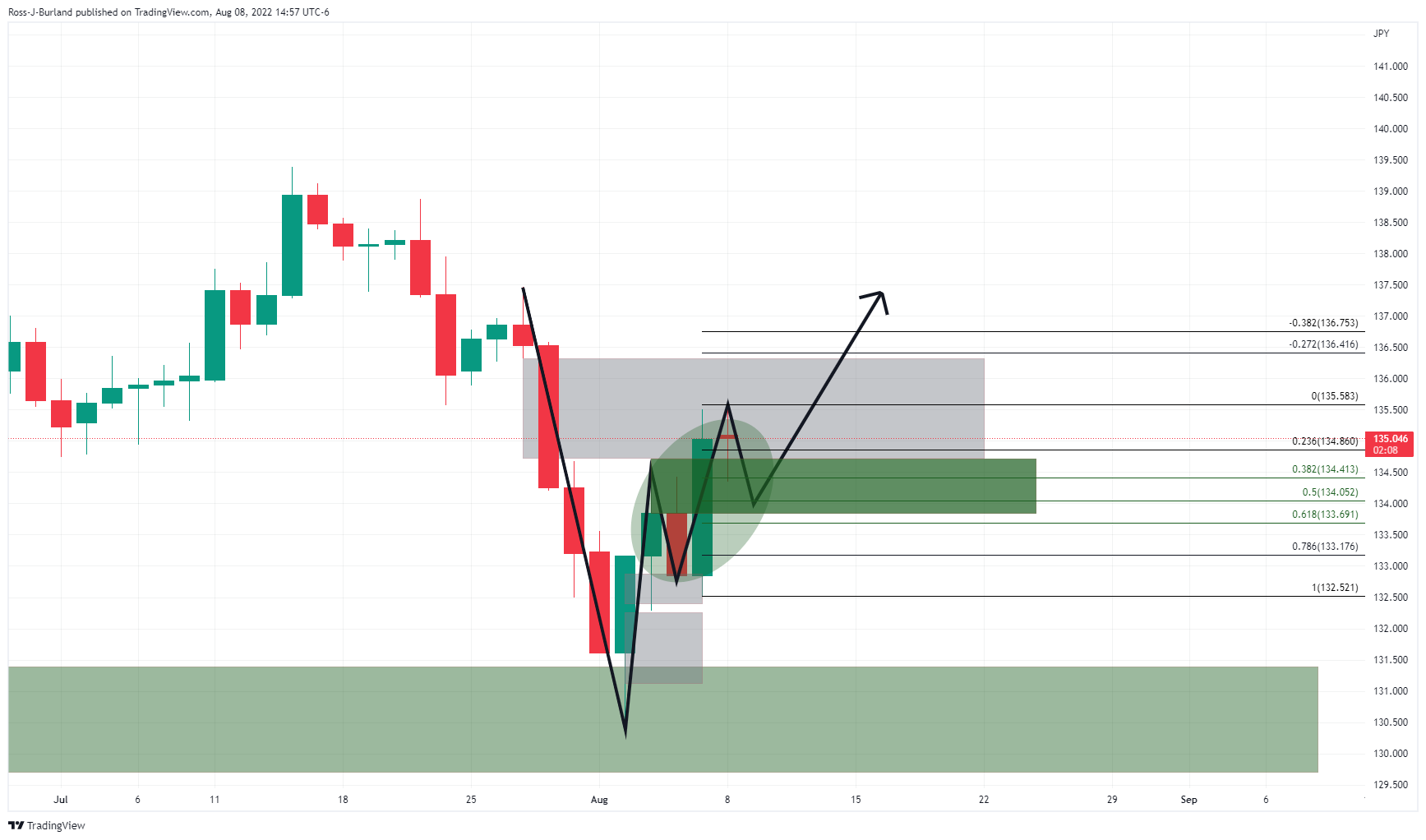

As illustrated, the price indeed moved in towards the targetted area of mitigation as per the prior analysis forecasted and explained. At this juncture, there are prospects of a correction of Friday's bullish candle into the neckline of the W-formation as follows:

The upside prospects will send on the performance of US yields, but there are stacking up for a bullish continuation in the 10-year yields according to the recovery attempts within the broadening formation as follows:

The yield has corrected towards the neckline of the W-formation on the daily chart within the lower boundary of the broadening formation.

In turn, should the price hold above the flagged levels on the chart above, then a break of the trendline resistance could result in a rally in yields, a weight for gold prices.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.