- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/USD Price Analysis: Bull flag teases run-up to 0.7080

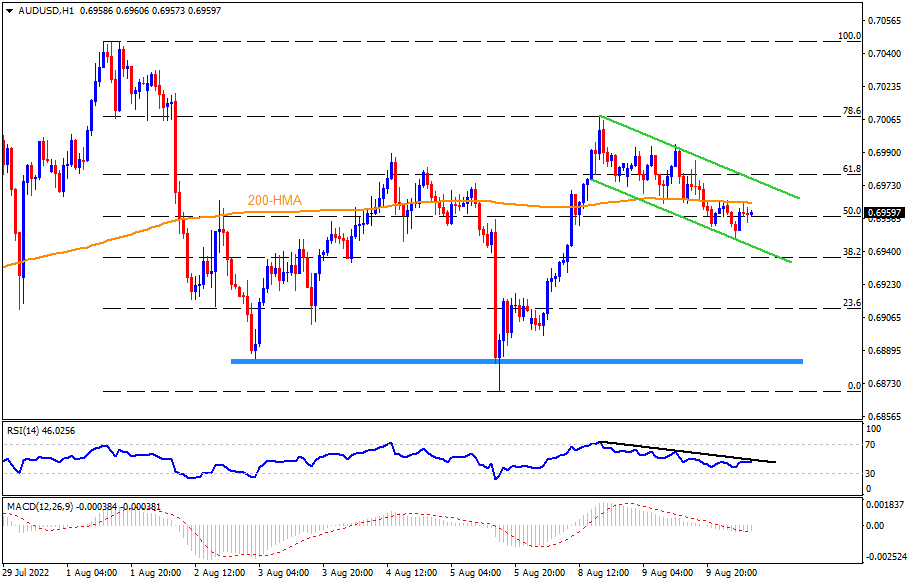

AUD/USD Price Analysis: Bull flag teases run-up to 0.7080

- AUD/USD remains indecisive below 200-HMA inside bullish chart formation.

- RSI, MACD hints at further weakness, 200-HMA guards immediate upside.

- Bulls need validation from 0.6980 resistance, weekly horizontal support tests bears.

AUD/USD retreats to 0.6960 while portraying sluggish moves inside a short-term bull flag. That said, the Aussie pair recently eased from the 200-HMA during Wednesday’s Asian session.

Given the lower high in RSI (14) backing the latest weakness in the AUD/USD prices, as well as the bearish MACD signals, the quote is likely to remain depressed inside a flag, currently between 0.6940 and 0.6980.

It’s worth noting that the 23.6% Fibonacci retracement level of August 01-05 declines, near 0.6910, could test the AUD/USD bears after 0.6940. However, a one-week-old horizontal area near 0.6885 might restrict the Aussie pairs’ further downside.

On the contrary, the 200-HMA level near 0.6965 guards the quote’s immediate recovery.

Following that, the stated flag’s upper line, close to 0.6980 by the press time, holds the key to the AUD/USD pair’s rally.

During the rise, the Aussie pair may take a breather around tops marked on Monday and on August 01, near 0.6995 and 0.7045-50 in that order, ahead of fueling the run-up towards the theoretical target surrounding 0.7080.

AUD/USD: Hourly chart

Trend: Pullback expected

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.