- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- When is the UK inflation and how could it affect GBP/USD?

When is the UK inflation and how could it affect GBP/USD?

The UK CPIs Overview

The cost of living in the UK as represented by the Consumer Price Index (CPI) for July month is due early on Wednesday at 06:00 GMT.

Given the recently released unimpressive employment data, coupled with the allegations of the Bank of England’s (BOE) inaction, today’s data will be watched closely by the GBP/USD traders.

The headline CPI inflation is expected to refresh a 30-year high with a 9.8% YoY figure versus 9.4% prior while the Core CPI, which excludes volatile food and energy items, is likely to rise to 5.9% YoY during the stated month, from 5.8% previous readouts. Talking about the monthly figures, the CPI could ease to 0.4% versus 0.8% prior.

It’s worth noting that the recent pressure on wage prices and upbeat jobs report also highlight the Producer Price Index (PPI) as an important catalyst for the immediate GBP/USD direction.

That being said, the PPI Core Output YoY may rise from 15.2% to 15.9% on a non-seasonally adjusted basis whereas the monthly prints may ease to 0.0% versus 0.8% prior. Furthermore, the Retail Price Index (RPI) is also on the table for release, expected to rise to 12.0% YoY from 11.8% prior while the MoM prints could ease to 0.6% from 0.9% in previous readings.

In this regard, Westpac said,

Annual inflation in the UK is expected to rise again in July as energy inflation pressures remain. Consensus is 0.4%mth; 9.8%yr, with core inflation ticking up to 5.9%yr. With another wave of retail energy prices looming in Q4, the Bank of England forecasts headline CPI to reach a staggering 13%yr before year-end.

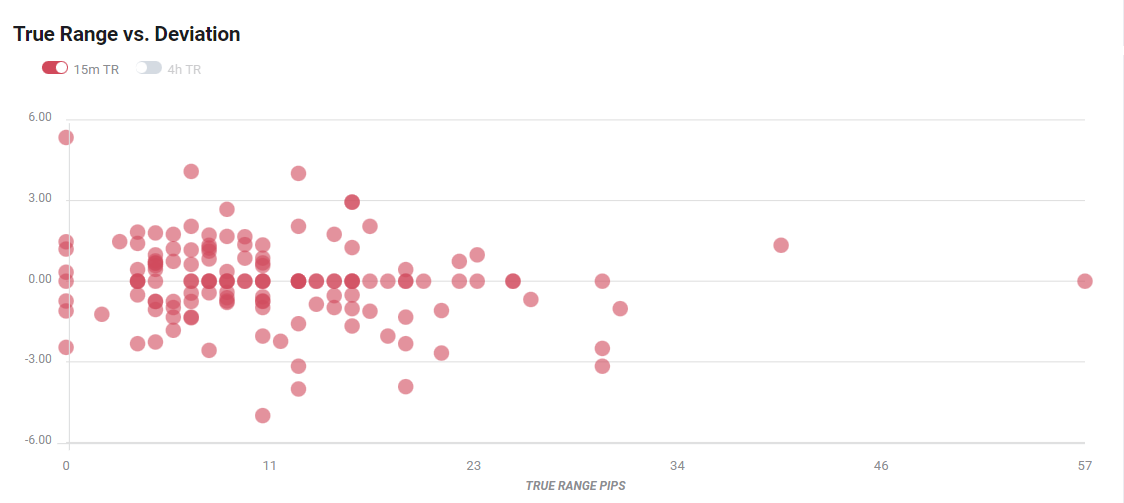

Deviation impact on GBP/USD

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 30-40 pips.

How could it affect GBP/USD?

GBP/USD cheers the broad US dollar weakness while picking up bids to refresh the intraday high around 1.2115 ahead of the UK inflation releases.

The BOE has long been criticized for undertaking a softer attack on inflation mainly by the current UK PM front runner Liz Truss and her team. While identifying the same, BOE Governor Andrew Bailey mentioned that he is “open for review”, which in turn highlights today’s CPI data for the GBP/USD traders.

Should the inflation numbers manage to stay firmer on the MoM, in addition to posting the multi-year high YoY numbers, GBP/USD is likely to extend the latest recovery. Alternatively, pullback moves may have another chance of reversing as the Federal Open Market Committee (FOMC) meeting minutes loom.

Technically, the 20-DMA level, near 1.2500, tests the short-term GBP/USD upside. However, the cable pair’s ability to cross the one-month-old descending trend line, around 1.2250 at the latest, joins the firmer RSI line to underpin bullish bias.

Key notes

GBP/USD Price Analysis: Pokes weekly resistance line around 1.2100

Technical view ahead of UK inflation data

About the UK CPIs

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.