- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD aims a break above $1,740 ahead of US Durable Goods Orders

Gold Price Forecast: XAU/USD aims a break above $1,740 ahead of US Durable Goods Orders

- Gold price is aiming to overstep the immediate hurdle of $1,740.00.

- Lower estimates for the US Durable Goods Orders data are supporting the gold prices.

- Fed’s guidance on interest rates at Jackson Hole will be keenly watched.

Gold price (XAU/USD) is attempting a break above $1,740.00 on lower estimates for US Durable Goods Orders data. Earlier, the precious metal rebounded sharply after printing a fresh monthly low of $1,727.85 on Monday. The pullback move seems less lucrative due to the unavailability of momentum in the upside move, therefore the gold prices will remain on the tenterhooks.

The downbeat preliminary estimates for the US Durable Goods Orders have supported the yellow metal. As per the market consensus, the economic data is expected to scale down vigorously to 0.5% from the prior release of 2%. It is worth noting that core price pressures remained steady in the last reading at 5.9%. Therefore, the Durable Goods Orders data should remain the same or go through a minor change. However, a serious decline in the economic data indicates a plunge in the overall demand.

Apart from that, the commentary from Federal Reserve (Fed) chair Jerome Powell at Jackson Hole Economic Symposium will remain in limelight. Fed Powell will dictate the economic situation in the US and guidance on inflationary pressures and interest rates.

Gold technical analysis

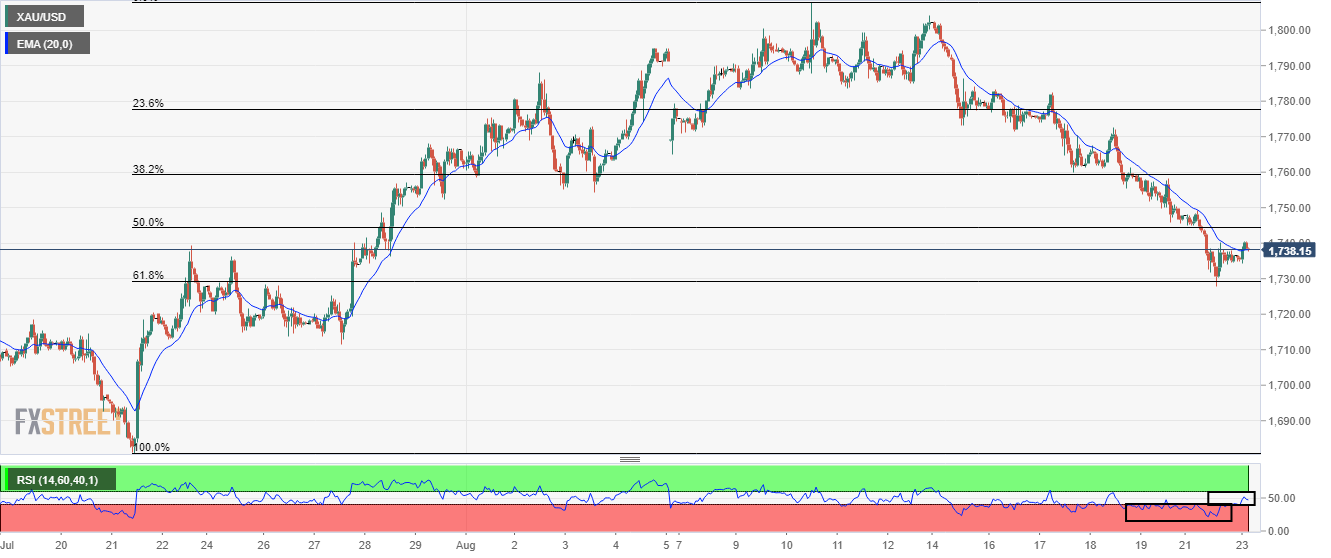

On an hourly scale, gold prices are aiming to extend their recovery after rebounding from 61.8% Fibonacci retracement (placed from July 21 low at $1,680.91 to August 10 high at $1,807.93) at $1,729.44. The precious metal has challenged the 20-period Exponential Moving Average (EMA) at $1,738.00 and a break above the same could turn the short-term trend into a bullish trajectory.

Also, the Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range from the bearish range of 20.00-40.00, which indicates that the gold prices are not bearish now.

Gold hourly chart

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.