- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD bounces off cycle lows around 0.9900, focus on data

EUR/USD bounces off cycle lows around 0.9900, focus on data

- EUR/USD regains some poise and rebounds from 0.9900.

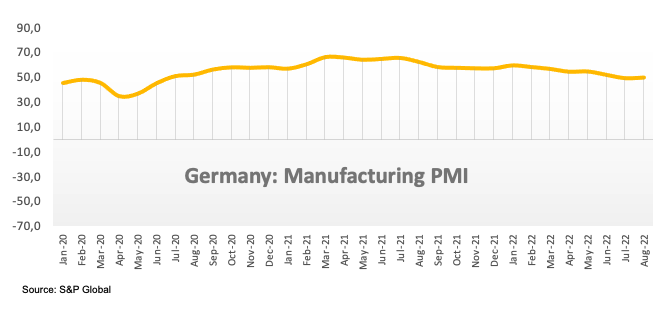

- German flash Manufacturing PMI improves a tad in August.

- EMU advanced Manufacturing PMI seen at 49.7 this month.

After bottoming out in fresh cycle lows around 0.9900, EUR/USD seems to have met some bargain hunters and trades with modest gains near 0.9950 on turnaround Tuesday.

EUR/USD depressed in nearly 20-year lows

EUR/USD remains under heavy downside pressure and trades in levels last visited in December 2002 in the vicinity of the 0.9900 neighbourhood on the back of the persevering upside in the greenback.

Indeed, speculation of further tightening by the Fed and expectations of a hawkish message from Chair Powell at the Jackson Hole Symposium continue to bolster the upside in the greenback, which has lifted the US Dollar Index (DXY) back above the 109.00 mark in detriment of the risk complex in past sessions.

In the euro calendar, flash Manufacturing PMI in Germany improved a tad to 49.8 in August, while the Services gauge appears deteriorate at 48.2. In the broader Euroland, the preliminary Manufacturing PMI is expected at 49.7 and 50.2 when it comes to the Services reading. Later, the European Commission will release its flash Consumer Confidence print for the current month.

Across the pond, advanced Manufacturing and Services PMIs are also due ahead of July’s New Home Sales and the API report.

What to look for around EUR

EUR/USD prints new nearly 2-decade lows around 0.9900 amidst the relentless advance in the greenback.

Price action around the European currency, in the meantime, is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges and the incipient slowdown in some fundamentals.

Key events in the euro area this week: Germany, EMU Flash PMIs, EMU Advanced Consumer Confidence (Tuesday) – Germany Final Q2 GDP Growth Rate, Germany IFO Business Climate, ECB Accounts (Thursday) – Germany GfK Consumer Confidence.

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is losing 0.10% at 0.9932 and a break below 0.9900 (2022 low August 23) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2022 low). On the other hand, the next up barrier comes at 1.0202 (high August 17) followed by 1.0280 (55-day SMA) and finally 1.0368 (monthly high August 10).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.