- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/TRY resumes the upside and approaches the all-time high

USD/TRY resumes the upside and approaches the all-time high

- USD/TRY fades Friday’s pullback and rises above 18.22.

- Türkiye’s Inflation Rate came at 80.21% YoY in August.

- Türkiye’s Producer Prices rose 143.75% YoY during last month.

The Turkish lira resumes its usual depreciation vs. the greenback and pushes USD/TRY back above the 18.22 level on Monday.

USD/TRY keeps targeting the 18.25 region and above

USD/TRY advances modestly above the 18.20 level at the beginning of the week, although keeping the prevailing multi-week consolidative phase well in place for yet another session.

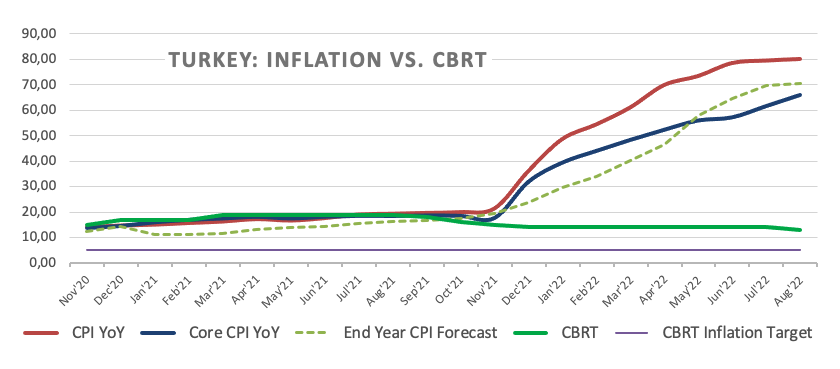

The resumption of the bearish mood in the lira came after inflation figures in Türkiye rose 80.21% YoY in August, the highest pace since September 1998. On a monthly basis, consumer prices rose 1.46%.

In addition, Producer Prices rose 2.41% inter-month and 143.75% from a year earlier.

Over the weekend, the Medium Term Program updated the country’s economic targets for the 2023-2025 period and now sees inflation rising 65% in 2022, 24.9% next year, 13.8% in 2024 and 9.9% in 2025.

What to look for around TRY

USD/TRY flirted with all-time highs around 18.25 last Friday, keeping the uptrend well in place and entering the ninth consecutive month in the positive territory.

In the meantime, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July), real interest rates remain entrenched well in negative territory and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent.

In addition, there seems to be no other immediate option to attract foreign currency other than via tourism revenue, in a context where official figures for the country’s FX reserves remain surrounded by increasing skepticism.

Key events in Türkiye this week: Inflation Rate, Producer Prices (Monday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.39% at 18.2233 and faces the immediate target at 18.2574 (2022 high September 2) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.7586 (monthly low August 9) would pave the way for 17.6272 (55-day SMA) and finally 17.1903 (weekly low July 15).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.