- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- US Dollar Index remains firm and targets 110.00

US Dollar Index remains firm and targets 110.00

- The index adds to Thursday’s small advance and targets 110.00.

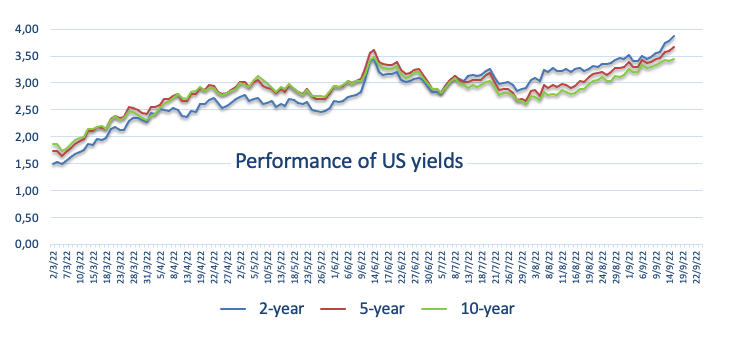

- US yields extend further the march north on Friday.

- Advanced Consumer Sentiment gauge next on tap in the docket.

The US Dollar Index (DXY), which gauges the greenback vs. its main competitors, keeps the bid bias well and sound and approaches the 110.00 neighbourhood at the end of the week.

US Dollar Index remains supported by Fed, data

The index keeps the optimism on the rise in the second half of the week and with the immediate target at the 110.00 neighbourhood.

The rebound in the dollar has been exacerbated following Tuesday’s release of higher-than-expected US inflation figures during August and remains well propped up by the unabated move higher in US yields, especially in the short end and the belly of the curve.

Following the publication of US CPI, a full-point interest rate hike by the Fed at the September 21 meeting emerged on the horizon, although its chances seem to have dwindled a tad since then. Currently, CME Group’s FedWatch Tool sees the possibility of a 100 bps rate raise at 24% amidst investors’ preference for a 75 bps move.

In the docket, the preliminary U-Mich Consumer Sentiment for the current month is due next seconded by Net Long-Term TIC Flows.

What to look for around USD

The index appears bid and keeps the post-CPI rebound well in place for the time being.

Bolstering the dollar’s underlying positive stance appears the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market. This view was reinforced by Chair Powell’s speech at the Jackson Hole Symposium.

Looking at the more macro scenario, the greenback appears propped up by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Flash Michigan Consumer Sentiment, TIC Flows (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation over a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

US Dollar Index relevant levels

Now, the index is advancing 0.12% at 109.88 and a break above 110.01 (weekly high September 13) would expose 110.78 (2022 high September 7) and then 111.90 (weekly high September 6 2002). On the other hand, the next support emerges at 107.68 (monthly low September 13) followed by 107.58 (weekly low August 26) and finally 105.76 (100-day SMA).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.