- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD bulls hang in there as geopolitcal headlines come to the fore

Gold Price Forecast: XAU/USD bulls hang in there as geopolitcal headlines come to the fore

- Gold has managed to hold on despite the resurgence in the US dollar.

- Gold's safe-haven appeal is supporting the price within a familiar daily range.

The gold price is settling in for the end of the North American session around flat for the day having traveled between a low of $1,655.71 and a high of $1,684.95 so far. The yellow metal has found demand on renewed geopolitical concerns following Russia's president, Vladimir Putin, saying he will pour more troops into his war against Ukraine while threatening to use nuclear weapons.

In the face of battlefield setbacks, the Russian leader has doubled down. Russia will mobilize 300,000 additional troops — a number larger than the original invasion force — and Moscow also appears poised to annex Ukrainian territory under its control.

The threat of a wider war is reviving the appeal of the precious metal due to its safe haven role in financial markets despite a bid in the greenback that is trading near the highest in 20 years, supported by the Federal Reserve's 75 basis-point increase to US interest rates on Wednesday and its promise that rates will rise again until inflation is under control.

Fed key takeaways

- US Federal Reserve interest rate decision +75 bps vs +75 bps expected.

- Target Range stands at 3.00% - 3.25%.

- Interest Rate on Reserves Balances raised by 75Bps to 3.15% from 2.40%.

- The policy vote was unanimous.

- Fed anticipates ongoing hikes will be appropriate, prepared to adjust policy as appropriate.

- Board members are highly attentive to inflation risks and strongly committed to returning inflation to 2%.

- Recent indicators point to modest growth in spending and production.

- Ukraine war creates additional upward pressure on inflation, weighing on global economic activity.

- Inflation remains elevated, reflecting pandemic-related imbalances, and higher food & energy.

- Job gains have been robust, the unemployment rate has remained low.

- The median forecast shows rates 4.4% at end-2022.

- Futures after FOMC decision imply traders see 89% chance fed raising rates at another 75bps at the November meeting.

In this context, the precious metals' price action could still have further to fall as the restrictive rates regime is set to last for longer, analysts at TD Securities argued. ''Indeed, gold and silver prices have tended to display a systematic underperformance when markets expect the real level of the Fed funds rate to rise above the neutral rate, as estimated by Laubach-Williams.''

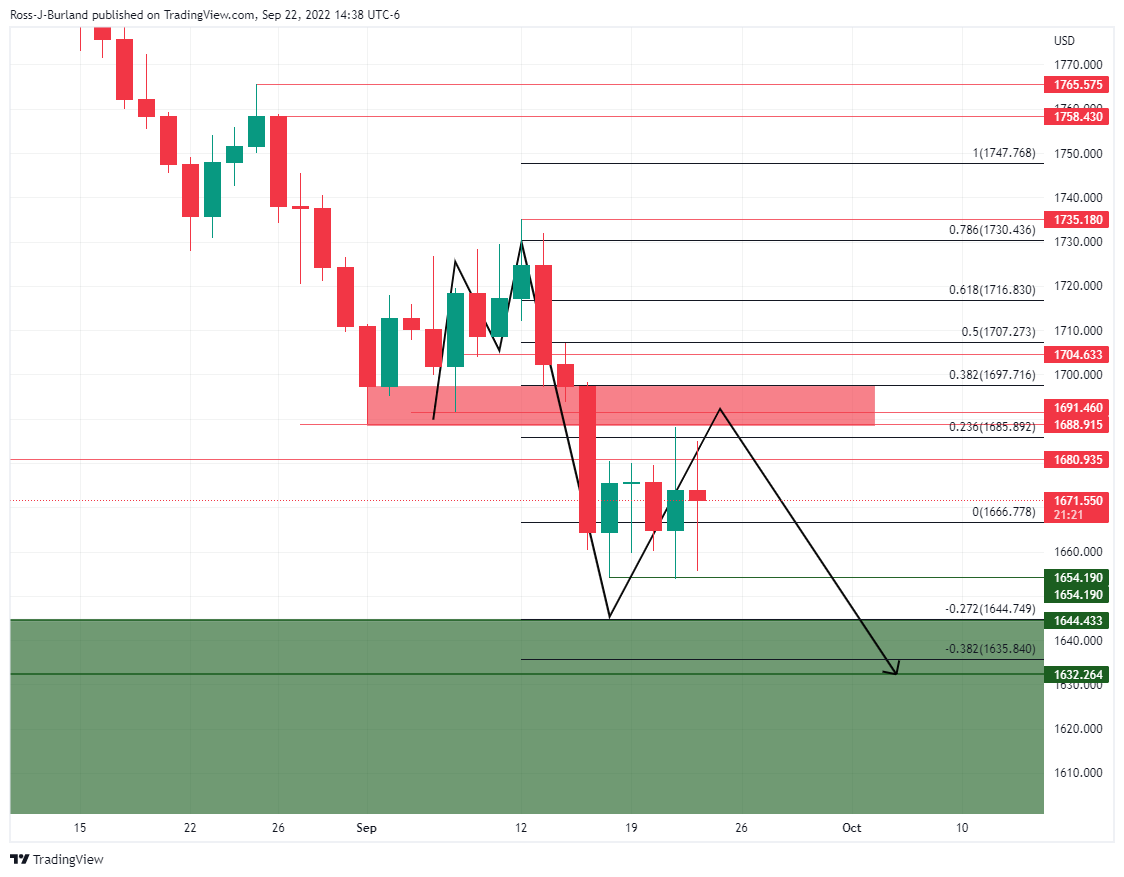

Gold technical analysis

Meanwhile, from a technical perspective, there are still prospects of a move higher from out of the sideways channel as per the M-formation which is a reversion pattern.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.