- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/JPY Price Analysis: Hovers around the 50/100-DMAs around 139.00

EUR/JPY Price Analysis: Hovers around the 50/100-DMAs around 139.00

- On Monday, the EUR/JPY finished the session trading positively, gaining 0.15%.

- The daily chart depicts the pair as neutral-biased.

- Short term, the EUR/JPY is headed to the downside and might test the 137.00 figure in the near term.

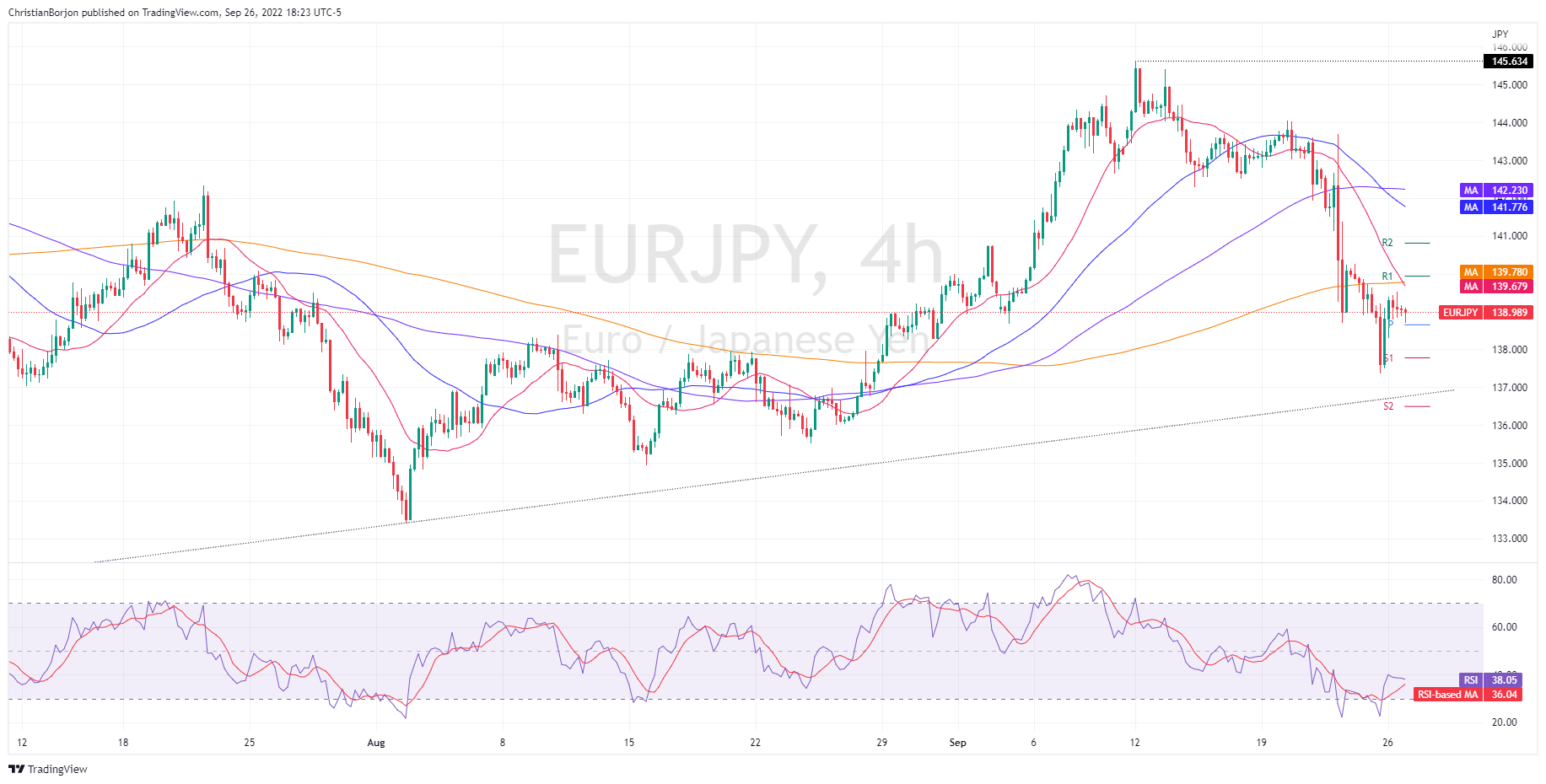

As the Asian Pacific session begins, the EUR/JPY barely drops 0.04%, courtesy of a risk-off impulse, due to increasing recession fears, as central banks continue to tighten monetary policy conditions, while the UK government unveiled a program of tax cuts, aimed to stimulate the already battered economy. At the time of writing, the EUR/JPY is trading at 138.99, below its opening price.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY tumbled below the confluence of the 50 and 100-day EMA during Monday’s session, influenced by the fall in the GBP/JPY. On its way south, the EUR/JPY reached a fresh monthly low of around 137.36, but a seven-month-old upslope support trendline capped the fall, and the pair bounced toward current spot prices. Even though the Relative Strength Index (RSI) tumbled to negative territory, EUR/JPY’s failure to break below the 200-EMA keeps the neutral bias intact.

In the near term, the EUR/JPY bias turned negative once the exchange rate tumbled below the 200-EMA, while the 20-day EMA dropped under the former, signaling that sellers begin to gather momentum. Additionally, the Relative Strength Index (RSI) at 38, in bearish territory, further cements the downward bias.

Therefore, the EUR/JPY first support would be the daily pivot at 138.65. Break below will expose the S1 pivot at 137.78, followed by the upslope trendline above-mentioned at around 137.00, ahead of the S2 daily pivot at 136.51.

EUR/JPY Key Technical Levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.