- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD plunges below $1700 after upbeat US NFP, next CPI

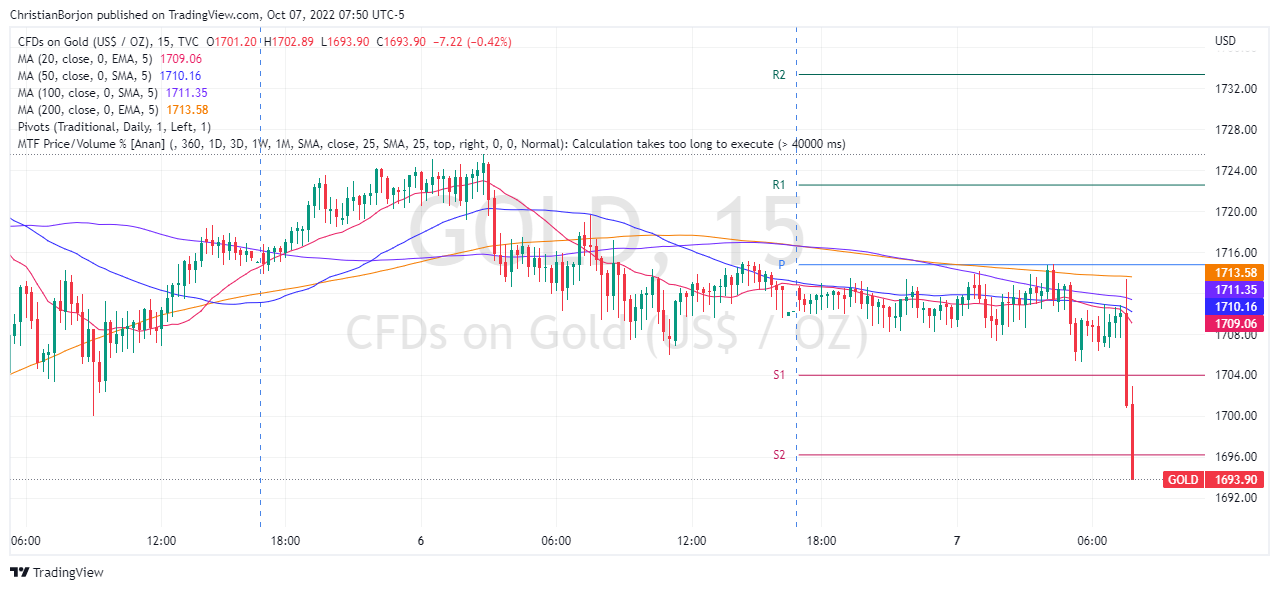

Gold Price Forecast: XAU/USD plunges below $1700 after upbeat US NFP, next CPI

- The gold price tumbled below the $1700 figure, in the aftermath of the US jobs report.

- US Nonfarm Payrolls exceeded estimates at 263K, further Fed hikes coming.

- US Treasury bond yields pushed to the upside, staying above 3.80%.

Gold price dropped after the US Labor Department reported employment figures, which exceeded estimations, justifying the Fed’s need for further tightening, bolstering the greenback. Therefore, XAU/USD is trading at around $1690, below its opening price.

Before the US Nonfarm Payrolls report was released, the yellow metal meandered around $1710. However, once the headline crossed newswires, gold’s initial reaction slid towards the $1700 region, but the initial move dissipated. Nevertheless, at the time of typing, it extended its losses below $1700 in a volatile reaction.

US Data reported by the US Bureau of Labor Statistics (BLS), showed that the US economy added 263K new jobs, smashing estimations of 250K, while the Unemployment Rate ticked lower to 3.5%, from 3.7% expectations. Even though it is a lower reading than August’s figures, it was above estimates, which would further cement the case for e Federal Reserve rate hike.

In the meantime, money market futures have priced in a 92% chance of a Fed 75 bps rate hake, up from 85.5%, before the US Nonfarm Payrolls report.

US Treasury bond yields pushed to the upside, with the US 10-year Treasury bond yield advancing three bps, at 3.865%, while the US Dollar Index, a gauge of the buck’s value vs. six currencies, is up 0.28%, at 112.565.

What to watch

Now that the US Nonfarm Payrolls report is on the rearview mirror, the next important events in the US calendar would be September CPI figures and the University of Michigan Consumer Sentiment in the next week.

Gold 5-minute Chart

Gold Key Technical Levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.