- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- ECB’s De Cos: Some shocks in ECB downside scenario have materialised

ECB’s De Cos: Some shocks in ECB downside scenario have materialised

Some shock in the European Central Bank's downside has materialised according to the ECB policymaker Pablo Hernandez de Cos said who crossed the wires late in the North America session. He previously said earlier this week that risks to the inflation outlook in the eurozone remain on the upside and have intensified, particularly in the short term.

He also said today that the UK situation should not be contagious if properly managed. He says this as the UK 20- and 30-year yields hit 20-year high above 5%

following Andrew Bailey's comments, who is the governor of the Bank of England. The government borrowing costs surged again when Bailey told pension funds they had three days to fix liquidity problems before the bank ends emergency bond-buying that has provided support.

Meanwhile, the euro is under pressure as the US dollar remains the favourite. Earlier today, Minneapolis Fed President Neel Kashkari reaffirmed policymakers' commitment to the current rate-hike path, saying the bar for a shift away from monetary policy tightening is "very high." These comments come ahead of Thursday's US Consumer Price Index reading which is expected to return to a four-decade high. Meanwhile, prices paid to US producers rose more than expected in September, supporting the greenback, according to data released on Wednesday.

Additionally, Reuters reports that the ECB's policymakers are close to deal to change the terms of targeted longer-term refinancing operations and that the decision could come Oct 27. The deal is governing trillions of euros worth of loans to banks in a move that will shave tens of billions of euros off in potential banking profits, sources close to the discussion said.

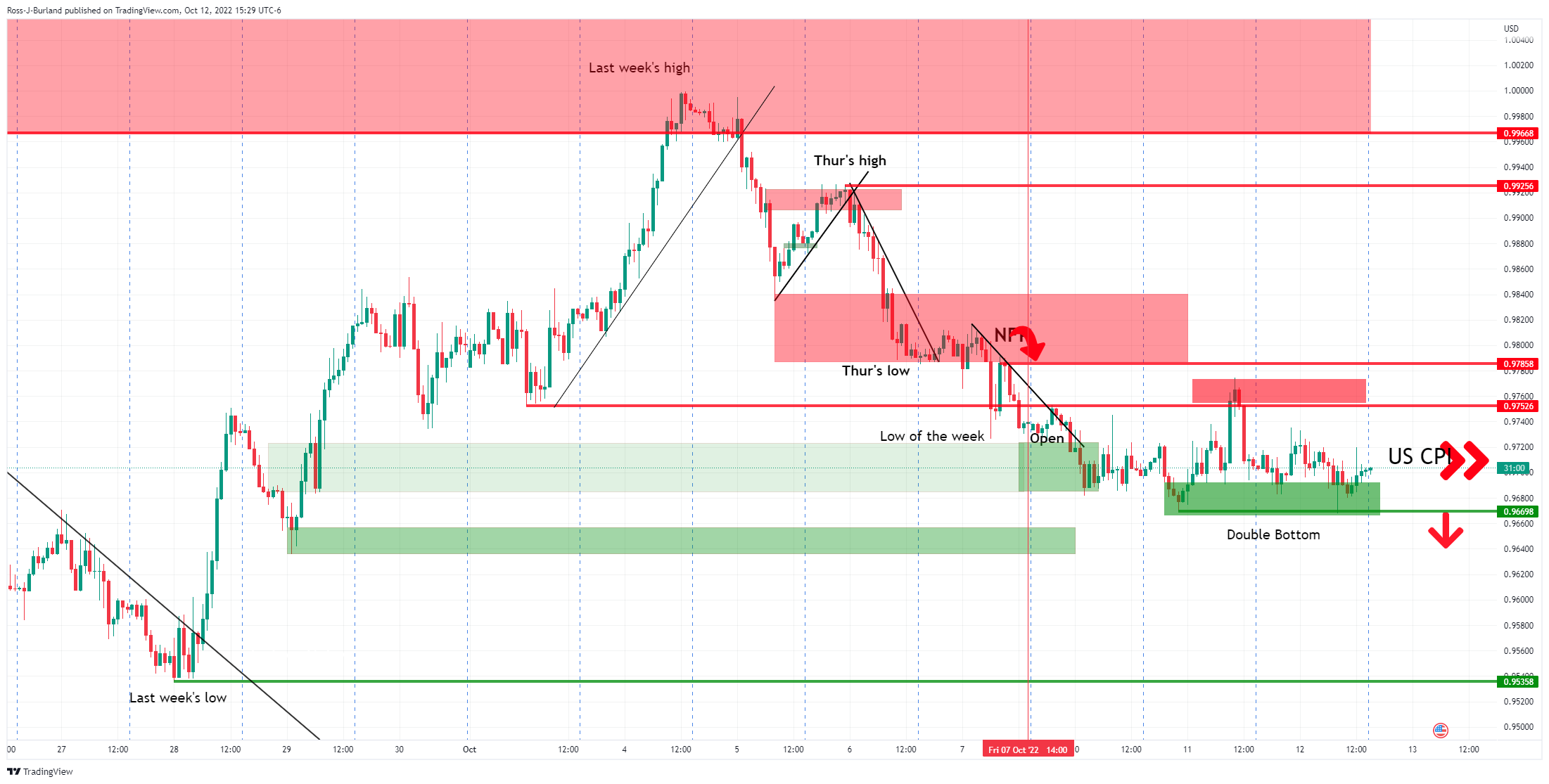

EUR/USD update

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.