- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/JPY Price Analysis: Bounces off weekly lows, though stalls at 163.00

GBP/JPY Price Analysis: Bounces off weekly lows, though stalls at 163.00

- GBP/JPY recovered Tuesday’s losses, gaining in the week, so far 1.05%.

- Short term, the GBP/JPY is upward biased, though facing solid resistance at the 100-day EMA around 163.00.

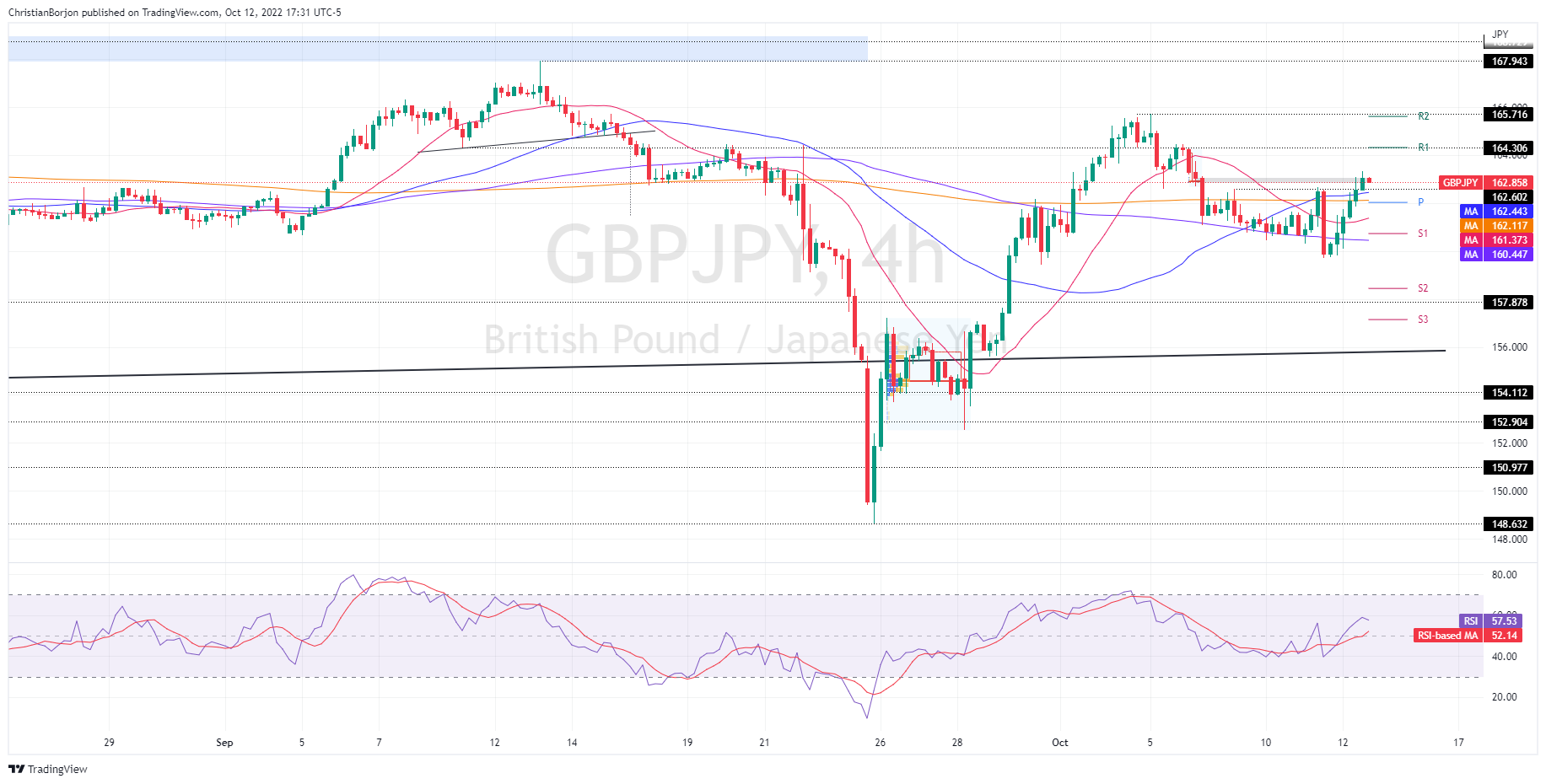

The GBP/JPY slightly advances as the Asian session begins, following a positive trading session for the British pound, which recovered Tuesday’s losses, courtesy of BoE’s Governor Andrew Bailey, who spooked investors when he said that the BoE due date for the emergency buying program, would be October 14. Traders reacted negatively, dumping risk-perceived assets. At the time of writing, the GBP/JPY is trading at 162.90.

On Wednesday, the GBP/JPY opened below the 160.00 mark, rallying sharply close to 300 pips. Why? All this happened as market sentiment improved earlier in the New York session and relieved that the UK’s Chancellor of the Exchequer, Kwarteng, authorized an additional 100 billion quid for the BoE, increasing its bond purchasing power to GBP 995 billion.

GBP/JPY Price Forecast

Given the backdrop, the GBP/JPY is still neutral-to-upward biased. Even though the GBP/JPY faces solid resistance around the 100-day EMA at 163.13, the GBP/JPY registered a fresh four-day high, meaning buyers are gathering momentum. Another factor that justifies the bias is the RSI on bullish territory, which could exacerbate a rally towards October 5 cycle high at 165.71.

The GBP/JPY four-hour scale illustrates six-consecutive bullish candles as the cross-currency pair edged toward 163.00. On its way upwards, the pair cleared the 20, 50, and 200-EMA, opening the door for further gains. Key resistance lies at the R1 daily pivot found at 164.30, which is also October’s 5 cycle high. Break above will expose the 165.00 figure, followed by the confluence of the October 4 daily high and the R2 pivot point at 165.71.

GBP/JPY Key Technical Levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.