- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Breaking: USD/JPY pops 149.00, highest since June 1990s

Breaking: USD/JPY pops 149.00, highest since June 1990s

- The Japanese yen hits a new 32-year low.

- Will the BoJ intervene again this week?

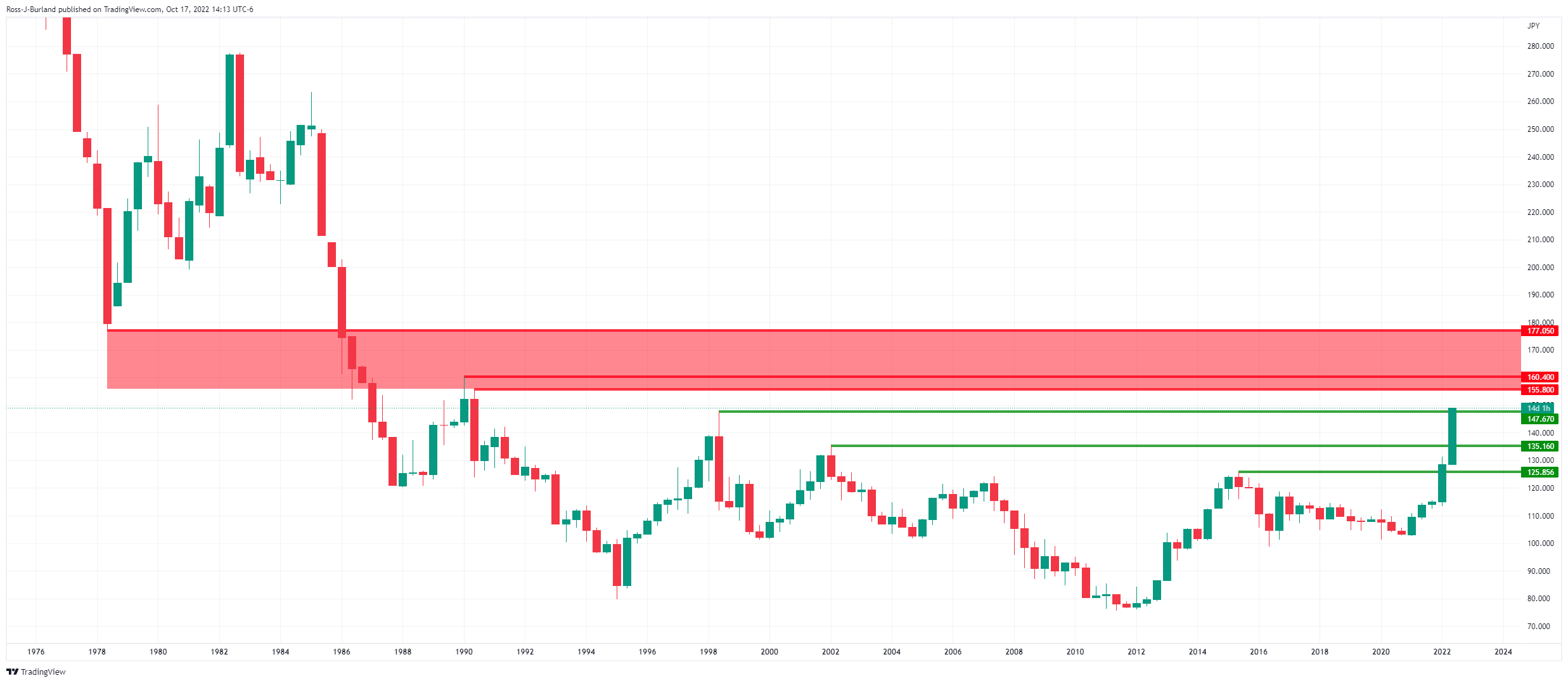

USD/JPY has pierced the 149.00 level as per the following 5-month chart:

The bull eye the prospects of running up to the psychological level of 150 where speculating lies for further intervention from the Japanese authorities. At the start of the week, Japan’s top currency diplomat Masato Kanda said authorities would firmly respond to any excessive currency fluctuations.

Each country would respond appropriately to an agreement on foreign exchange market moves by the Group of Seven (G7) and G20 meetings last week, he said.''

Japan's Finance Miniter Shun'ichi Suzuki has also stepped in and said that they will take decisive action against excess forex moves based on speculation. Suzuki says they are constantly watching fx movements with a sense of urgency.

The yen has declined nearly 30% against the dollar this year already as the divergence between the US Federal Reserve's hawkish stance and the Bank of Japan's ultra-lose policy. Last month, Japanese authorities conducted their largest-ever currency intervention to support the rapidly falling yen, having spent 2.84 trillion yen for its efforts which yielded a fleeting effect.

Meanwhile, the US dollar was softer against a basket of major currencies and sterling jumped on Monday after Britain's new finance minister ditched most of the government's "mini-budget", while better-than-expected earnings from Bank of America helped to boost risk appetite.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.