- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD Price Analysis: The bird is perched on a broken branch of the week's bearish template

NZD/USD Price Analysis: The bird is perched on a broken branch of the week's bearish template

- NZD/USD bears are lurking at key structures.

- The day ahead could be a whitewash for the bird if the US dollar rallies.

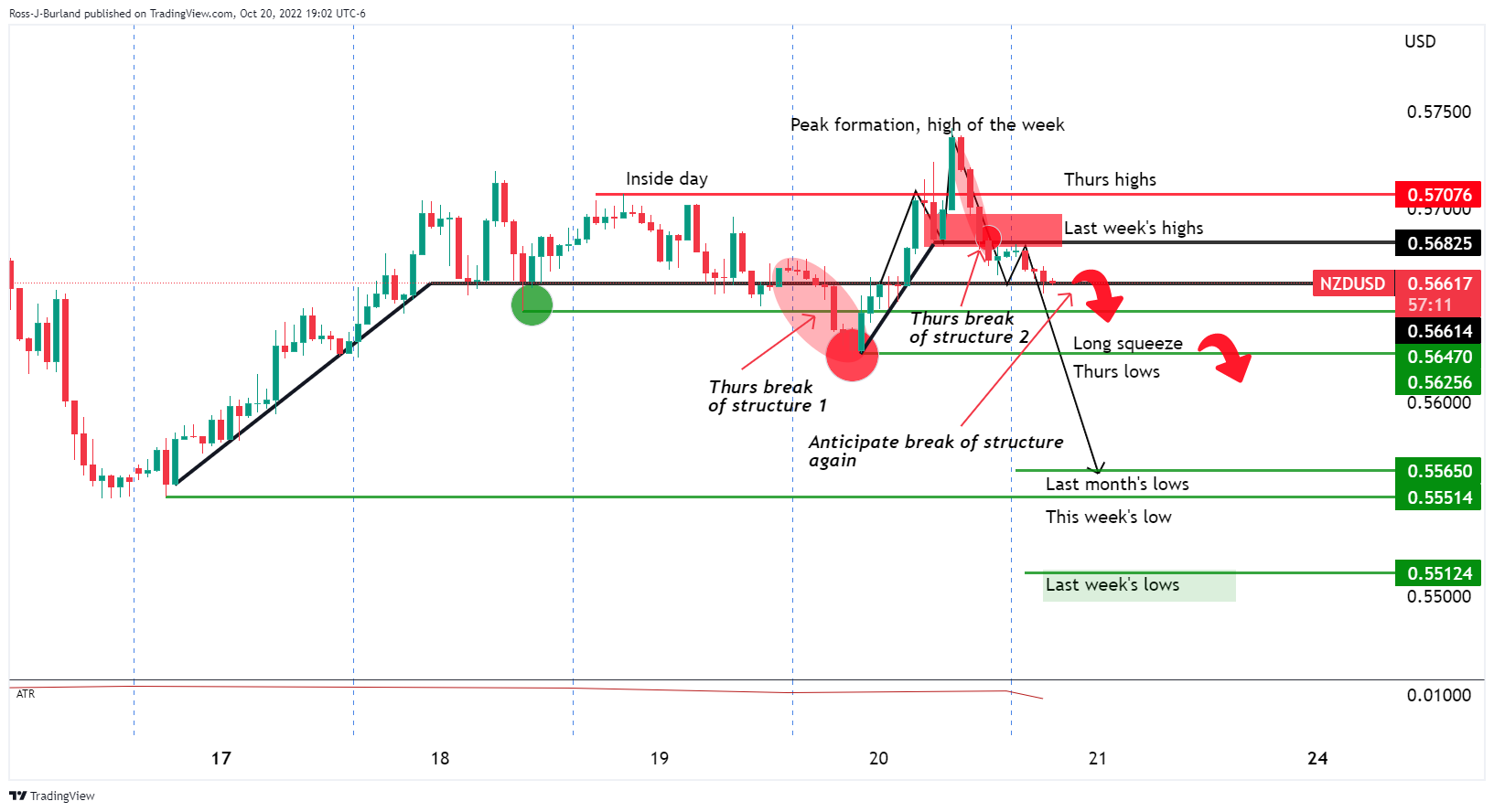

NZD/USD could be on the verge of a final long squeeze into positions that have been in the money since the start of the week. The US dollar is ripening for a rally from key daily support as US yields tear into fresh bulls cycle highs. The following illustrates the prospects for a sell-off into last week's lows for a fresh low on the week down to 0.5512. this is below the daily ATR of 97.

NZD/USD daily chart

NZD/USD H1 chart, weekly template

The bird is perched on a broken branch of this week's bearish template, hovering over longs like a guillotine given that this structure was already broken in Tokyo on Wednesday. The price is below the daily peaks and the M-formation's neckline and recently broken structure 2 at 0.5682. There are prospects of a break of structure 1 0.5661 again for the sessions ahead.

If the bears can get below there, 0.5650 will be eyed as the final structure that guards in-the-money long positions to the start of the week's prices near 0.5550 and then last week's bear cycle lows of 0.5512.

For now, eyes are being kept on US yields:

US 2-year yields and DXY

The yield is paying out at the highest levels in years and remains on the front side of the trendline. A test into the W-formations support and the trendline support could be underway for the way ahead, but should the yield move higher, the US dollar could take off and be the catalyst for the long squeeze in the kiwi.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.