- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- WTI reaches up to key resistance as trend followers stay on the bid

WTI reaches up to key resistance as trend followers stay on the bid

- WTI has moved into key resistance as trend followers stay on the bid.

- Supply concerns have been dominating the energy complex.

At the time of writing, West Texas Intermediate crude oil (WTI), is up by over 0.9% at $89.10 having claimed from a low of $87.35 reaching a high of $89.78 so far. Supply concerns have been dominating the market on the back of the United States reporting better-than-expected economic growth data for the third quarter. At the same time, tight supplies of diesel and other distillates are fuelling the bid.

The United States reported its gross domestic product rose by 2.6% on an annualized in the third quarter, beating the 2.3% consensus forecast but above the second quarter's 0.6% drop. The data comes ahead of PCE on Friday and the Federal Reserve meeting next week. In any case, the data today is expected to keep the Fed on track in its attempt to slow inflation by hiking rates steeply.

Meanwhile, weak distillate supplies are offering support to prices. The Energy Information Administration mid-week reported distillate stocks rose by 0.2 million barrels last week, rising off a 17-year low and offering support to oil. The EIA also noted US oil exports rose to a record last week. The agency reported that US gasoline inventories fell by about 1.5 million barrels last week and distillate stocks remained at record lows, while US exports of crude oil were strong, the bank said. This offset a smaller-than-expected 2.6-million-barrel increase in crude inventories.

Analysts at TD Securities argued that energy prices are being supported by algorithmic trend follower purchases. ''CTAs are building a net long position in Brent crude as uptrend signals strengthen, but extreme volatility is likely to cap participation from this cohort amid weak trend signals and risk parity portfolio deleveraging.

Diesel prices are also being supported by CTA trend followers, but similarly to other energy markets, algo firepower remains capped by extreme volatility in the complex which argues for little follow-through from CTAs.''

WTI technical analysis

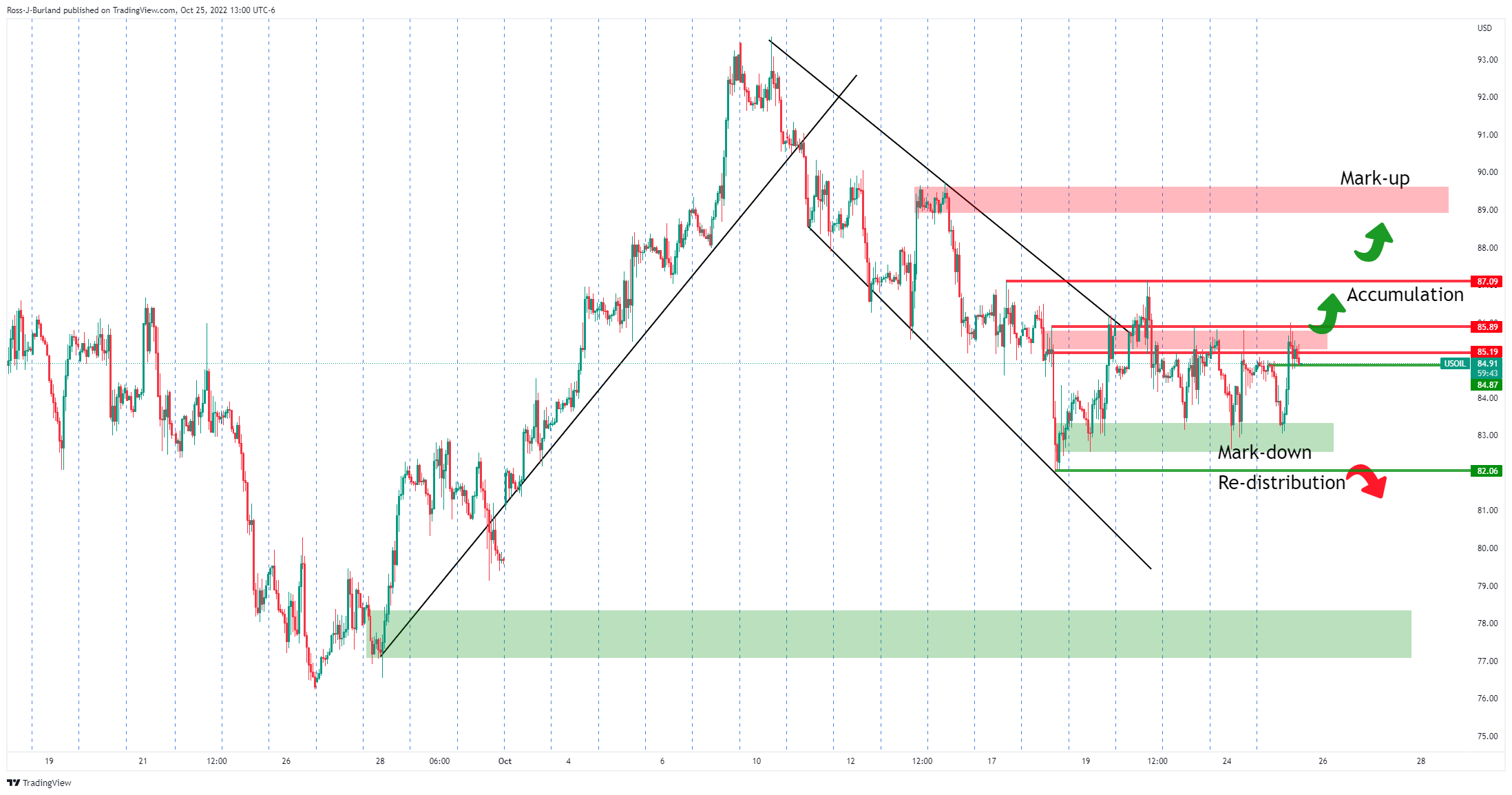

In a prior analysis, it was stated that ''the price could be on the verge of an upside rally on a break of structure, with bulls accumulating the recent price drop,'' with the price being on the backside of the channel:

As the following will illustrate, the price has moved into the projected resistance as follows:

At this juncture, the bulls will need to get above $90.00 for prospects of a break of the $93.60 mid-October highs.

$88.50 comes as the first key support ahead of $87.00.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.