- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

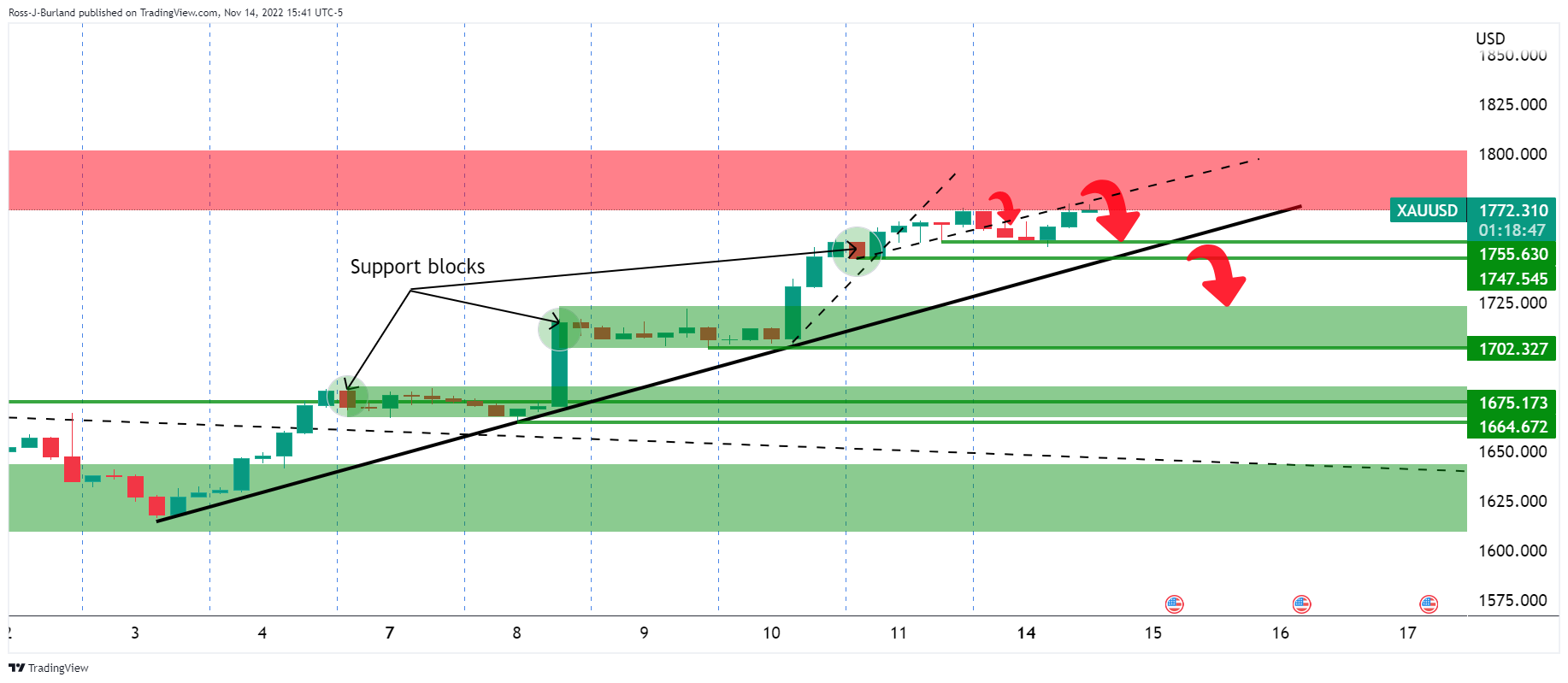

- Gold Price Forecast: XAUUSD moves to the backside of of the bull micro trend

Gold Price Forecast: XAUUSD moves to the backside of of the bull micro trend

- Gold could be on the verge of a move into the recent length built in November's rally.

- Bears are lurking at critical resistance as Monday establishes a fresh corrective high.

Despite a firmer US Dollar, the Gold price edged higher on Monday to a fresh three-month high even as US yields moved higher following Friday's US Consumer Price Index miss vs. the expectations. The yellow metal continues to garner demand based on traders betting that the Federal Reserve would ease off on big interest rate hikes following Friday's inflation data.

Despite a hawkish Federal Reserve meeting, whereby the Fed Chair, Jerome Powell, pushed back against the market's reaction to a dovish statement by arguing that the terminal rate could be higher than first anticipated, commodity prices have been staging a rally off year-to-date lows. There are a number of components to the switch in sentiment, including speculation that China will ease its restrictive zero-Covid policies. There had been growing speculation, due to a series of less inflationary outcomes in the US data of late, that a Fed pivot was on the horizon.

Friday's US consumer prices rose 0.4% for the month of October, up 7.7% over the year. This was down from 8.2% year over year in September and 0.2 percentage points below consensus, as was the ex-food and energy reading of 6.3%. This was a welcome report and the market reaction included a 5.5% surge in the S&P 500 and a 26 basis point drop in the 2-year Treasury yield that sent gold through the roof and the greenback off a cliff. Gold traders had already been focused on the rise in money manager short positioning over the last months leading to substantial short covering beyond the $1,720 resistance.

Fed speakers eyed

Meanwhile, risk events for the week ahead will lie with the Fed speakers, US Retail Sales, Chinese activity data, and updates with regard to the COVID noise in Chinese markets. As for Fed speakers, the US Dollar was thrown a lifeline by Fed's Christopher Waller who crossed the wires before the open and said Friday's inflation report was "just one data point," and that markets are "way out in front".

- Will need to see a run of CPI reports to take a foot off the brake.

- Positive that goods prices came down with some moderation in services, but it needs to continue.

- US policy rate is "not that high" given level of inflation.

- Rate hikes so far has not "broken anything.

- The US housing market needed to slow down.

- Signal was to pay attention to the endpoint not the pace of rate increases, and until inflation slows the endpoint is "a ways out".

Consequently, the US Dollar was bid at the start of the week: US Dollar bulls could start to emerge in the opening sessions:

On the other side of the spectrum, Fed Vice Chair Lael Brainard said on Monday that it will soon be appropriate for the Fed to reduce the pace of its interest rate hikes.

A slew more speakers are slated and analysts at TD Securities said ''Fed speakers are likely to push back on the overly dovish market reaction after the October CPI report. Officials will make clear that following the positive news on the inflation front, there must be further evidence of sustained monthly core inflation that is more in line with their 2% target. And given the persistent strength of the labor market, this may take a while.''

As for US Retail Sales, the analysts at TDS said, ''we look for retail sales to accelerate in October, following a largely sideways move in September. Spending was likely boosted by a significant increase in auto sales and the first gain in gasoline station sales in four months. Importantly, control group sales likely rose firmly, while those for bars/restaurants probably retreated following two months of expansions.''

Gold technical analysis

As per the start of the week's pre-open analysis, Gold, The Chart of the Week: XAUUSD bears licking their lips, watching for lower timeframe distribution, the yellow metal bears are lurking with the price on the backside of the now broken trendlines (counter trendlines):

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.