- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- When are the UK jobs and how could they affect GBPUSD?

When are the UK jobs and how could they affect GBPUSD?

UK Jobs report overview

Early Tuesday, the UK’s Office for National Statistics (ONS) will release the October month Claimant Count figures together with the Unemployment Rate in the three months to September at 07:00 AM GMT.

Today’s UK employment data becomes more important considering the Bank of England’s (BOE) latest efforts to keep the British economy in its liquid stage, coupled with the readiness to defend the rate hike trajectory. It should be noted that the jobs report also becomes important as it will be the first since Rishi Sunak won the Prime Minister’s (PM) seat.

The UK labor market report is expected to show that the Average Weekly Earnings, Including Bonuses, in the three months to September, remained unchanged at 6.0% while ex-bonuses, the wages are seen rising to 5.6% from 5.3% prior readings.

Further, the ILO Unemployment Rate is likely to remain intact at 3.5% for the three months ending in September. It’s worth noting that the Claimant Count Change figures are expected to deteriorate to -12.6K versus 25.5K in previous readouts.

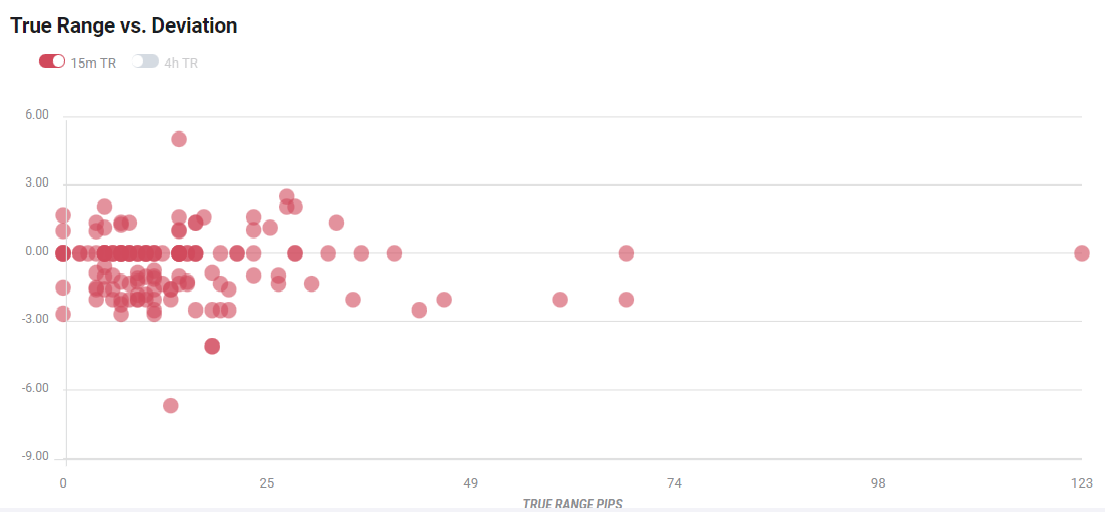

Deviation impact on GBPUSD

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could they affect GBP/USD?

GBPUSD remains mildly bid around 1.1770, reversing the week-start pullback from a 2.5-month high, heading into Tuesday’s London open.

While the recent improvement in British economic growth numbers and firmer inflation data keeps pushing the BOE towards more rate hikes, today’s employment data need to stay in line to keep the GBPUSD buyers hopeful.

That said, a likely easing in the Claimant Count Change may help GBPUSD to extend the latest rebound but a negative surprise, which is more expected, will also justify the US dollar’s rebound to convince the bears.

Technically, GBPUSD buyers keep the reins unless the quote provides a daily closing below the 100-DMA support surrounding 1.1650. Alternatively, the pair’s recovery moves need validation from the late August swing high of 1.1900 to keep the buyers on the table.

Key notes

GBPUSD Price Analysis: Stays pressured inside bullish triangle ahead of UK employment data

GBPUSD faces barricades around 1.1800 ahead of UK Employment/Autumn Statement

About UK jobs

The UK Average Earnings released by the Office for National Statistics (ONS) is a key short-term indicator of how levels of pay are changing within the UK economy. Generally speaking, positive earnings growth anticipates positive (or bullish) for the GBP, whereas a low reading is seen as negative (or bearish).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.