- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUDUSD Price Analysis: Negative divergence triggers a bearish reversal, bears are hopeful below 0.6700

AUDUSD Price Analysis: Negative divergence triggers a bearish reversal, bears are hopeful below 0.6700

- A shift of market sentiment into a negative trajectory has weakened risk-perceived currencies.

- The breakdown of the symmetrical triangle and activation of negative divergence has underpinned the Greenback.

- The 20-EMA is acting as a major hurdle for the asset.

The AUDUSD pair has delivered a downside break of the consolidation formed in a narrow range of 0.6716-0.6750 in the Tokyo session. The asset has sensed selling pressure as investors’ risk appetite has trimmed dramatically.

A recovery experienced in S&P500 futures in Asia is fading now. Meanwhile, the US dollar index (DXY) is oscillating near its immediate hurdle of 106.60. The 10-year US Treasury yields have also recovered to near 3.73%.

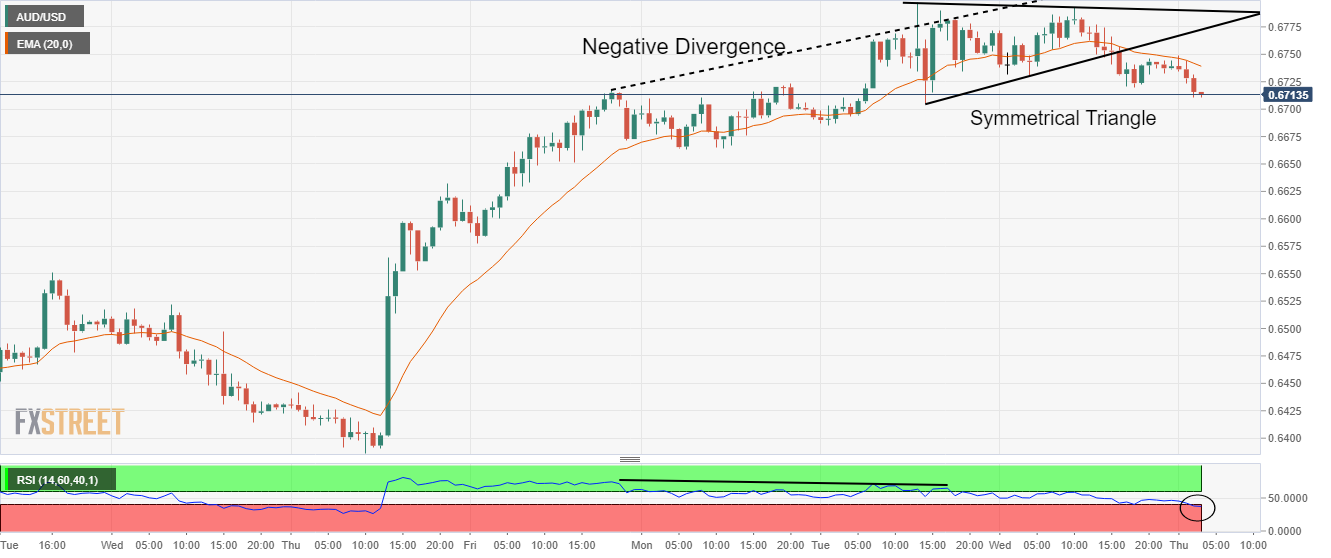

On an hourly scale, the asset has witnessed an expansion in volatility after a downside break of the Symmetrical Triangle formed around Tuesday’s high at 0.6800. Earlier, the major displayed a loss in the upside momentum after a formation of bearish negative divergence. The asset was continuously forming higher highs while the momentum oscillator, Relative Strength Index (RSI) (14) formed a lower high. Also, the RSI (14) has shifted into the bearish range of 20.00-40.00, which indicates that the downside momentum has been activated.

The asset has also surrendered the cushion of the 20-period Exponential Moving Average (EMA), which signals that the short-term trend is bearish now.

A decisive move below the round-level support of 0.6700 will rag the asset towards Monday’s low at 0.6663, followed by November 8 high at 0.6550.

On the flip side, the Aussie bulls could regain traction if the asset recaptures Tuesday’s high near 0.6800. An occurrence of the same will drive the asset towards September 13 high around 0.6900 and a psychological resistance of 0.7000.

AUDUSD hourly chart

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.