- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/USD Price Analysis: Marches towards 1.1900 as yields extend losses

GBP/USD Price Analysis: Marches towards 1.1900 as yields extend losses

- An improvement in risk appetite is shifting momentum towards risk-sensitive currencies.

- The Cable is heading towards the downward-sloping trendline of the symmetrical triangle.

- Overlapping 20-EMA with asset indicates a consolidation head.

The GBP/USD pair has witnessed a steep rise to near 1.1856 in the Tokyo session after sensing buying interest below 1.1800. The Cable is marching towards the round-level resistance of 1.1900 as the risk appetite of the market participants has improved.

Meanwhile, the mighty US dollar index (DXY) has dropped below 107.58 amid a decline in safe-haven's appeal. The US Treasury yields are facing immense pressure led by vanishing confidence for the continuation of bigger rate hike announcements by the Federal Reserve (Fed).

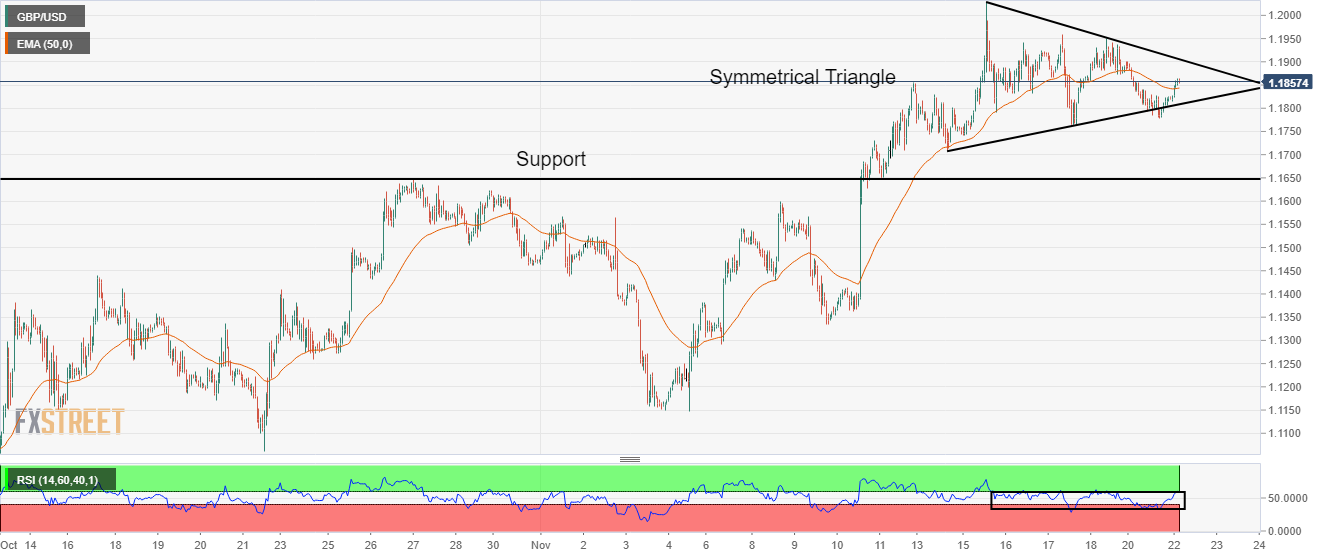

On an hourly scale, the asset is forming a symmetrical triangle chart pattern, which indicates a sheer slippage in volatility. The asset is advancing towards the downward-sloping trendline, plotted from November 15 high at 1.2029 while the upward-sloping trendline of the chart pattern is placed from November 14 low at 1.1710.

The 20-period Exponential Moving Average (EMA) at 1.1844 is overlapping with Cable prices, which indicates a consolidation ahead.

On the contrary, the Relative Strength Index (RSI) (14) is attempting to shift into the bullish range of 60.00-80.00, for upside momentum.

Going forward, a break above Friday’s high at 1.1950 will drive Cable towards November 15 high at 1.2029, followed by the round-level resistance at 1.2100.

On the flip side, a drop below Monday’s low at 1.1780 will drag the asset toward November 14 low at 1.1710. A slippage below November 14 low will expose the asset to the horizontal support plotted from October 27 high at 1.1646.

GBP/USD hourly chart

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.