- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD extends the rally and targets 1.0600

EUR/USD extends the rally and targets 1.0600

- EUR/USD advances to new multi-month highs past 1.0580.

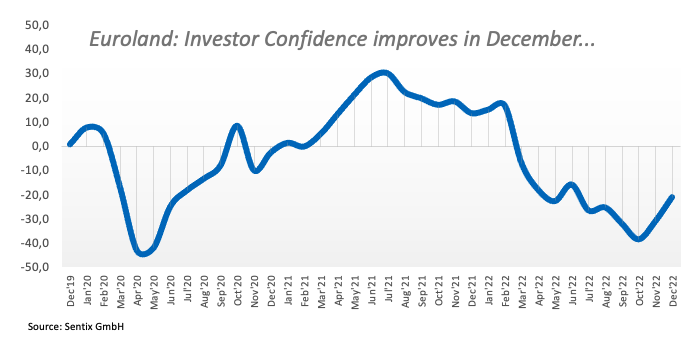

- The EMU Sentix Index surprises to the upside in December.

- Markets’ attention will be on the US ISM Non-Manufacturing.

The optimism around the European currency remains well and sound and lifts EUR/USD to new 6-month peaks in the 1.0580/85 band on Monday.

EUR/USD up on USD-weakness

EUR/USD advances for the fourth consecutive session and extends further the recent breakout of the key 200-day SMA (1.0362), approaching at the same time the 1.0600 neighbourhood.

The continuation of the uptrend in the pair once again comes in tandem with extra decline in the Greenback, which morphed into fresh multi-month lows in the USD Index (DXY).

In the German money markets, the 10-year Bund yield look flatish around 1.85% in a context where a 50 bps rate raise by the ECB at the December 15 gathering appears to be shaping up.

Data wise in the broader Euroland, the Investor Confidence tracked by the Sentix Index ticked higher to -21.0 for the current month, while November’s final Services PMI dropped marginally to 48.5. In Germany, the final Services PMI receded to 46.1 during last month.

In the NA session, the ISM Non-Manufacturing will take centre stage seconded by Factory Orders and the final Services PMI.

What to look for around EUR

EUR/USD pushes higher and trades at shouting distance from the key 1.0600 region at the beginning of a new trading week.

In the meantime, the European currency is expected to closely follow US Dollar dynamics, the impact of the energy crisis on the region and the Fed-ECB policy divergence. In addition, markets repricing of a potential pivot in the Fed’s policy remains the exclusive driver of the pair’s price action for the time being.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the Euro over the short-term horizon.

Key events in the euro area this week: Eurogroup Meeting, ECB Lagarde, Germany Final Services PMI, EMU Retail Sales, Final Services PMI (Monday) - Germany Construction PMI (Tuesday) – EMU Flash Q3 GDP Growth Rate (Wednesday) – ECB Lagarde (Thursday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the protracted energy crisis on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.11% at 1.0551 and is expected to meet the next up barrier at 1.0584 (monthly high December 5) ahead of 1.0614 (weekly high June 27) and finally 1.0773 (monthly high June 27). On the other hand, the breach of 1.0362 (200-day SMA) would target 1.0330 (weekly low November 28) en route to 1.0222 (weekly low November 21).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.