- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- S&P 500 reclaims 4,000 following the release of a soft US inflation report

S&P 500 reclaims 4,000 following the release of a soft US inflation report

- The S&P 500, the Nasdaq 100, and the Dow Jones remain positive.

- Softer than expected, US CPI data augmented speculations that the Fed will be less aggressive.

- Traders expect the Federal Reserve to hike to 5% and cut rates ahead of Q4 2023.

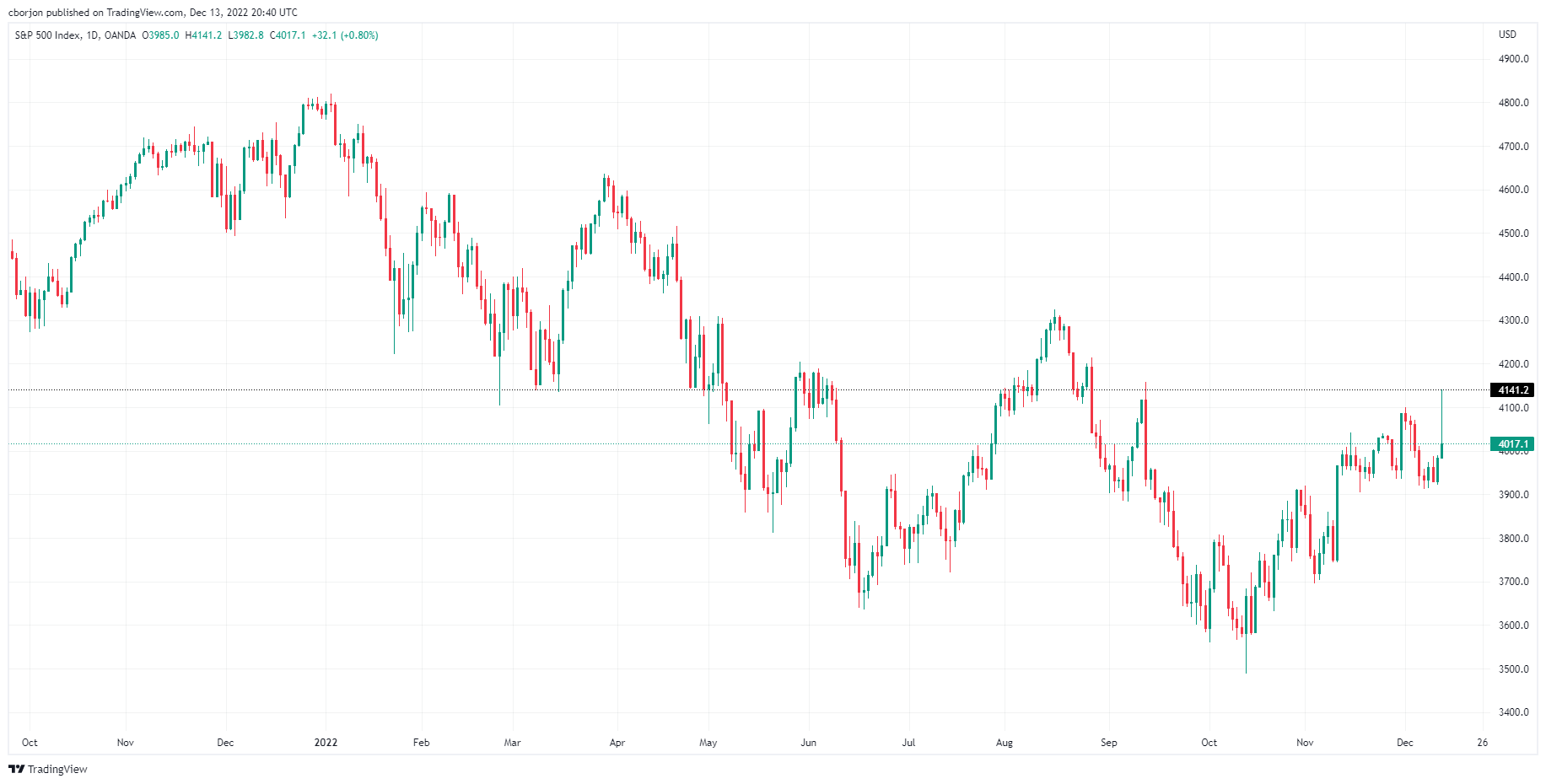

US stocks remained volatile after the release of inflation data in the United States (US) and remain positive off the day's highs, with the S&P 500, the Nasdaq 100, and the Dow Joines Industrial Average, each gaining 0.98%, 1.33%, and 0.47%. At the time of writing, the S&P 500 sits around 4,026.90.

It should be said that the indices, albeit remaining positive, are trading well below the day’s highs, as shown by Tuesday’s price action, forming a vast “inverted hammer” candlestick. Some traders speculate that is the reflection of profit-taking ahead of Wednesday’s Federal Reserve monetary policy meeting.

Before Wall Street opened, the US Department of Labor revealed that November’s Consumer Price Index (CPI) rose less than the 7.3% YoY expected to 7.1%. The so-called core CPI for the same period, which excludes volatile items like food and energy, printed 6.0% vs. 6.3% estimates. The reaction on the data sent the S&P 500 rallying to fresh three-month highs.

Money market futures seem to indicate an upcoming rise in the Federal Funds rate, making it peak at 5%. Eurodollar futures portrayed traders speculating that the Federal Reserve would make its first rate cut of around 20 bps by September 2023. Meanwhile, the US Dollar Index appeared volatile as it fell to six-month lows near 103.586, although recovering shortly afterward and now resting comfortably at 103.987.

Elsewhere, US Treasury bond yields, namely the 10-year benchmark note rate, plunged 15 bps, from around 3.630% to 3.459%, though of late, recovered some ground, sitting around 3.514%.

Analysts at TD Securities said, “the November CPI report does not affect the expectation of a 50bp rate increase at tomorrow’s FOMC meeting. Additionally, given the strength in core services inflation, it is clear the Fed will need to remain in a tightening mode beyond the December meeting. We will be looking for any Fed communication tomorrow regarding a further downshift in the hiking pace for the February meeting.”

What to watch

Ahead of the week, the US economic docket will feature the Federal Reserve Open Market Committee (FOMC), where the Fed is expected to hike rates by 50 bps the Federal Funds rate (FFR). Additionally, the Summary of Economic Projections (SEP) would be released, and the dot-plot would portray the Fed officials’ expectations for interest rates.

S&P 500 Daily Chart

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.