- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD fell toward 1.0640s after the Federal Reserve hiked rates by 50 bps

EUR/USD fell toward 1.0640s after the Federal Reserve hiked rates by 50 bps

- Federal Reserve maintained a neutral-hawkish tone in the monetary policy statement, almost unchanged from November’s.

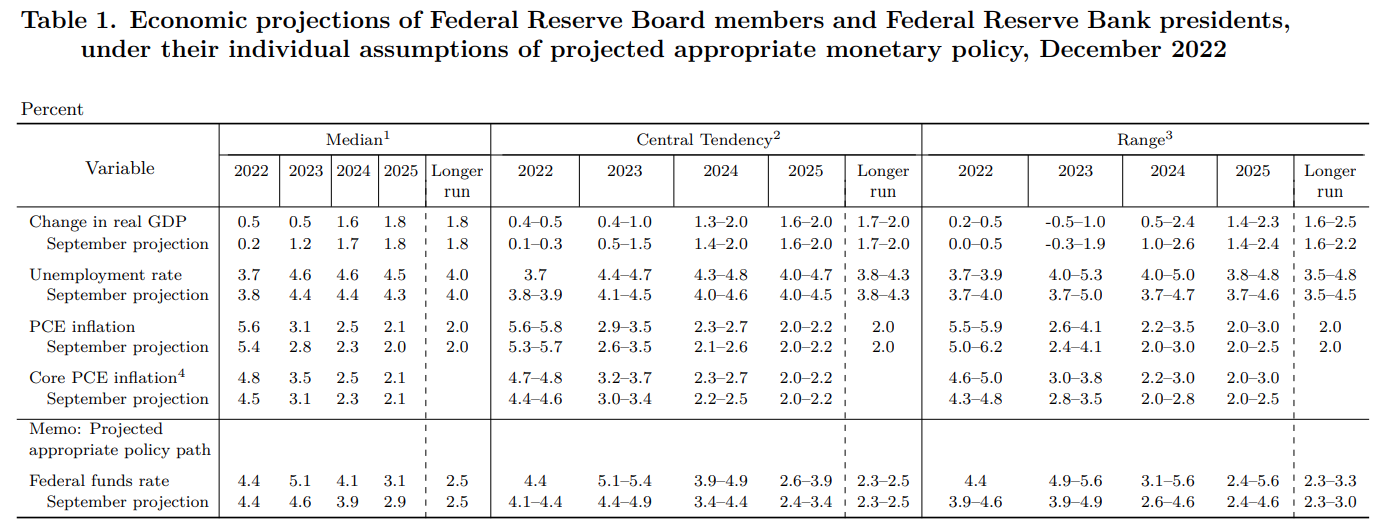

- Fed officials expect the Federal Funds rate to get as high as 5.1%, vs. 4.6% in September.

- Inflation in the United States is expected to hit the 2% threshold by 2024.

The EUR/USD dropped toward 1.0630s after the Federal Reserve (Fed) raised rates by 50 bps, as widely expected by analysts while maintaining a dovish tone, as investors prepared for the Fed Chair Jerome Powell press conference around 18:30 GMT. At the time of writing, the EUR/USD trades volatile, around the 1.0640/1.0660 range.

Summary of the Federal Reserve monetary policy statement

The Federal Reserve Open Market Committee (FOMC) decided to hike the Federal Funds rate (FFR) as expected toward the 4.25-4.50% range, acknowledging that the labor market remains tight and that inflation remains elevated, “reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.”

FOMC officials added that “ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.” Additionally, policymakers expressed that it would take the “cumulative tightening of monetary policy,” inflation, and economic and financial developments.

Regarding the Summary of Economic Projections (SEP), most officials expect the “terminal” rate at around 5.10% according to the median and foresee the Gross Domestic Product (GDP) for 2022 at 0.5% and in 2023 at 0.5%. Inflation is expected to fall to 3.5% in 2023 and will hit the 2.1% mark by 2025.

Source: Federal Reserve

EUR/USD 5-minute Chart

EUR/USD Key Technical Levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.