- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/JPY Price Analysis: Corrective bounce needs validation from 132.80

USD/JPY Price Analysis: Corrective bounce needs validation from 132.80

- USD/JPY picks up bids after falling the most since October 1998.

- Oversold RSI backs recovery moves bearish MACD signals 50% Fibonacci retracement challenges bulls.

- Previous support lines, key SMAs are additional upside hurdles to cross for the bulls before taking control.

- August month’s low, golden Fibonacci ratio eyed during fresh downside.

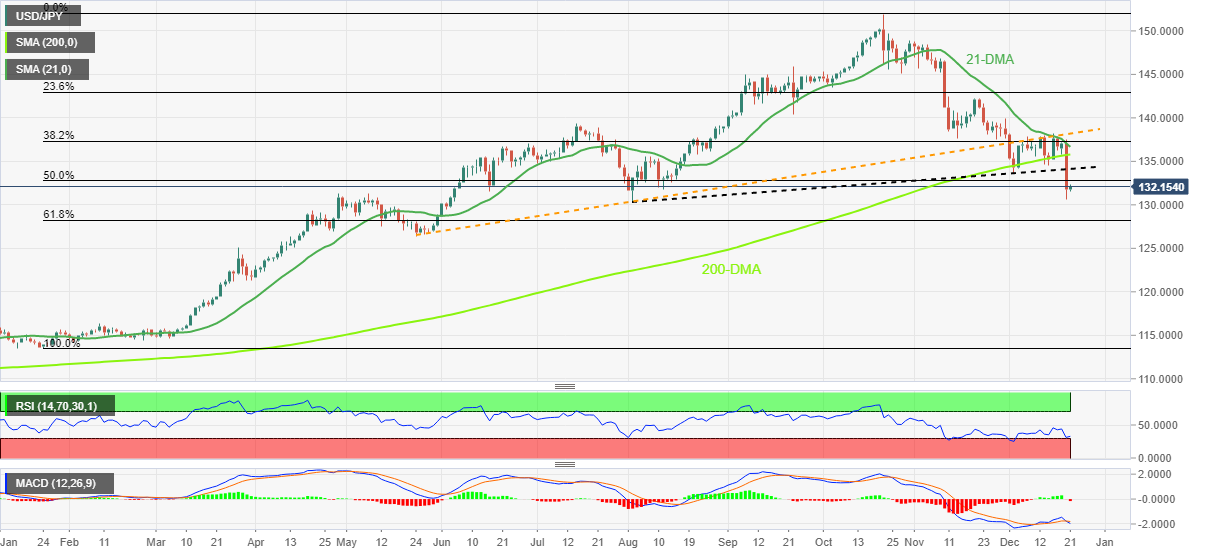

USD/JPY licks its wounds above 132.00, up 0.30% intraday near 132.20 heading into Wednesday’s European session. That said, the Yen pair dropped the most in 24 years and refreshed a four-month low after the Bank of Japan (BOJ) shocked the markets.

The quote’s latest rebound seemed to have justified the oversold RSI (14) conditions as bulls approach the 50% Fibonacci retracement level of the pair’s January-October upside near 132.80.

It’s worth noting, however, that the previous support line from August and the 200-DMA, respectively near 134.00 and 135.80, could challenge the USD/JPY buyers afterward.

Even if the quote manages to stay firmer past 135.80, the 21-DMA and a seven-month-old support-turned-resistance line, around 136.70 and 138.60, will be in focus for the bulls.

On the flip side, April’s low near 130.40 and the 130.00 psychological magnet could challenge the short-term USD/JPY downside.

Following that, the 61.8% Fibonacci retracement level of 128.20, also known as the “Golden Ratio”, should test the bears. Also acting as a downside filter is May’s low near 126.35.

Overall, USD/JPY is likely to remain off the buyer’s radar unless trading below 138.60 while the sellers need to wait for a break below the 130.00 level to retake control. Even so, an upside break of the immediate resistance could extend the latest recovery.

USD/JPY: Daily chart

Trend: Limited recovery expected

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.