- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD bulls are tiring ahead of US CPI as the main event

NZD/USD bulls are tiring ahead of US CPI as the main event

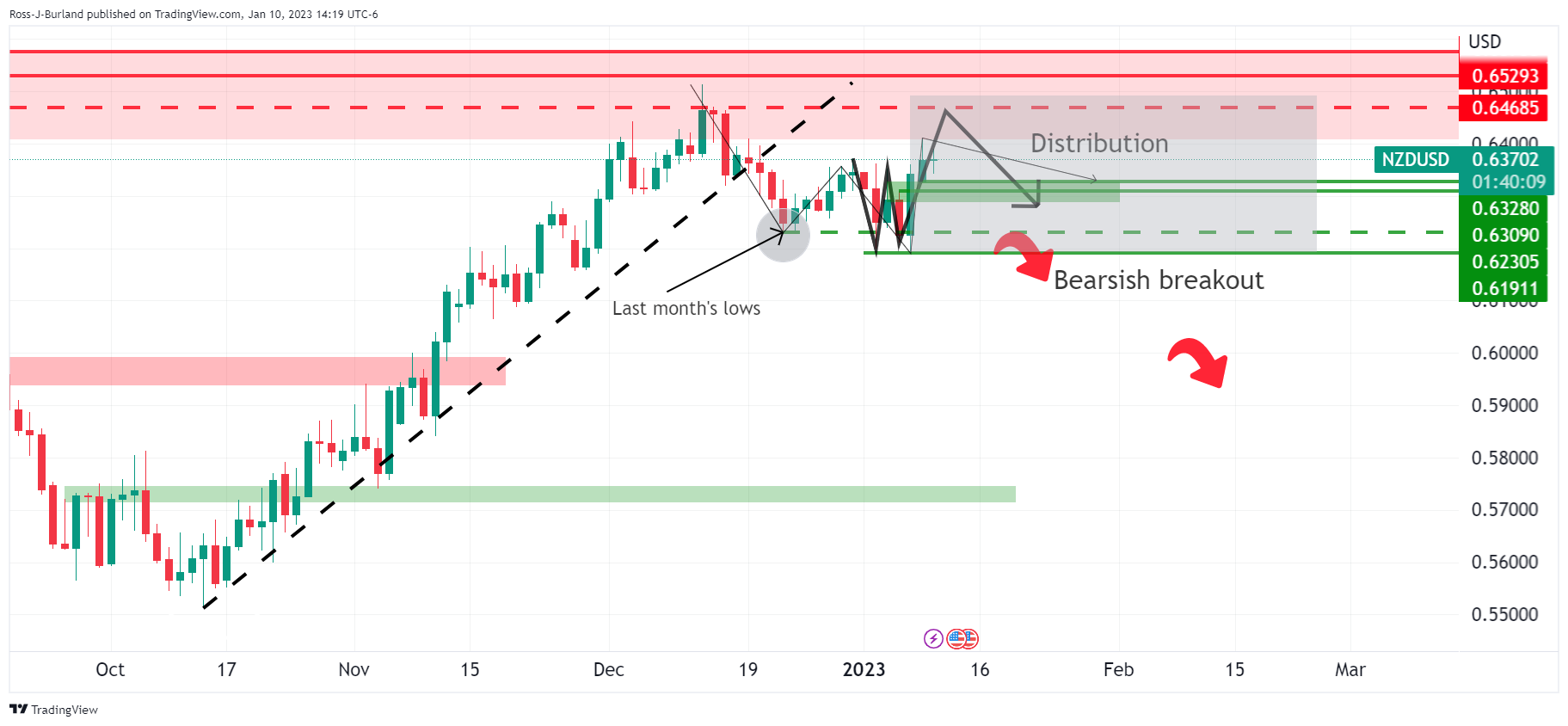

- NZD/USD bulls eye a test of resistance before Thursday's CPI event that leaves the 0.6470s exposed.

- NZD/USD traders will be looking to the lower timeframes for signs of deceleration from the bulls that could lead to a break of 0.6200.

NZD/USD is heading into the end of the North American session flat on the day so far, giving kudos to the prior technical analysis, NZD/USD Price Analysis: Bears are lurking in critical resistance area.

In forex markets that are treading water in search of catalysts, at the time of writing, NZD/USD is trading at 0.6367, about where it opened on Tuesday but it ranged between a low of 0.6342 and 0.6389 on the day.

US CPI data in focus

In a note at the start of the Asian day on Wednesday, analysts at ANZ Bank said the fact that ''FX markets are treading water ahead of key US CPI data tomorrow night is no real surprise given the amount of emphasis bond markets is putting on that data (as the last major piece of the puzzle before the February Federal Reserve meeting).''

The analysts added that ''markets remain USD centric; and while US CPI has the scope to weaken the USD if the data is weak/softer, one of the Fed’s key messages remains that wherever its policy rate peaks, cuts will be a long way off. That may yet dampen USD headwinds.''

As for the expectations of the CPI data, analysts at TD Securities said that they are looking for core prices to have edged higher on a month-on-month basis (MoM) in December, closing out the year on a relatively stronger footing.

''Indeed, we forecast a firm 0.3% MoM increase, as services inflation likely gained momentum. In terms of the headline, we expect Consumer Price Index (CPI) inflation to register a slight decline on an unrounded basis in December but rounded up to flat MoM, as energy prices offered large relief again. Our m/m projections imply that headline and core CPI inflation likely lost speed on a year-over-year basis in December,'' the analysts added.

For the US Dollar, the analysts said ''unless the core measure significantly surprises to the upside, USD rallies should be sold into. We think the bar is high to compel a reversal of fortune despite the USD tactically stretched.''

NZD/USD technical analysis

Nevertheless, as per the prior technical analysis, NZD/USD is on the backside of the prior bullish trend and could be lining up for a bearish breakout:

That is not to say, however, that a test of resistance cannot happen before Thursday's CPI event. This leaves the 0.6470s exposed. In any case, traders will be looking to the lower timeframes for signs of deceleration from the bulls that could lead to a break of 0.6200 and the 0.6191 recent lows in time to come.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.