- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD bulls hunt down the 0.6450s

NZD/USD bulls hunt down the 0.6450s

- NZD/USD bulls stay the course and target 0.6450s and then 0.6480s.

- The NZ CPI will be key next week.

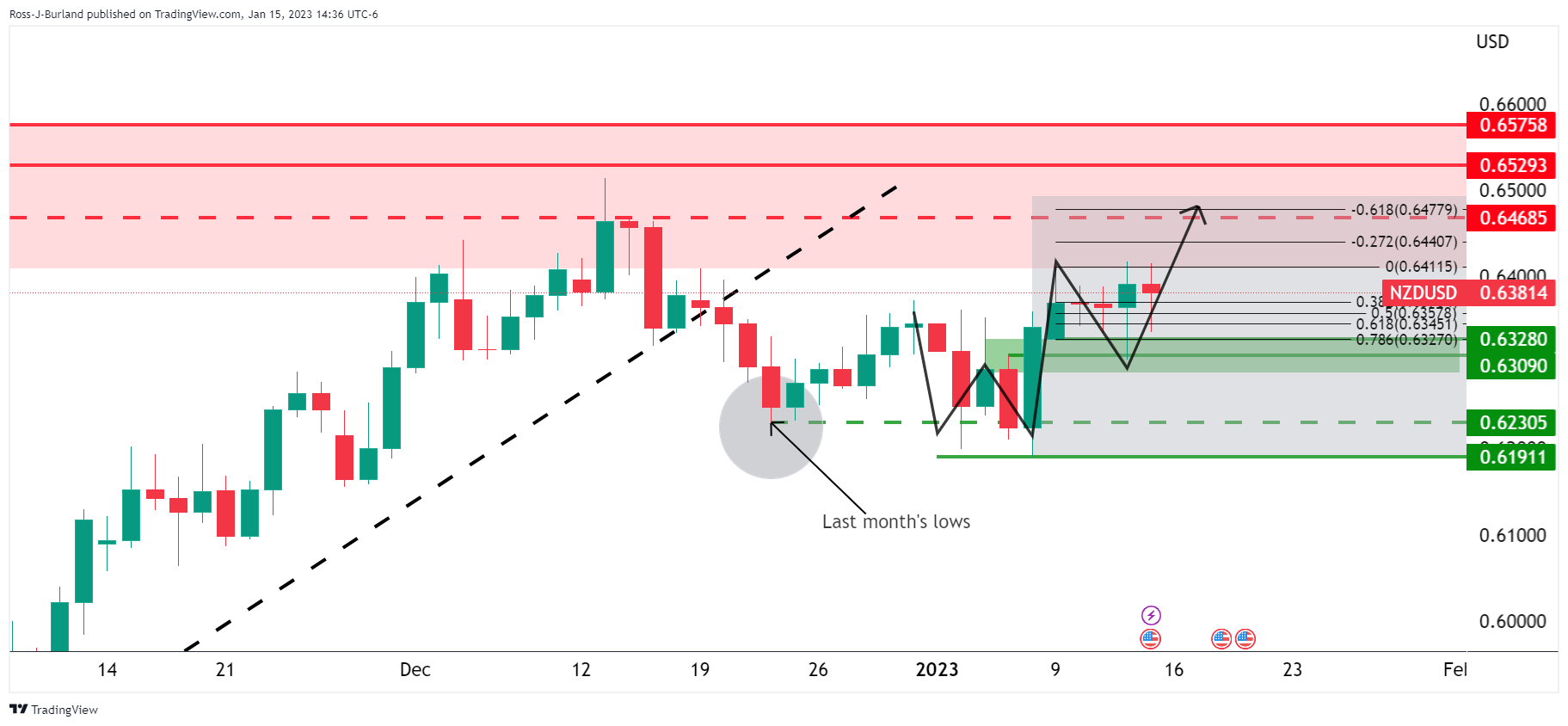

NZD/USD is creeping higher towards an aforementioned target in prior analysis from earlier in the week, hovering in 1-month highs. At the time of writing, the bird is flying high by some 0.8% having rallied from a low of 0.6366 and extending the gains since breaking back above last month's lows of 0.6230 and trapping breakout bears, squeezing towards the 0.6470s ahead of critical data next week.

''Although difficult to pinpoint exactly why, the rally was NZ-specific, with strength seen across most crosses,'' analysts at ANZ Bank explained. ''One wonders whether worrying signs of sticky inflation in yesterday’s NZIER QSBO survey gave the Kiwi a boost (even though NZ short-end rates fell yesterday, preferring instead to focus on the collapse in confidence),'' the analysts added further. ''Either way, it’s all a bit messy, but high rates without the growth to boot is hardly a strong sign of confidence for NZ.Inc,'' the analysts at ANZ Bank concluded.

Meanwhile, NZ Consumer Price Index next week will be critical and could be pivotal, leading to a breakout one way or another as the pair heads into a potential stop gar before the data. With regards to the Reserve Bank of New Zealand, ''local markets have swung back to pricing broadly even odds of either a 50bp or 75bp Reserve Bank of New Zealand hike next month; that leaves near-term risks more balanced,'' the analysts at ANZ Bank argued.

NZD/USD technical analysis

In prior analysis, it was shown that while being on the backside of the daily bullish impulse and trend, there were still prospects of a move into the trendline resistance, acing as the final push before a major bearish breakout:

Zoomed in further...

The W-formation was highlighted as a bullish bottoming pattern and the fact that the price broke the monthly lows, we had breakout traders trapped.

The upside towards 0.6480 was a probable scenario for this week to meet prior highs and a -61.8% ratio. The price remains on track for this target area:

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.