- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD is at a critical crossroads ahead of a very high impact number of days ahead

EUR/USD is at a critical crossroads ahead of a very high impact number of days ahead

- EUR/USD is now about the key events coming up for the rest of the week, including the Fed and ECXB as well as NFP.

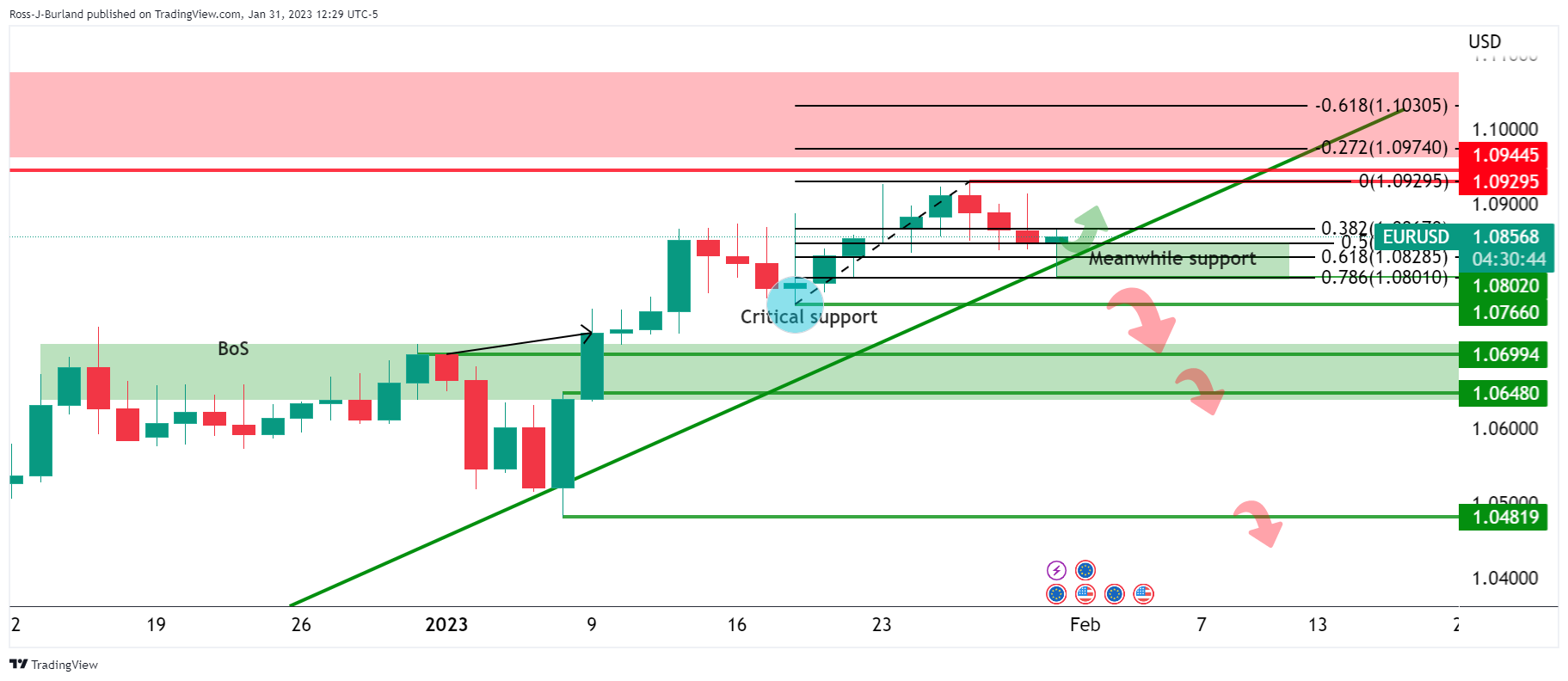

- For the time being, the meanwhile support of the 78.6% Fibonacci and the 50% mean reversion areas between 1.0800 and 1.0850 are keeping the bulls in play.

EUR/USD is at a crossroads trading around 1.0863 and slightly up on the day by .015% having ranged between a low of 1.0802 and 1.0867 in what has been a two-way business day ahead of central bank meetings.

The Federal Reserve showdown on Wednesday is the first major risk for EUR/USD and then the European Central Bank will be on Thursday, but the icing on the cake could be the US nonfarm Payrolls on Friday, especially if there are any surprises to come from that event. The central bank outcomes are expected to see the Federal Reserve hike by no more than 25 basis points and the European Central Bank by 50 basis points.

The communication leading up to these interest rates decisions has pretty much sealed the deal in this respect and markets are also expecting hawkish rhetoric from the central bank governors, Jermoe Powell and Christine Lagarde respectively. However, their tone around growth and inflation as well as guidance on further potential hikes could be market-moving. Indeed, the Federal Open Market Committee will want to flag the fact that we are going to see higher rates for a little bit longer, but it’s all about whether or not the market believes that narrative.

With respect to the US Dollar, analysts at TD Securities argued that it is not as sensitive to STIR pricing, ''so a higher for longer stance may not resonate as much. USD is stretched, though the catalyst for reversal by the Fed seems like a high bar. Parts of FX are displaying signs of rally fatigue, however. ''

EUR/USD technical analysis

EUR/USD is at a critical juncture on the charts ahead of the Federal Reserve event. The bulls remain in play but there are prospects of a significant correction if the market finds itself wrong on the Fed. A break of the bull cycle's trendline support and a hawkish outcome at the Fed would see the price plummet over time for a test all the way down to 1.0650/00.

EUR/USD daily charts

Zoomed in...

For now, the price is holding on the front side of the trendline so the bias remains bullish with eyes on 1.0930/50 and then the upper quarter area of the 1.09s and 1.10s after that.

Zoomed in x2 ...

As we can see, the critical horizontal support is located at 1.0765, just below the quarter level that guards a run on 1.0700 and into 1.0650 and even 1.0600 as a 100% measured move of the current consolidation range:

.

For the time being, the meanwhile support of the 78.6% Fibonacci and the 50% mean reversion areas between 1.0800 and 1.0850 are keeping the bulls in play on the front side of the bullish trendline, so again, the bias remains bullish at this point.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.