- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Silver Price Analysis: XAG/USD consolidates around 200-hour SMA, just above mid-$23.00s

Silver Price Analysis: XAG/USD consolidates around 200-hour SMA, just above mid-$23.00s

- Silver stalls the overnight recovery move near the $23.70-80 support breakpoint.

- The technical setup warrants some caution before placing fresh directional bets.

- A break below the $23.00 mark is needed to support prospects for deeper losses.

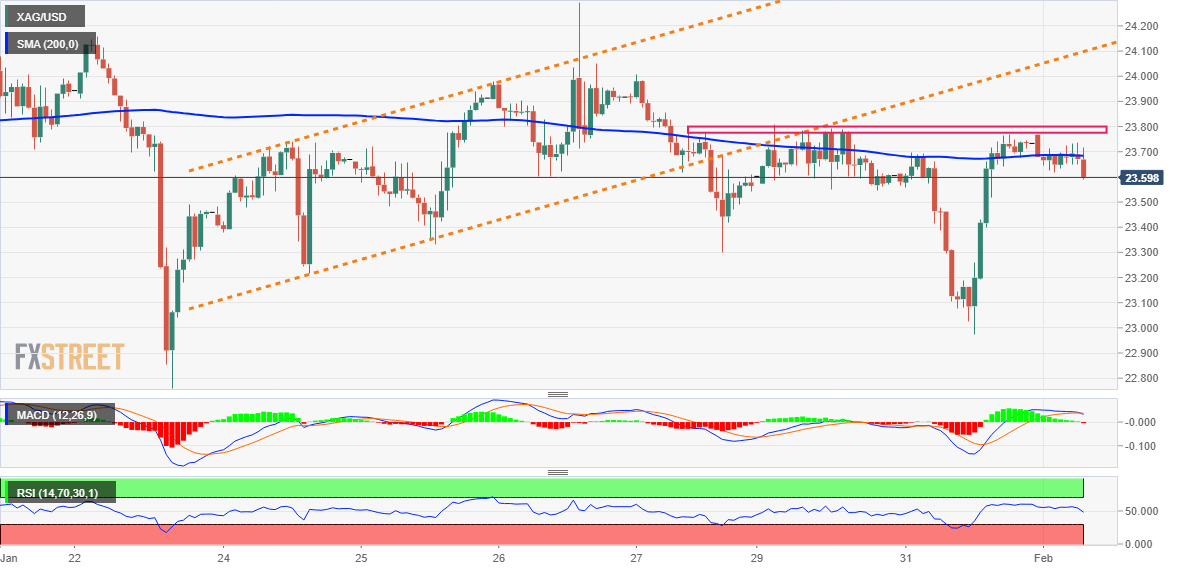

Silver struggles to capitalize on the previous day's goodish rebound from sub-$23.00 levels, or over a one-week low and oscillates in a narrow band through the early European session on Wednesday. The white metal is currently placed just above the mid-$23.00s, consolidating around the 200-hour SMA.

From a technical perspective, the XAG/USD remains capped near the $23.70-$23.80 support breakpoint, marking the lower end of a short-term ascending trend channel. The said area might act as a pivotal point for traders, which if cleared decisively should pave the way for some meaningful upside.

The XAG/USD might then aim to surpass the $24.00 round figure and retest the multi-month top, around the $24.50-$24.55 zone touched in January. The positive momentum could get extended further and allow bullish traders to reclaim the $25.00 psychological mark for the first time since April 2022.

That said, neutral technical indicators on daily/4-hour charts warrant some caution before positioning for a further near-term appreciating move. Moreover, the recent rangebound price action witnessed since December 21 points to indecision among traders over the next leg of a directional move for the XAG/USD.

In the meantime, the $23.30 area might now protect the immediate downside ahead of the overnight low, around the $23.00-$22.95 region. This is closely followed by support near the $22.75 region, which if broken decisively will make the XAG/USD vulnerable to fall towards the $22.20-$22.15 support.

Silver 1-hour chart

Key levels to watch

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.