- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD eyes more weakness below $1,860 as yields soar, Fed Powell’s speech eyed

Gold Price Forecast: XAU/USD eyes more weakness below $1,860 as yields soar, Fed Powell’s speech eyed

- Gold price has faced barricades around the 23.6% Fibo retracement at $1,880.00 as yields soar.

- The commentary from Fed Powell about interest rate guidance will be keenly watched.

- The USD Index has refreshed its four-week high at 103.28 amid a risk-off mood.

Gold price (XAU/USD) is displaying a sideways auction after building a cushion around $1,860.00 in the early Asian session. The precious metal is expected to display more weakness after surrendering immediate support as US Treasury yields are gaining dramatically ahead of the speech by Federal Reserve (Fed) chair Jerome Powell. The return generated by 10-year US Treasury bonds has scaled to nearly 3.65% with sheer pace.

Markets remained jittery on Monday led by US-China tensions and tight United States labor market data, which has infused fresh blood into Fed’s policy tightening spell. The risk aversion theme kept S&P500 in a negative trajectory consecutive for the second trading session. The US Dollar Index (DXY) extended its upside journey after surpassing the 102.80 resistance and refreshed its four-week high at 103.28.

For further guidance, the commentary from Fed’s Powell about the roadmap of taming stubborn inflation and fresh concerns about inflation projections due to a rebound in labor market conditions will be keenly watched. Meanwhile, U.S. Treasury Secretary Janet Yellen said on Monday the United States may avoid a recession as inflation is coming down while the labor market remains strong, as reported by Reuters.

Gold technical analysis

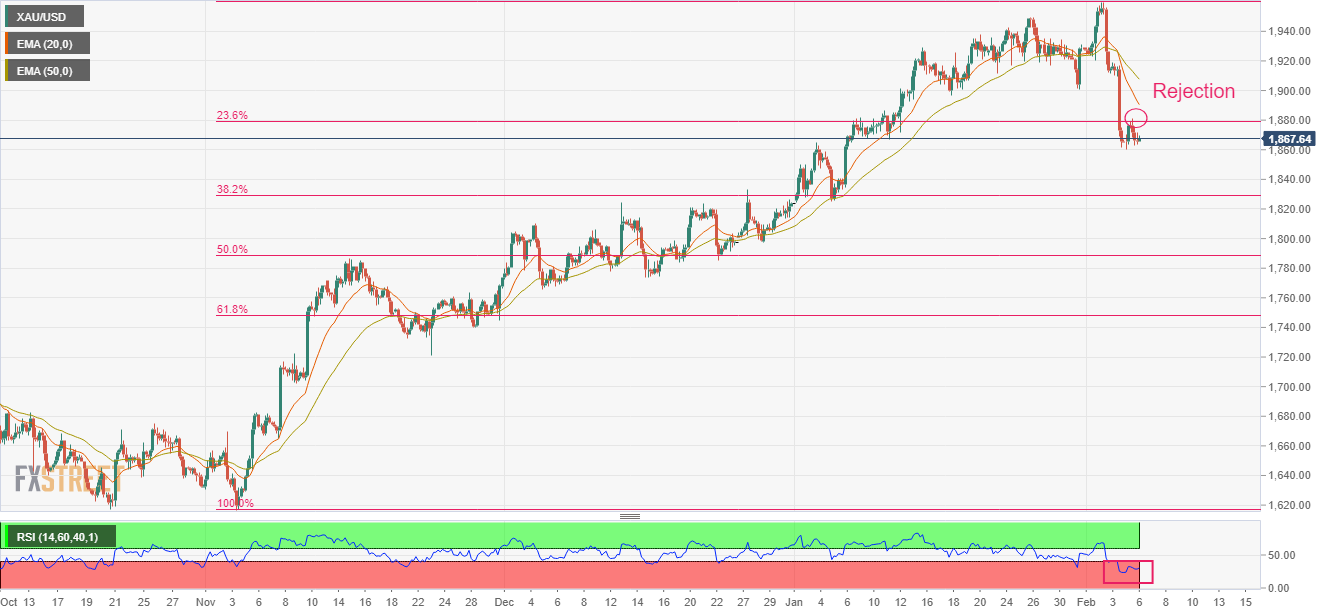

Gold price has sensed rejection after attempting to scale above the 203.6% Fibonacci retracement (placed from November 3 low at $1,616.69 to February 2 high of around $1,960.00) at around $1,880.00 on a four-hour scale. A rejection around 23.6% Fibo retracement indicates that the asset has been exposed to the next cushion at 38.2% Fibo retracement placed around $1,829.45.

A bear cross, represented by the 20-and 50-period Exponential Moving Averages (EMAs) at $1,921.60, adds to the downside filters.

Adding to that, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates more weakness ahead.

Gold four-hour chart

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.