- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD bulls move in and target a break above 0.6365

NZD/USD bulls move in and target a break above 0.6365

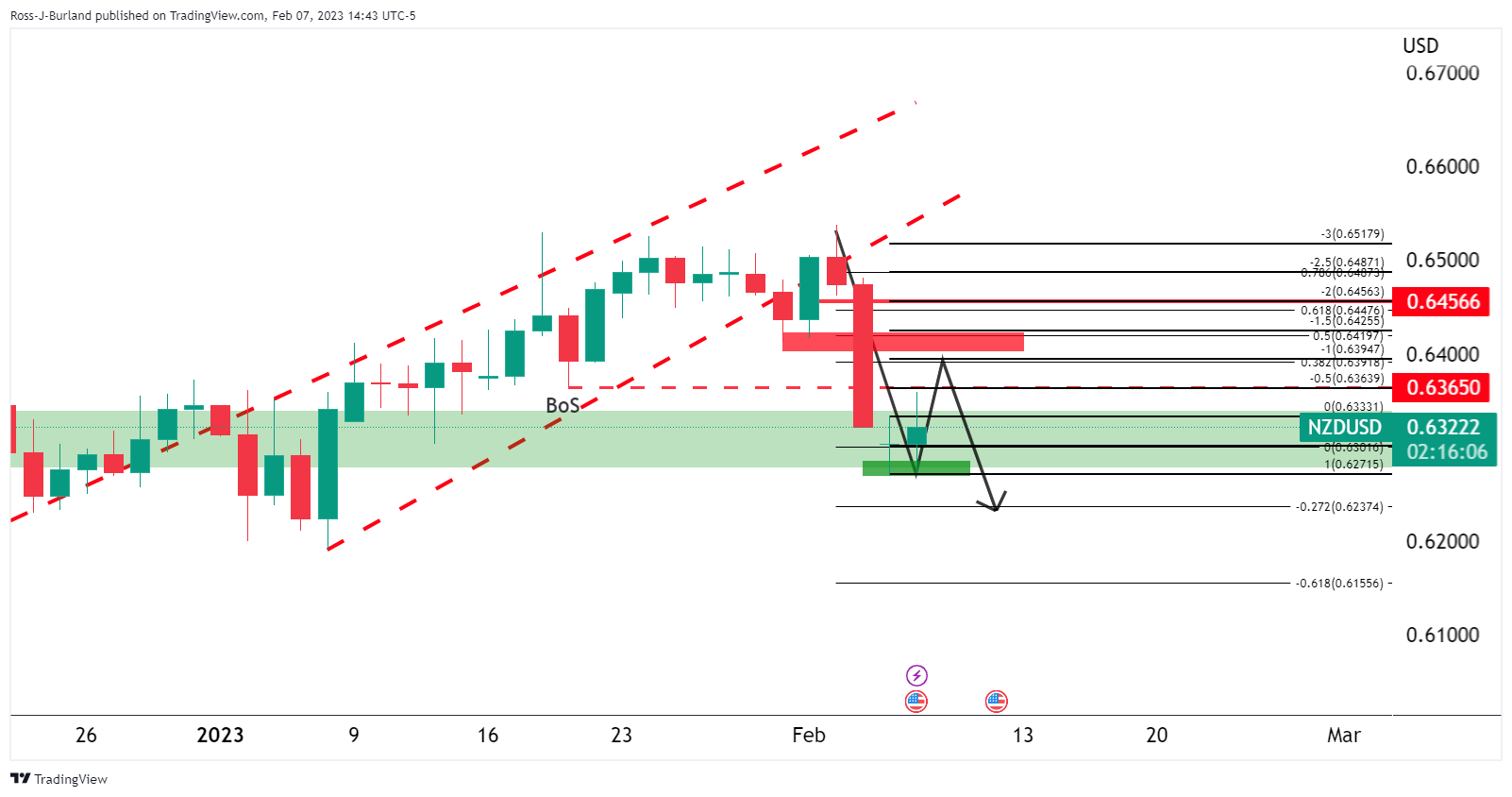

- NZD/USD could be headed for a deep bullish correction if they get above 0.6365.

- If the bulls hold the fort, we will be closing in the green for a second day putting the directional bias in favour of longs.

NZD/USD is up on the day with the US dollar still under pressure despite a hawkish tone from the Federal Reserve pertaining to the recent Nonfarm Payrolls data. Federal Reserve's chairman Jerome Powell said in comments day made at The Economic Club of Washington, D.C. Signature Event that he expects 2023 to be a year of significant declines in inflation.

The US Dollar fell during a slew of comments that gave something to both the bulls and the bears. However, the greenback bounced back when investors digested some of the more hawkish tones. Powell explained that the ‘base case is that it will take time and more rate increases to finish the process.

Nevertheless, the greenback remains on the back foot technically and the high beta currencies such as the Kiwi have enjoyed a bounce in US stocks on Tuesaday following a series of down days since the NFP report. The US economy added 517K jobs in January, the most since July and much more than market expectations of 185K. Following the release of the data on Friday, ISM services also pointed to a strong services sector, adding to concerns about persistent inflation and bolstering the case for more rate increases.

Meanwhile, the latest domestic data showed that New Zealand's Unemployment Rate edged up to 3.4% in the 4th quarter of 2022 from 3.3% in the 3rd quarter, bolstering bets that the central bank will shift to a less aggressive stance. NZ's annual inflation also came in below the Reserve Bank of New Zealand's 7.5% projection and investors now expect the RBNZ to downshift to a 50 basis point rate hike in February after delivering a record 75 basis point increase in November.

As for the direction for the Bird, analysts at ANZ Bank wrote in a note on Wednesday that they upgraded their NZD forecasts – ''we now see it reaching 0.65 in Q3, 0.67 in Q4, and 0.68 by the fourth quarter next year''.

NZD/USD technical analysis

NZD/USD could be headed for a bullish correction given that it closed green on Monday, with prospects of a move into in-the-money shorts from Friday's selloff. We have a double bottom under last week's lows and bulls are moving in on those lows at around 0.6320.

If the bulls hold the fort, we will be closing in the green for a second day putting the directional bias in favour of longs for the sessions ahead. A 100% measured move of the current consolidation range has a confluence with the 38.2% Fibonacci near 0.6390. a break of 0.6400 opens the risk of a move to 0.6425 in a 50% mean reversion to near the prior lows 31 Jan lows. However, 0.6365 needs to give first as a prior Jan 19 support structure.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.