- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/JPY Price Analysis: Bullish fundamentals meet a technically bullish chart bias

USD/JPY Price Analysis: Bullish fundamentals meet a technically bullish chart bias

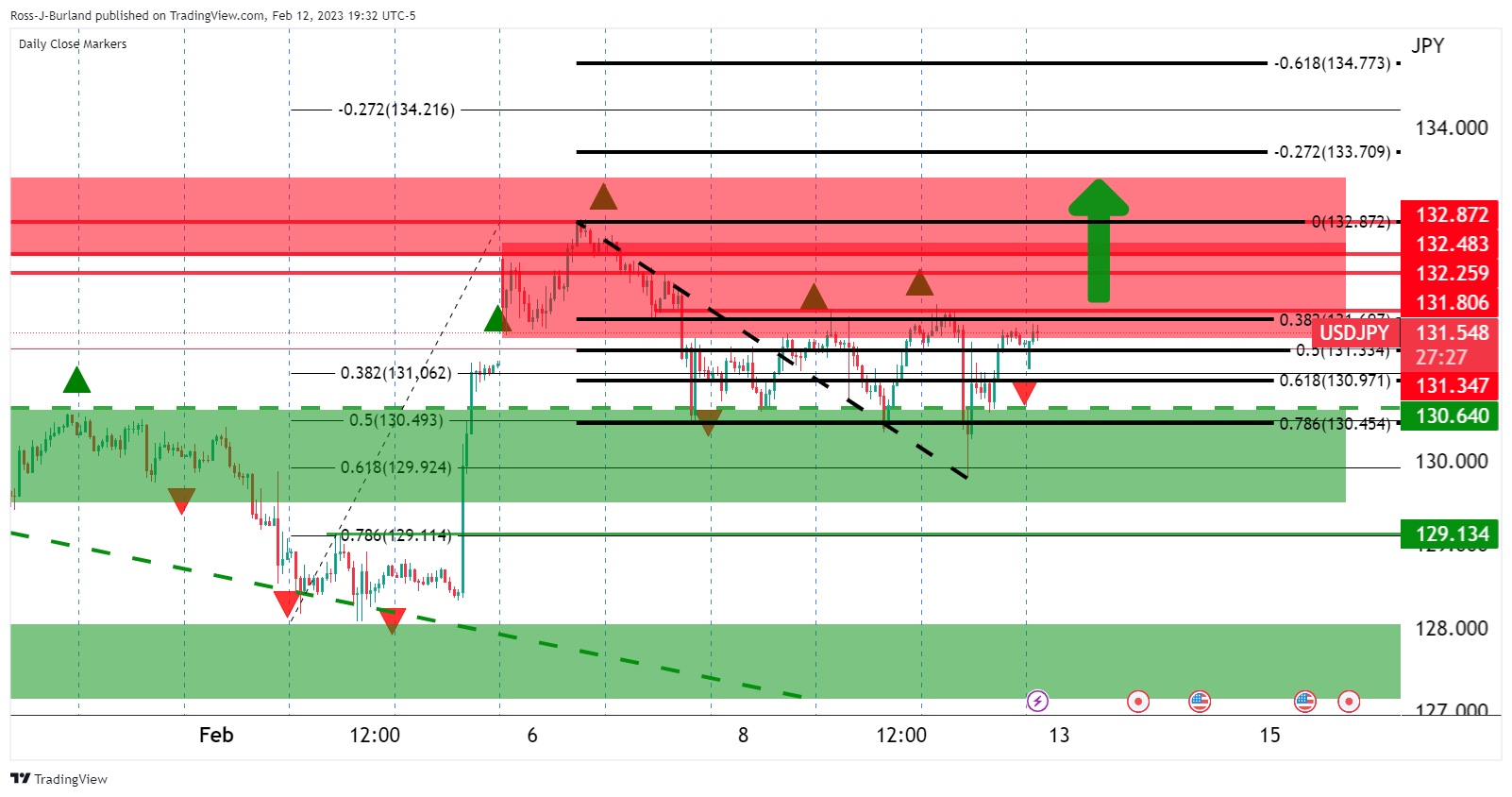

- USD/JPY bulls are moving in from an area of support made last week at 130.00.

- USD/JPY bulls eye a -272% of the prior bearish correction's range at 133.70.

USD/JPY could be about to make a move to the upside for this week's initial balance range as the Asian shares fall on Monday.

Investors are looking to this week's US data in Consumer Prices and Retails Sales, so there is an air of nervousness at the same time that the news of the US air force had shot down a flying object near the Canadian border, the fourth object downed this month, circulates. Officials declined to say whether it resembled the large white Chinese balloon that was shot down earlier this month. This has resulted in the MSCI's broadest index of Asia-Pacific shares outside Japan falling at the start of the week by 0.1%, adding to the loss of 2.2% last week.

Risk-off themes have tended to benefit the US Dollar lover of the Japanese currency as the Yen lost some of its appeals as the currency of choice to fund so-called carry trades at the turn of last year. Speculators cut bearish bets on it to the lowest level in nearly four months in the wake of December's shock move by the Bank of Japan. The BOJ rocked markets with a decision to loosen the parameters of its yield-control policy, sending the currency soaring by close to 5% on the day of the announcement.

This all leaves the outlook bullish from both fundamental and a technical standpoints as follows:

USD/JPY daily chart

The price is on the backside of the prior bearish daily trend. The bulls are committing to the upside after a correction of the breakout from prior resistance which offers a foundation for the bulls to stay the course. For the days ahead, there could be prospects proven of a move to 133.70 cemented should the bulls crack 132.80 recent highs:

USD/JPY H1 chart

This level is marked as the -272% of the prior bearish correction's range and is a common target for continuation trades. 134.0 the figure comes above there as the next milestone for the bulls.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.