- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD Price Analysis: Further downside hinges on 0.6290 break

NZD/USD Price Analysis: Further downside hinges on 0.6290 break

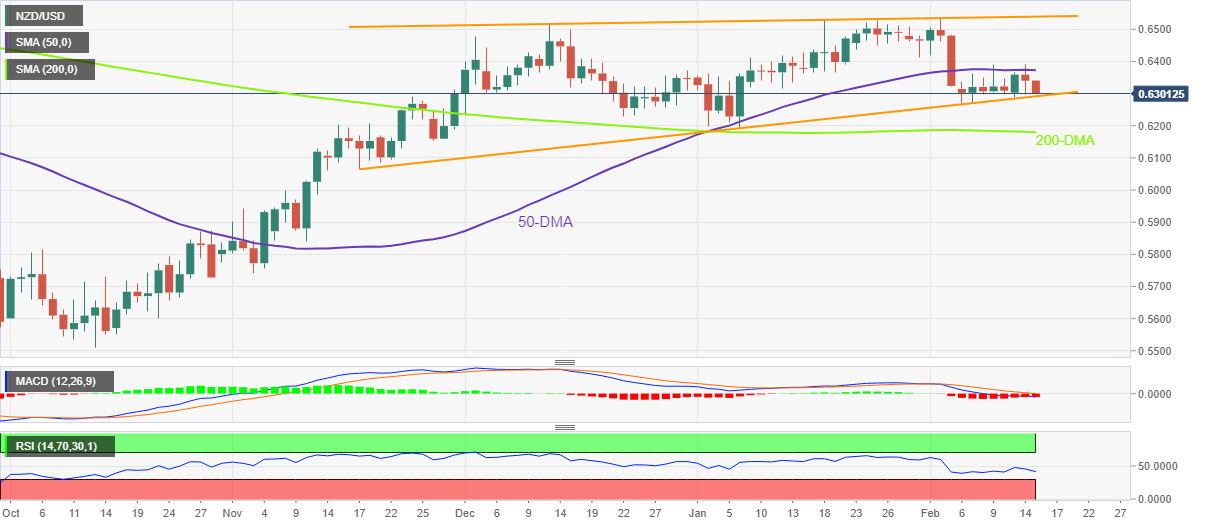

- NZD/USD marks the second defeat from 50-DMA, renews intraday low.

- Three-month-old rising wedge restricts downside ahead of 200-DMA.

- Bearish MACD signals, downbeat RSI and failure to cross 50-DMA favor sellers.

NZD/USD takes offers to refresh the intraday low near 0.6300 as it extends the previous day’s pullback from the 50-DMA hurdle during early Wednesday.

In doing so, the Kiwi pair marks the second such failure to cross the key Daily Moving Average (DMA) while staying inside a three-month-old rising wedge bearish chart formation.

Other than the failure to cross the 50-DMA, bearish MACD signals join the downbeat RSI (14), not oversold, to keep the bears hopeful.

However, a clear downside break of the three-month-old ascending support line, forming part of the stated rising wedge bearish chart formation, near 0.6290, becomes necessary.

Following that, the 200-DMA support surrounding 0.6180 and the mid-November 2022 swing low around 0.6065, could act as the last defense before directing the Kiwi pair toward the theoretical target of 0.5810. During the fall, the 0.6000 round figure may act as an extra filter towards the north.

Alternatively, a daily closing beyond the 50-DMA hurdle surrounding 0.6375 could aim for the 0.6400 threshold and the stated wedge’s top line near 0.6540. Though, any further upside appears less lucrative unless crossing the June 2022 high of near 0.6575.

NZD/USD: Daily chart

Trend: Further downside expected

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.