- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD bears are waiting to move in to keep pressures on below 0.6300

NZD/USD bears are waiting to move in to keep pressures on below 0.6300

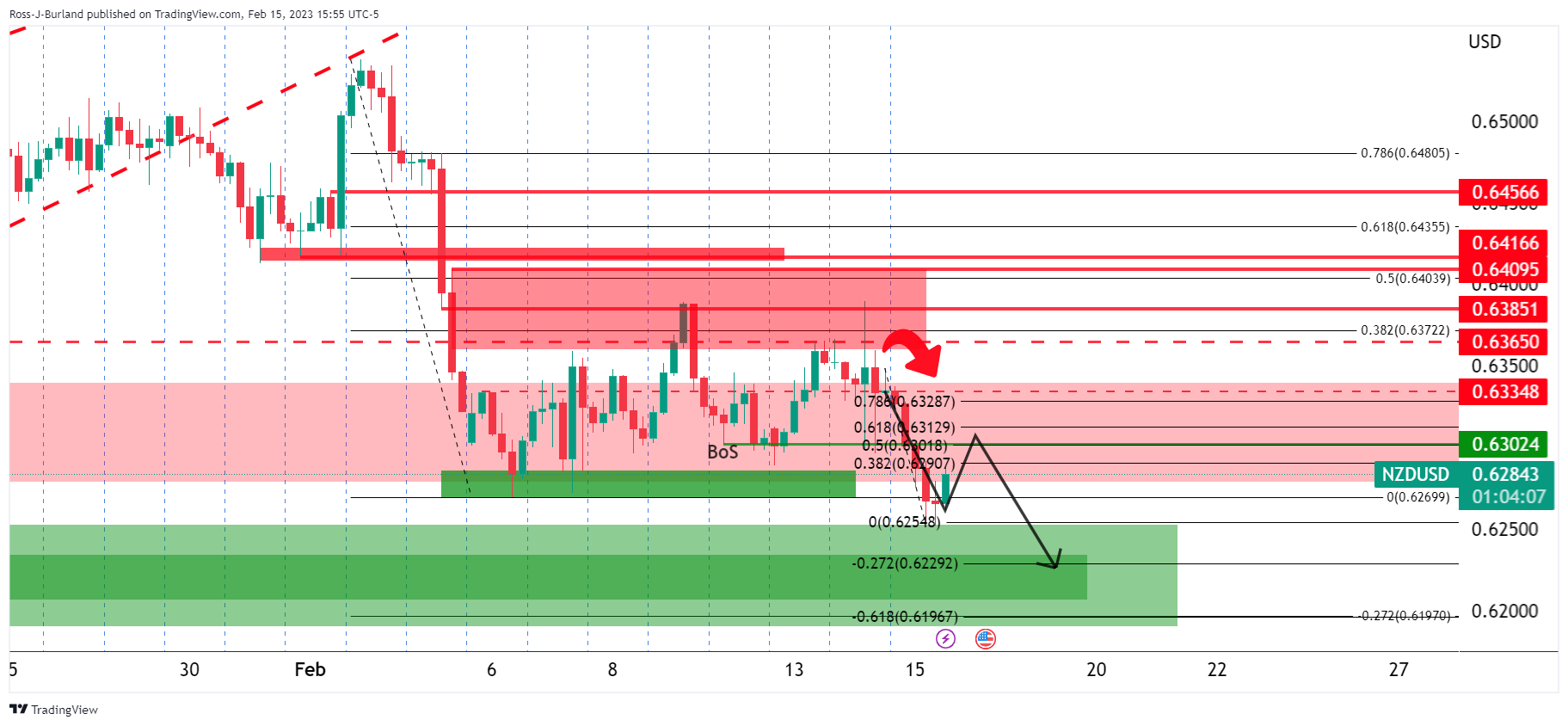

- NZD/USD bears target the low 0.62s following the break of structure.

- A bullish correction is in process currently, but if bears commit below 0.6300, then this correlates with near a 61.8% ratio.

NZD/USD is down on the day as we enter the end of the North American session as the markets tussle with the prospects of higher for longer inflation in the United States and watch the Fed pivot disappear over the horizon.

At the time of writing, NZD/USD is trading at 0.6280 and is down some 0.8% on the day after falling from a high of 0.6337 to a low of 0.6252. The US Dollar, as measured in the DXY index, broke to the topside in the wake of strong US Retail Sales on the back of the prior day's Consumer Price index. Both reports saw bond yields there ratchet up another notch which has played into the hands of risk-off assets and the greenback.

Analysts at ANZ Bank said, ''regular readers will be aware that we have for some time been worried that the USD might re-firm if interest rate expectations there started rising and expectations for late-2023 rate cuts were to fade, and that’s what seem to be playing out.''

''But at the same time, unlike last year’s USD surge, this time we don’t have other central banks going slow – with the European Central Bank and Reserve Bank of New Zealand both on track to hike by 50bp at their next meetings,'' the analyst explained further. ''That, and valuations, may cap (but perhaps not stop) USD upside, but counting on that could be risky.''

NZD/USD technical analysis

Meanwhile, there are seeing prospects of a move lower.

While below resistance, the odds are for a move into the low 0.62s following the break of structure. a correction is in process currently, but if bears commit, say below 0.6300, then a sell-off from the region of a 50%, 61.8% ratio could be on the cards for the day ahead.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.