- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

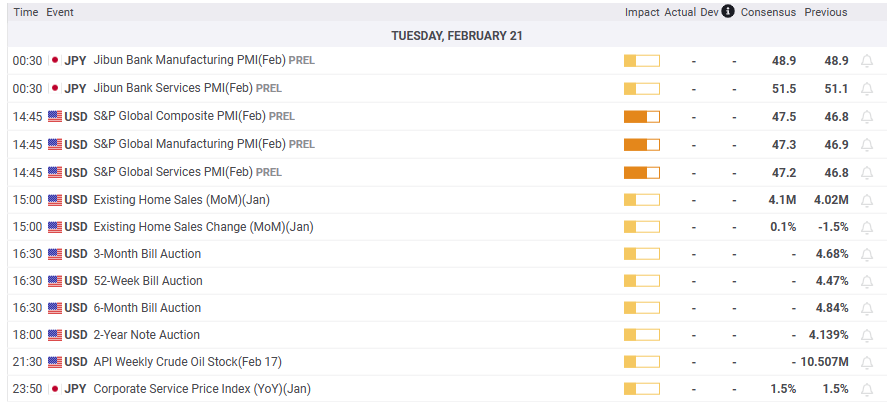

- USD/JPY hovers around 134.30s as traders eye Japanese and US PMIs, US housing data

USD/JPY hovers around 134.30s as traders eye Japanese and US PMIs, US housing data

- USD/JPY is still underpinned by the US 10-year Treasury bond yield and the market mood.

- The latest US inflation data triggered the last week’s USD/JPY rally from 131.50 to 135.00.

- USD/JPY Technical analysis: To remain consolidated, slightly tilted upwards.

The USD/JPY fluctuated in Monday’s session as US financial markets remained closed during President’s Day. US equity futures are negative, except for the Dow Jones Industrial Average. The US Dollar continued to trend lower, while US Treasury bond yields capped the USD/JPY fall. The USD/JPY is trading at 134.23, above its opening price by 0.07%.

After reclaiming the 50-day Exponential Moving Average (EMA) at 132.73, the USD/JPY enjoyed a rally that peaked at around 135.11. Bull’s failure to hold gains above the latter exacerbated a fall to the 134.20s area, mainly driven by the fall in the US 10-year benchmark note rate, which finished last Friday’s session on a lower note.

Last week’s US inflation data in the consumer segment showed some slowing down. Prices paid by producers, also known as PPI, rose above estimates and the previous month’s reading on a monthly basis. Therefore, traders shifted from a risk-on to a risk-off environment, as traders expect a more hawkish than estimated US Federal Reserve (Fed).

In the meantime, changes in the Bank of Japan (BoJ) are increasing volatility in the pair. Given that Kazuo Ueda remains the leader to become the new BoJ Governor, investors are positioning toward a more hawkish BoJ stance. On early Monday in the Asian session, the current BoJ Deputy Governor Amamiya said that the BoJ has the necessary tools to exit from ultra-loose monetary conditions.

What to watch?

USD/JPY Technical analysis

The USD/JPY uptrend lost steam as it formed an inverted hammer near the peak at around 135.00. Buyers’ failure to hold to the latter exacerbated a retracement below the 100-day EMA at 134.72, opening the door to consolidate within the important 200-day EMA at 133.77 and 134.70, a 100 pip range. The Relative Strength Index (RSI) shifted falt though at bullish territory, signals that buyers are taking a respite, while the Rate of Change (RoC), is almost unchanged. Break above the 100-day EMA, and the USD/JPY might re-test 135.00. On the downside, a break below 134.00 would challenge the 200-day EMA.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.