- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD Price Analysis: Brace for volatility contraction ahead of RBNZ policy

NZD/USD Price Analysis: Brace for volatility contraction ahead of RBNZ policy

- NZD/USD is juggling ahead of the interest rate decision by the RBNZ.

- The Kiwi asset has sensed a decent buying interest after testing the horizontal support plotted from 0.6200.

- RBNZ's Shadow Board recommended a 50bps OCR increase citing strong inflationary pressures.

The NZD/USD pair is juggling below the immediate resistance of 0.6260 as investors are awaiting the interest rate decision from the Reserve Bank OF New Zealand (RBNZ) for further impetus. The New Zealand Consumer Price Index (CPI) has not delivered any sign, which could convey that inflationary pressures are peaked now. Therefore, a continuation of an interest rate hike is expected from RBNZ Governor Adrian Orr.

Meanwhile, a promise of a cyclone relief package of NZ$300 million ($187.08 million) by NZ Prime Minister (PM) Chris Hipkins has triggered fresh concerns about an increment in inflation projections. The release of the helicopter money might propel overall consumer spending and eventually the price pressures. On Monday, RBNZ's Shadow Board recommended a 50bps OCR increase citing strong inflationary pressures.

The US Dollar Index (DXY) is auctioning above 103.50, however, higher volatility cannot be ruled out as United States markets will open after a holiday-truncated weekend.

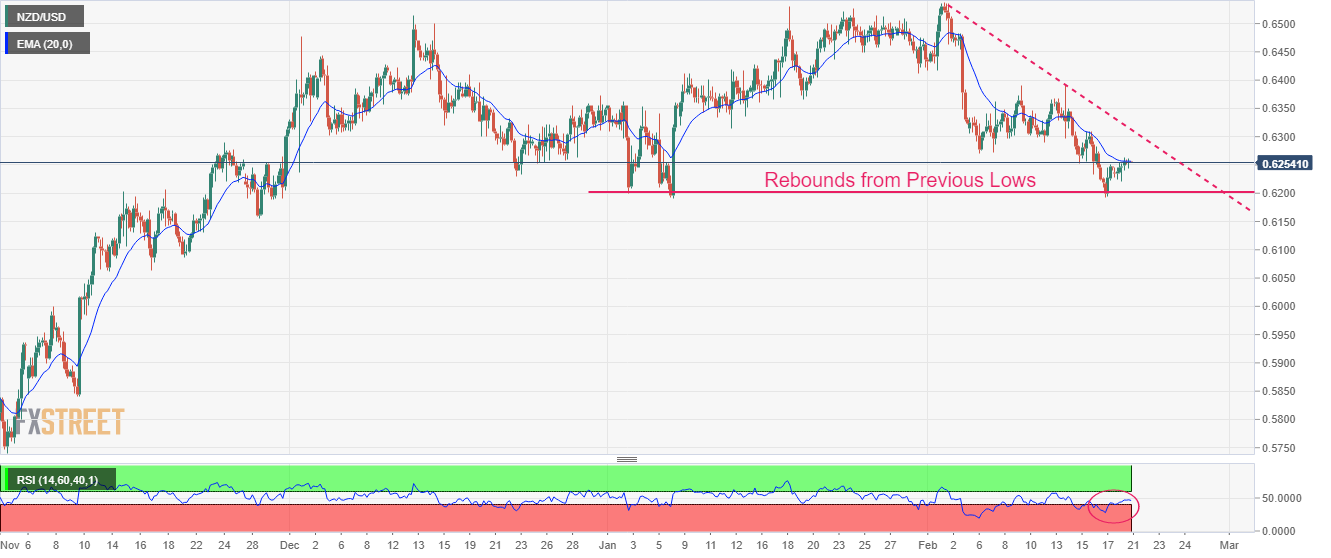

NZD/USD has sensed a decent buying interest after testing the horizontal support plotted from January 3 low around 0.6200 on a four-hour scale. This indicates a Double Bottom chart formation that results in a bullish reversal. The Kiwi asset is deploying efforts in surpassing the 20-period Exponential Moving Average (EMA) at 0.6258.

Meanwhile, the Relative Strength Index (RSI) (14) has managed to avoid the bearish range of 20.00-40.00. The RSI (14) has climbed back inside the 40.00-60.00 range and is awaiting a fresh trigger for a decisive move.

For further upside, the Kiwi asset needs to surpass January 8 low at 0.6272, which will drive the asset towards January 9 low at 0.6320, followed by February 7 high at 0.6363.

Alternatively, a breakdown of January 6 low at 0.6193 will drag the asset toward November 28 low at 0.6155. A slippage below the latter will expose the asset for more downside toward the round-level support at 0.6100.

NZD/USD four-hour chart

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.