- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/CAD is subdued around 1.3530s as traders are in wait-and-see mode

USD/CAD is subdued around 1.3530s as traders are in wait-and-see mode

- USD/CAD collides with solid resistance and retreats to its 1.3520s lows.

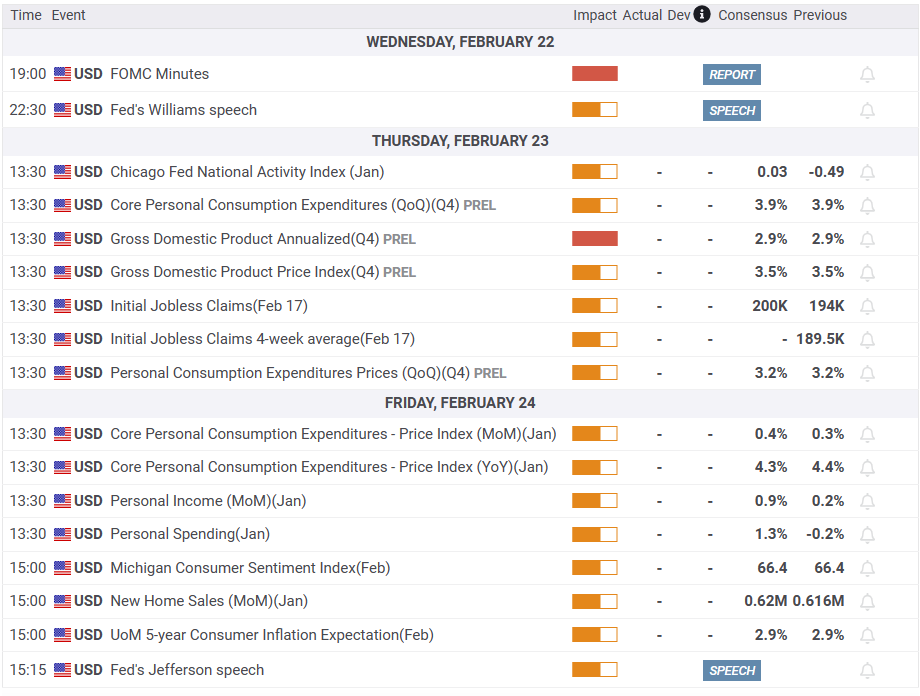

- Traders are bracing for additional forward guidance from the US Federal Reserve.

- If the BoC pauses, the USD/CAD will extend its gains.

The USD/CAD is barely unchanged ahead of the FOMC’s minutes release, though slightly tilted to the downside, with losses of 0.05%. Traders worried that the Fed would raise rates further than expected, dampening the market mood during the last couple of weeks. At the time of typing, the USD/CAD is trading at around 1.3530s.

USD/CAD turns negative, drops 0.06%, before FOMC’s minutes release

Wall Street’s bulls are taking a respite before the Fed releases its minutes. US economic data throughout the last two weeks justified the need for further tightening, meaning a higher USD/CAD exchange rate. Inflation data in the US slowed down, except for the monthly readings of the Producer Price Index (PPI), which came above estimates and the prior’s month data. In addition, a Fed regional manufacturing index reported on its survey that prices jumped the most in 10 months, exacerbating a reassessment of how high the Fed will go. Therefore, worried investors turned to safety and bought the US Dollar (USD).

Consequently, the US 10-year Treasury bond yield spiked 40 basis points (bps) and underpinned the greenback.

Aside from this, the Canadian side revealed that inflation cooled down, a sign for the Bank of Canada (BoC) to pause its hiking cycle. Meanwhile, New Home Prices in Canada dived 0.2% in January from December data from Statistics Canada showed on Wednesday, but the annual rate slowed to 2.7%.

Hence, the USD/CAD broke above 1.3500 after trading sideways for almost two months. Nevertheless, the major faced a four-month-old resistance trendline and was rejected after hitting multi-week highs at 1.3560 and dropping toward 1.3520s.

What to watch?

USD/CAD Key technical levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.