- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/USD dives towards 0.6800 after FOMC’s minutes

AUD/USD dives towards 0.6800 after FOMC’s minutes

- The minutes showed that some Federal Reserve officials wanted a 50 bps rate hike.

- Policymakers’ worries are linked to a tight labor market and commented inflation risks are tilted upwards.

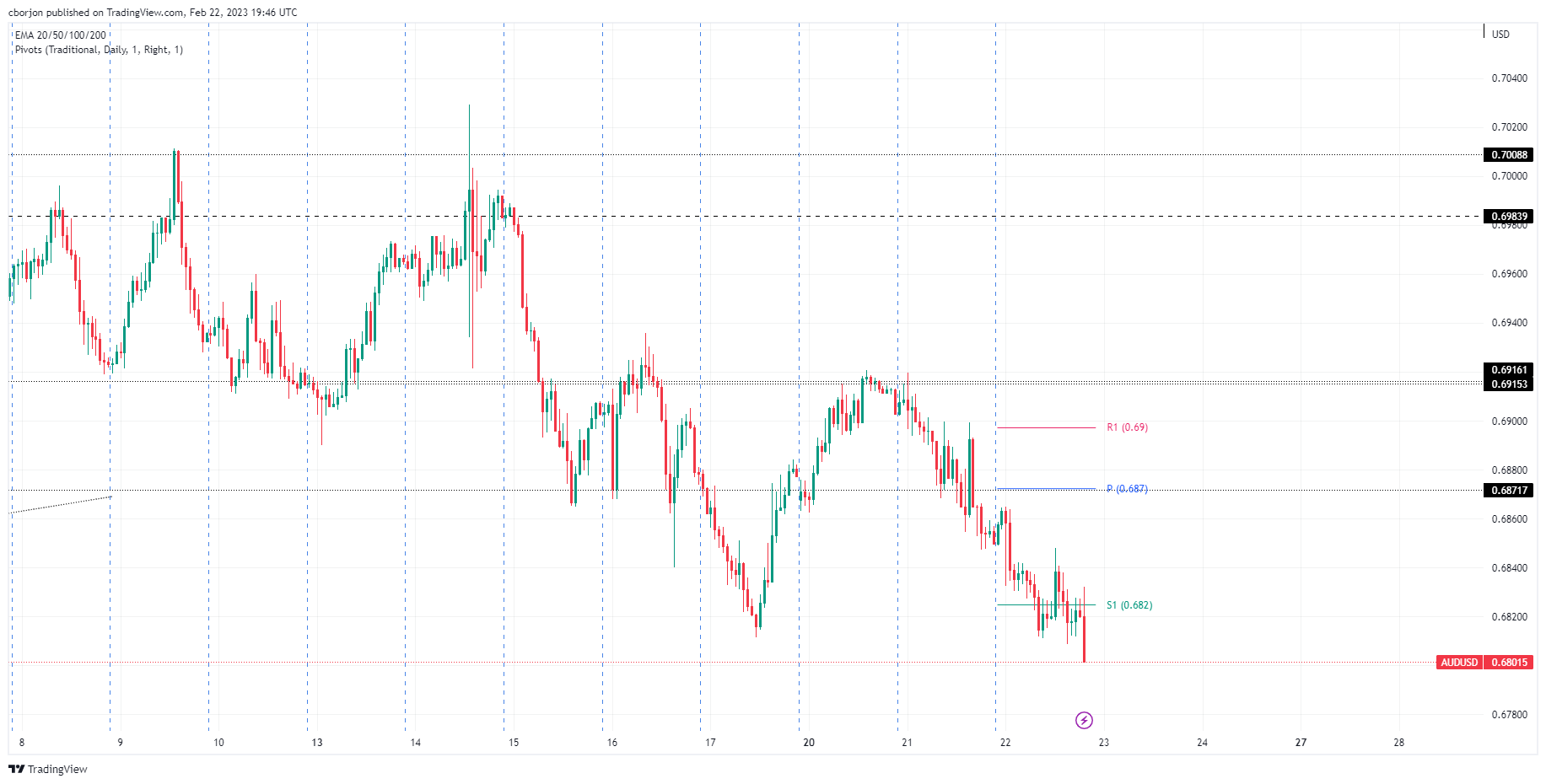

- AUD/USD Price Analysis: Spiked towards 0.6830 before reversing its path to print a new weekly low of around 0.6801.

AUD/USD prolonged its losses during the Wednesday session and dropped nearby the day’s low of 0.6808 after the release of the Federal Open Market Committee (FOMC) minutes, which revealed that “few participants” favored a 50 bps rate hike. At the time of writing, the AUD/USD exchanges hands at 0.6826.

Summary of the FOMC’s minutes

The FOMC revealed in its minutes that some Federal Reserve policymakers wanted a more aggressive rate hike, with minutes citing that “a few participants favored raising rates by 50 bps.” Further, all the Fed board members agreed that more rate hikes are needed to achieve the Fed’s target and that balance sheet reduction would continue according to the plan.

Fed policymakers reiterated that inflation risks remain skewed to the upside, including China’s reopening and Russia’s invasion of Ukraine, reiterating that the labor market remains tight. Participants said the economic outlook is weighed on the downside, and some participants saw prospects of a recession in 2023.

AUD/USD Reaction to FOMC’s minutes

The AUD/USD 1-hour chart shows a spike towards 0.6832 before the AUD/USD reversed its course, breaching south of the S1 daily pivot point at 0.6825. It should be said that volatility has increased, and after reaching a low of 0.6808, as of late, the AUD/USD is tumbling sharply, eyeing a break below the 0.6700 mark.

AUD/USD 1-Hour chart

AUD/USD Key technical levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.