- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/USD hovers around 0.6820 after hitting a new February low

AUD/USD hovers around 0.6820 after hitting a new February low

- AUD/USD climbs despite upbeat economic data in the United States suggesting further Federal Reserve tightening is needed.

- FOMC’s minutes were hawkish and emphasized the need for higher for longer.

- Initial Jobless Claims dropped in the latest week, while the US economy expanded in Q4 2022.

AUD/USD recovered some ground on Thursday after falling to fresh February lows at 0.6803, though it recovered some ground, despite overall US Dollar (USD) strength across the board. A risk-on impulse is another reason that it’s underpinning the Australian Dollar (AUD). At the time of typing, the AUD/USD exchanges hands at 0.6826, above its opening price by 0.39%.

AUD/USD to remain pressured after latest FOMC minutes, US data

US equities have opened in the green after the Federal Reserve Open Market Committee (FOMC) revealed its minutes. The minutes were slightly hawkish, with some officials pushing for a 50 bps rate hike, though all agreed to raise 25 bps. Policymakers remained worrisome about the tightness of the labor market and commented that growth risks are skewed to the downside. Also, they commented on financial conditions for the first time. According to the Chicago Fed National Financial Conditions Index, conditions remained the loosest since February 2022. This could trigger some attention from Fed officials at subsequent meetings.

The US Dollar strengthened after the release of the latest meeting minutes. That sent the AUD/USD to new February lows, though the AUD/USD is erasing some of its Wednesday losses on Thursday.

Data from the United States (US) portrayed the tightness of the labor market after the Department of Labor (DoL), revealed Initial Jobless Claims for the week ending on February 18. The claims rose by 192K, below the 200K estimated and beneath the last week’s 194K. In a separate report, the US Department of Commerce (DoC) featured the US Gross Domestic Product (GDP) for Q4 on its second estimate came at 2.7%, below the prior’s reading of 2.9%.

The US Dollar Index (DXY), which tracks the buck’s value vs. six currencies, slides 0.01% at 104.85, the reason for the latest uptick in the AUD/USD pair.

In the meantime, Private Capital Expenditure in Australia rose 2.2% in Q4 2022, higher than Q3’s data at 0.6% QoQ.

AUD/USD Technical analysis

The AUD/USD is testing the 100-day Exponential Moving Average (EMA) at 0.6829, which, once cleared, will pave the way for further upside toward the 200-day EMA at 0.6859. Nevertheless, the Relative Strength Index (RSI) at bearish territory and the EMA above could cap the AUD/USD rally, which would put into play the 0.6800 figure. Therefore, the AUD/USD downtrend is intact, and it could shift neutral if buyers reclaim the 200-day EMA.

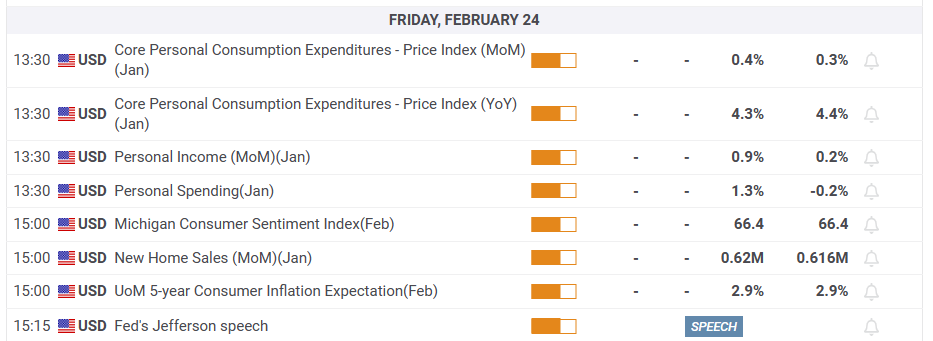

What to watch?

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.