- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/CAD bears are movimg in ahead of key US data

USD/CAD bears are movimg in ahead of key US data

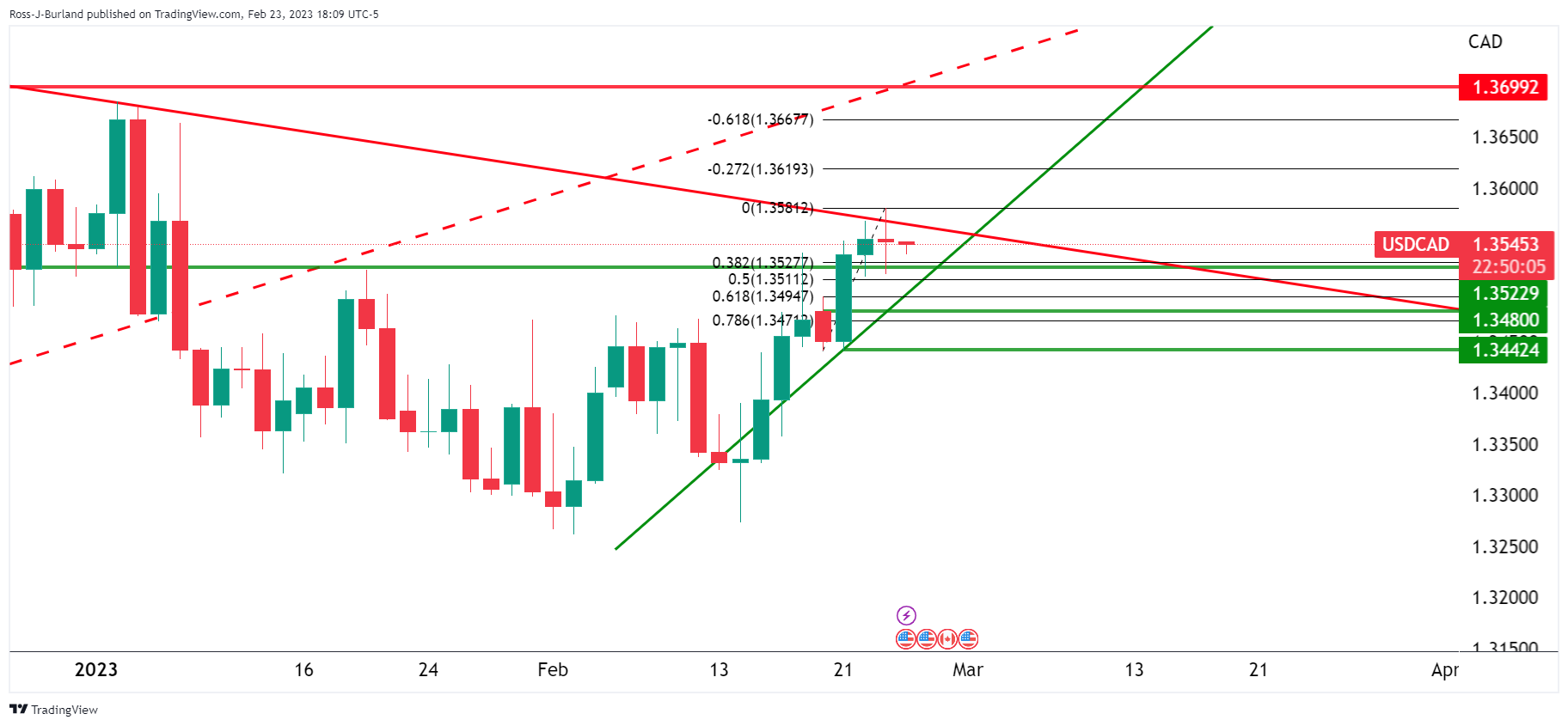

- USD/CAD is meeting resistance leaving the 38.2% Fibonacci retracement level towards 1.3500 exposed.

- US data will yet again be front and centre to end the week.

The US Dollar was bolstered by yet further evidence of an inflationary theme in the US economy with the strong economic data that continues to suggest the US Federal Reserve's monetary policy tightening could be extended if it is to bring down the highest inflation in decades. The number of Americans filing new claims for unemployment benefits unexpectedly fell last week, showing a still-tight labor market and a resilient US economy.

Meanwhile, the second estimate of US Q4 Gross Domestic Product being revised down 0.2% to 2.7% saar. The downward revision was driven by weakness in private consumption which was reported at 1.4% vs 2.1% in the preliminary estimate. The GDP deflator rose 4.3%, up from 3.9% in the previous estimate. The personal savings rate was revised to 3.9%, up 0.5pts.

Speaking of deflators, Friday's PCE deflator will be a key red news event. Ahead of the event, the Fed funds futures traders are now pricing for the federal funds rate to reach 5.34% in July, and staying above 5% all year. That rate is currently between 4.50%-4.75% range.

''The market is expecting the January headline data to remain at 5.0% YoY, in line with the previous month,'' analysts at Rabobank said. ''This would strengthen concerns that the downtrend in inflationary indicators may have stalled. Data in line with market expectations would thus add further weight to the view that the Fed will have to work harder to push inflation back to its target level. Currently implied market rates are pointing to a peak in Fed funds close to 5.33%.''

USD/CAD technical analysis

The above charts outline the boundaries for the price in USD/CAD that arrives with a meanwhile bearish bias as the bulls meet resistance following a burst to the upside on US Dollar strength. The bears eye a 38.2% Fibonacci retracement level towards 1.35 the figure for the day ahead.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.