- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/USD climbs to 0.6730s on mixed US data though downside risks remain

AUD/USD climbs to 0.6730s on mixed US data though downside risks remain

- AUD/USD capped its downfall on risk-on sentiment and mixed US data.

- Durable Good Orders and Pending Home Sales showed mixed readings.

- Fed’s Jefferson commented that tackling inflation to the 2% target would not be easy.

- AUD/USD Price Analysis: To continue its downtrend as it stays below 0.6825.

The AUD/USD trims some of its earlier losses though it remains below the 0.6800 figure after posting a daily high of 0.6743 as the week begins. Dismal economic data in the United States (US) and risk appetite improvement are two reasons that weighed on the US Dollar (USD) and boosted the Australian Dollar (AUD). At the time of writing, the AUD/USD exchanges hands at 0.6739, slightly above its opening price.

Wall Street continues to trade in the green despite a bad Durable Goods Orders report for January in the United States (US). Durable orders plunged -4.5%, vs. a 5.1% gain in December. Excluding Transportation, also known as core orders, rose 0.7% against a no change.

Further data in the US showed an improvement in Pending Home Sales, with the YoY reading sliding less than the -33.9% estimated to -24.1%. On a monthly basis, sales jumped 8.1% vs. expectations of 1%. Pending Home sales have posted two straight reports above zero for the first time since 2020.

The US Dollar Index (DXY), which measures the US Dollar value in relation to six currencies, fell 0.52% to 104.725, reversing gains from last Friday driven by an increase in the US Federal Reserve’s (Fed) preferred inflation indicator, the Core PCE. After data on goods orders, the DXY decreased from approximately 105.100 to current quotations.

In the meantime, speculations that the Fed will tighten monetary conditions still after Governor Phillip Jefferson noted that inflation is too high and reiterated the Fed’s commitment to getting back (inflation) to 2%. He added that “under no illusion,” it will be easy to get inflation back to 2%.

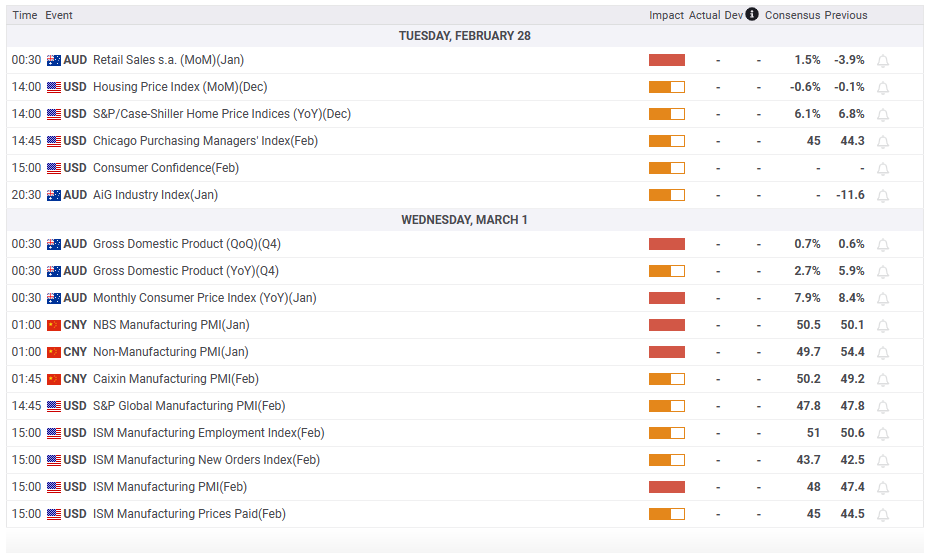

What to watch?

AUD/USD Technical analysis

The AUD/USD downtrend remains in play once the pair collapsed below the 200 and 100-day EMAs, at 0.6857 and 0.6825, respectively. Furthermore, the Relative Strength Index (RSI) accelerated its downtrend but is shy of reaching oversold conditions. This means there is enough room for AUD/USD sellers to drag prices down. Therefore, the AUD/USD first support would be 0.6700, followed by December’s 20 low of 0.6629, ahead of 0.6600.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.