- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/CAD rallies above 1.3600 on weak Canada GDP, mixed US data

USD/CAD rallies above 1.3600 on weak Canada GDP, mixed US data

- Canada’s economy grew at a 0% pace in Q4, annualized, justifying the BoC pause in rate increases.

- US house prices tumbled while the US Dollar continued to trade in the backfoot.

- USD/CAD Price Analysis: Further upside is warranted on a daily close above 1.3600.

After dismal economic data reported from Canada, the USD/CAD advances toward the 1.3600 figure, while the US Dollar (USD) registers some losses. In addition, market sentiment shifted sour as US equities opened in the red. At the time of writing, the USD/CAD exchanges hands at around 1.3610.

Canada’s GDP was flat, a tailwind for USD/CAD

Statistics Canada revealed the Gross Domestic Product (GDP) for Q4, which was expected at 2.9% QoQ, though missed estimates and came flat at 0%. According to the agency, inventory accumulations and declines in business investment, mainly machinery, and equipment were the reasons for weaker growth in Q4.

Even though the reading is negative, it takes the pressure off the Bank of Canada (BoC). The BoC announced at its last monetary policy meeting that it would pause rate hikes. Consequently, further USD/CAD strength is warranted, as the US Federal Reserve (Fed) is expected to continue its tightening cycle with speculation around the financial markets that the Fed could go as high as 6%, according to Bank of America (BofA) Global Research.

The USD/CAD jumped after the data release and printed a daily high of 1.3609. Nevertheless, the dust had settled, and the major retraced toward the 1.3590s area.

On the US front, monthly house prices dropped in December by 0.1% MoM, in data published by the US Federal Housing Finance Agency showed on Tuesday. At the same time, the S&P/Case-Shiller Home Price Index arrived at 4.6% YoY in December, down from 6.8% in November and lower than analysts’ estimate of 6.1%.

Also read:

- Canada: Annualized real GDP declines to 0% in Q4 vs. 1.5% expected

- US: Housing Price Index declines 0.1% in December vs -0.6% expected

USD/CAD Technical analysis

The USD/CAD daily chart portrays the pair as upward biased after bottoming around 1.3200. After falling to YTD lows at 1.3262, the USD/CAD has prolonged its gains and has broken above crucial resistance areas, like the 20, 50, and 100-day Exponential Moving Averages (EMAs). Therefore, interest rate differentials and technical momentum could pave the way for further upside.

The USD/CAD next resistance would be the daily high at 1.3609. A breach of the latter will expose the YTD high at 1.3685, ahead of 1.3700, followed by the November 3 swing high at 1.3808.

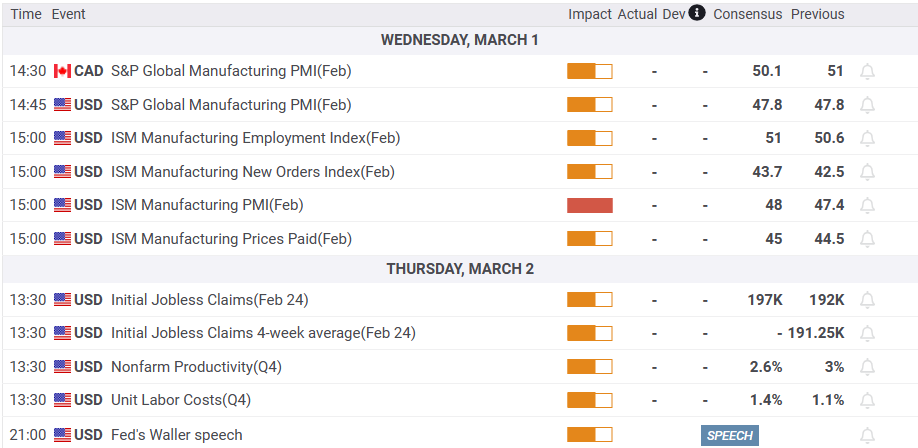

What to Watch

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.